Trading Conditions

Products

Tools

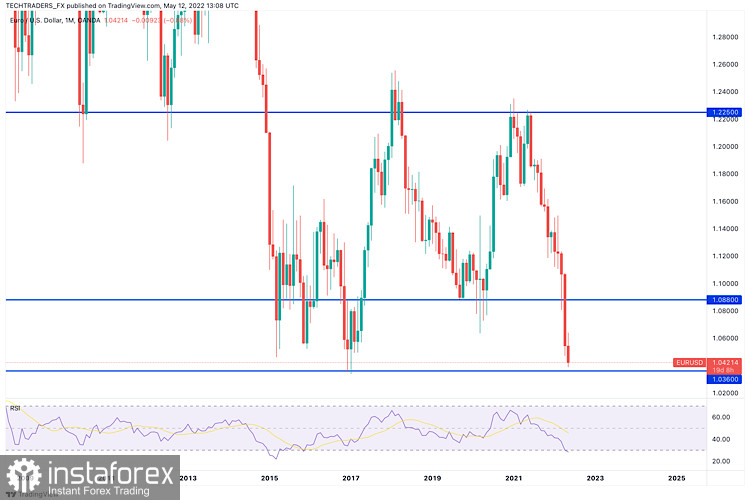

EUR/USD has recovered modestly from the fresh multi-year low it set below 1.0400 earlier in the day. The data from the US showed that the Producer Price Index (PPI) edged lower to 11% on a yearly basis in April from 11.5% in March, causing the US Dollar Index to erase a portion of its daily gains.

The EUR/USD pair currently trades a handful of pips above the 1.0400 threshold, but the daily chart suggests that the pair could still continue to fall. The pair has finally found some directional strength after a consolidative stage, and technical indicators reflect so, heading firmly lower near oversold readings. At the same time, the pair develops well below bearish moving averages, also reflecting prevalent selling interest.

For the near term, and according to the 4-hour chart, the risk remains skewed to the downside. Technical indicators maintain their bearish slopes, despite being near oversold readings, while the pair gave up after repeatedly failing to advance beyond a mildly bearish 20 SMA. Renewed selling pressure below the aforementioned daily low exposes January 2017 multi-year low at 1.0339.

Support levels: 1.0385 1.0340 1.0295

Resistance levels: 1.0470 1.0510 1.0550

InstaForex analytical reviews will make you fully aware of market trends! Being an InstaForex client, you are provided with a large number of free services for efficient trading.

We may place cookies for analysis of our visitor data, to improve our website and measure advertising performance. Overall this data is used to provide a better website experience. More information

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of Instant Trading EU Ltd including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaForex anyway.

We are sorry for any inconvenience caused by this message.

Stay

Stay