Trading Conditions

Products

Tools

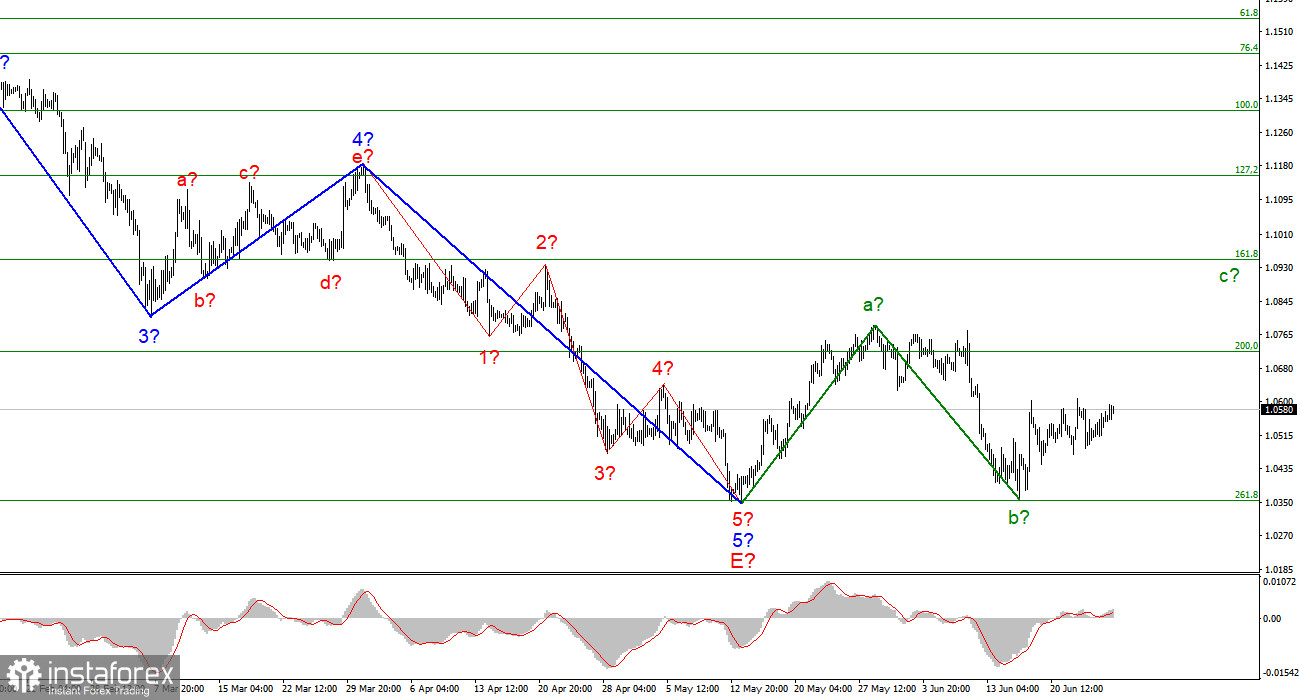

The wave marking of the 4-hour chart for the euro/dollar instrument continues to look convincing and does not require adjustments. In addition, the markup has not changed in recent weeks, as the market is completely calm. The instrument has completed the construction of a downward trend segment. If the current wave marking is correct, then the construction of a new upward trend section has begun at this time. It can turn out to be three-wave, or it can be pulsed. At the moment, two waves of a new section of the trend are visible. Wave A is completed, and wave b is also presumably completed. If this is indeed the case, then the construction of an ascending wave c has now begun. The instrument has not decreased under the low of the descending trend section, so the wave marking still retains its integrity. However, I note that the downward section of the trend may complicate its internal wave structure and take a much more extended form. Unfortunately, a very promising wave markup may be broken due to the news background. But at the moment, the chances of building an upward wave c remain. Only the news background can interfere.

Lagarde's speeches and European inflation

The euro/dollar instrument rose by 25 basis points on Monday. Market activity remains very low, which it was on Friday, although there were a couple of reports on Friday and today too. Nevertheless, after several relatively active days, the market took a pause, which lasted for the second day. Of course, in such conditions, the wave pattern is even less likely to complicate or change. I am still waiting for the euro quotes to rise, but I feel that it can be a long wait. This week, the most interesting will be the report on inflation in the European Union. Let me remind you that for all central banks, the issue of reducing inflation is now the most important. Thus, every new report that indicates its growth is a stone in the garden of the central bank. And in the case of the European Central Bank, there are already a lot of stones in the garden.

The market expects that inflation in the EU will rise to 8.4%. It seems that the growth rate of this indicator is slowing down a bit, but I think it's just a coincidence. The ECB has never raised the rate yet and will only completely abandon the quantitative stimulus program in July. Thus, inflation has no reason to decrease. Nevertheless, next month the ECB may still go to an unprecedented event for itself and raise the rate for the first time in many years. If this happens, the demand for the European currency may grow slightly, since before that the market was forced to look at the instrument through the prism of tightening monetary policy only by the Fed. If the ECB at least starts the process of tightening the PEPP, it can give an impetus to growth. However, I will also remind you that the Fed may raise the rate next month, and by 75 basis points at once. Therefore, the euro currency needs to take advantage of the moment and increase as much as possible before this happens.

General conclusions

Based on the analysis, I conclude that the construction of the downward trend section is completed. If so, then now you can buy a tool with targets located near the estimated mark of 1.0947, which equates to 161.8% Fibonacci, for each MACD signal "up". Wave b is presumably completed. An unsuccessful attempt to break through the level of 261.8% indicates that the market is not ready for new sales of the instrument.

On a larger scale, it can be seen that the construction of the proposed wave E has been completed. Thus, the entire downward trend has acquired a complete look. If this is indeed the case, then in the future for several months the instrument will rise with targets located near the peak of wave D, that is, to the 15th figure.

InstaForex analytical reviews will make you fully aware of market trends! Being an InstaForex client, you are provided with a large number of free services for efficient trading.

We may place cookies for analysis of our visitor data, to improve our website and measure advertising performance. Overall this data is used to provide a better website experience. More information

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of Instant Trading EU Ltd including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaForex anyway.

We are sorry for any inconvenience caused by this message.

Stay

Stay