Trading Conditions

Products

Tools

On Wednesday, the GBP/USD currency pair increased by at least 200 points. Volatility was extremely high once more. Yesterday's macroeconomic backdrop was present, but it needed to be sufficiently potent to spur such a movement. However, there were legitimate reasons for the growth of the pound sterling, unlike the euro. The price on the 4-hour TF stayed within the moving average. Second, the Scottish government appealed to the Supreme Court of Britain, asking for permission to hold an independence referendum. The Supreme Court of Britain released its decision on the appeal yesterday. The court denied this request, which also decided that a second referendum within the last ten years can only be held with London's permission. However we will go into more detail about this below, but for the time being, it appears that the UK won't lose a third of its territory anytime soon.

Accept this is a significant enough factor for the pound's value to increase. Given that it grew much more modestly, it's possible that the pound sterling itself helped the euro currency rise. Going back to macroeconomic statistics, we can see that in the UK, the business activity indices for the services and manufacturing sectors have hardly changed from October and have continued to be below the "waterline." The indices in the United States also displayed negative dynamics, but other reports were not as dire, and some were even positive. As a result, the market would have reacted very biasedly if it had only responded to statistics. Everything would make sense if the market responded to the Supreme Court of Great Britain's ruling. That's to say that the British pound's prior growth lacked much logic in general.

The pair has the potential to form an upward trend in the medium term because, from a "technology" standpoint, it has crossed all of the Ichimoku indicator's lines on the 24-hour TF. The upward trend was not reversed at the 4-hour TF because it did not drop below the moving average. The "hole" in the British budget appears to have been fixed by increasing taxes and reducing spending, which will help the economy survive this winter. Of course, the Conservatives may suffer due to these choices in the upcoming parliamentary elections, but that time will not come soon.

It turned out that Nicola Sturgeon doesn't have any "aces up her sleeve."

Only yesterday, we were discussing how Nicola Sturgeon might be hiding a few surprises; otherwise, why would she have cheerfully promised the Scottish people a new referendum during the previous parliamentary elections? Remember that if Sturgeon's party wins the election, she pledged to hold a referendum by the end of 2023. The party won the election, but Sturgeon's strategy would never be clear if London's approval were necessary for a valid referendum. Rishi Sunak, Liz Truss, and Boris Johnson would not consent. Who in their right mind would consent to a situation where they could lose a third of their territory? Therefore, it is utterly unsurprising that London only responded with refusals. It was revealed yesterday that the leader of the SNP will keep pressing London for the right to hold a referendum, and that's all. There were undoubtedly vociferous speeches criticizing the "undemocratic" nature of these refusals, but it turned out that Sturgeon had no "aces up her sleeve." Constant permission requests serve no purpose. Will London eventually change its mind after receiving so many rejections? Is that what Sturgeon hopes to achieve?

The 21st century has amply demonstrated that any territorial dispute is most frequently settled through military means, so if she attempts to hold a referendum without the approval of Westminster, she may end up in a military conflict. Even though it is currently difficult to believe that Sturgeon will take such a step, it is possible that we could experience another armed conflict in the upcoming years. She has no choice but to defend herself in front of her populace, dread the upcoming election, and keep sending demands pouring into London.

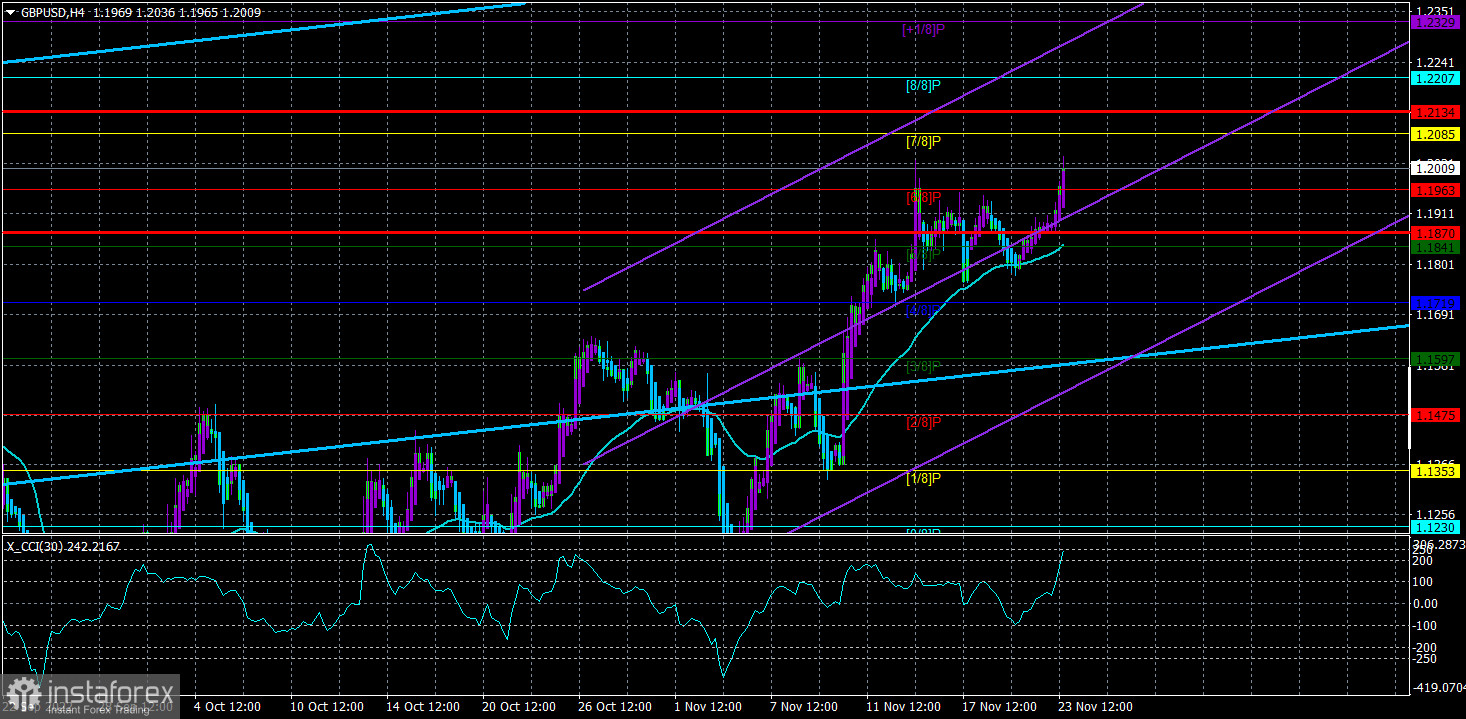

Over the previous five trading days, the GBP/USD pair has averaged 132 points of volatility. This value is "high" for the dollar/pound exchange rate. Thus, we anticipate movement inside the channel on Thursday, November 24, constrained by the levels of 1.1870 and 1.2134. The Heiken Ashi indicator's turning downward indicates a new phase of the corrective movement.

Nearest levels of support

S1 – 1.1963

S2 – 1.1841

S3 – 1.1719

Nearest levels of resistance:

R1 – 1.2085

R2 – 1.2207

R3 – 1.2329

Trading Suggestions:

In the 4-hour timeframe, the GBP/USD pair resumed moving upward. Therefore, until the Heiken Ashi indicator turns down, you should maintain buy orders with targets of 1.2134 and 1.2207. Open sell orders should have a target price of 1.1719 and be fixed below the moving average.

Explanations of the illustrations:

Linear regression channels – help determine the current trend. The trend is strong if both are directed in the same direction.

Moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which you should trade now.

Murray levels – target levels for movements and corrections.

Volatility levels (red lines) – the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.

InstaForex analytical reviews will make you fully aware of market trends! Being an InstaForex client, you are provided with a large number of free services for efficient trading.

We may place cookies for analysis of our visitor data, to improve our website and measure advertising performance. Overall this data is used to provide a better website experience. More information

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of Instant Trading EU Ltd including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaForex anyway.

We are sorry for any inconvenience caused by this message.

Stay

Stay