Trading Conditions

Products

Tools

The wave pattern for GBP/USD remains quite complex and ambiguous. For some time, the wave structure seemed convincing, indicating a downward wave set with targets below the 1.2300 level. However, demand for the U.S. dollar grew too strong for this scenario to play out, and it continues to increase.

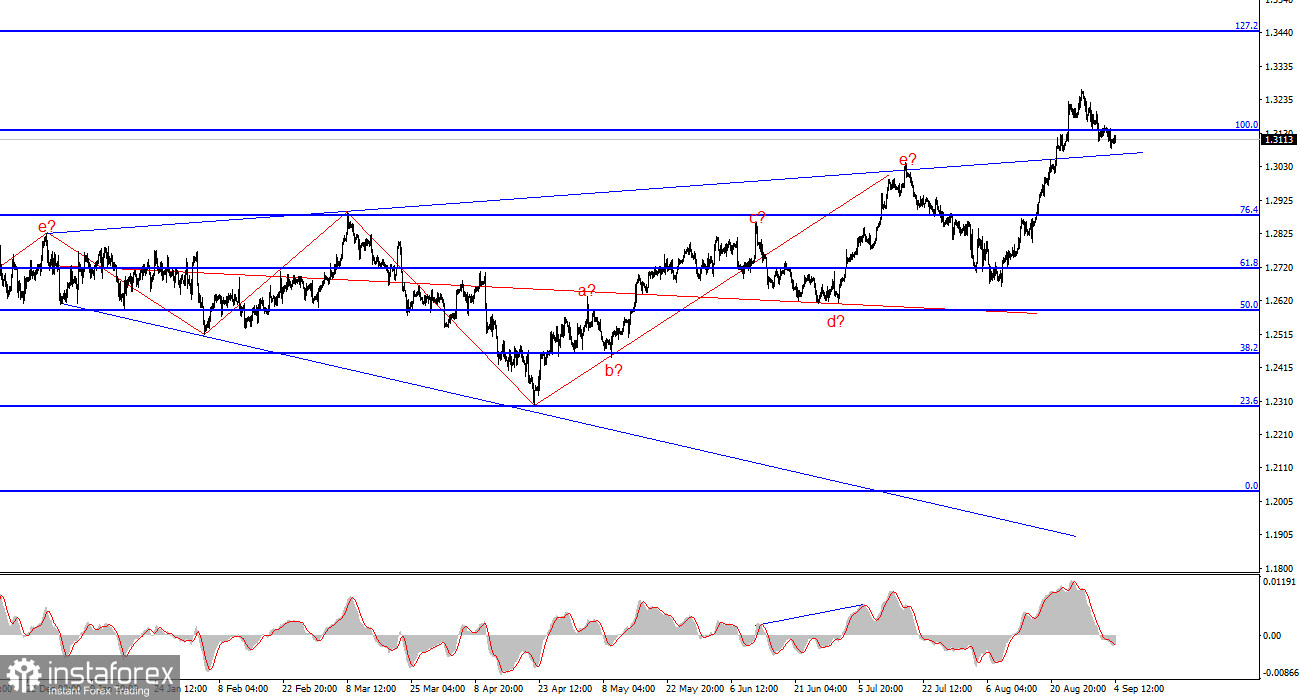

At the moment, the wave pattern has become difficult to interpret. In my analysis, I generally use simple structures because complex ones often involve too many nuances and ambiguities. We have now observed another upward wave, which has pushed the pair beyond the triangular consolidation pattern. The current upward wave set, which likely began on April 22, could extend further as the market appears unsettled until it fully prices in all stages of the Fed's rate-cutting cycle. A three-wave corrective structure is forming again, and a successful break of the 1.3142 level, which corresponds to the 100% Fibonacci retracement, indicates the market's readiness for at least a slight decline.

On Wednesday, the GBP/USD exchange rate again remained relatively flat. Every time the dollar attempts to strengthen, something inevitably halts its progress. Yesterday, the market was ready to increase demand for the U.S. dollar, but the ISM manufacturing index wasn't convincing enough. Today, the market was prepared to boost dollar demand, but the final UK services PMI came out higher than the preliminary estimate. Everything seems to be working against the U.S. currency.

For the next few days, the dollar is likely to struggle to gain market support. For now, sellers are holding to the critical 1.3142 level, which still gives them a chance to form at least one corrective wave. Ideally, there should be at least three corrective waves. It may seem pessimistic, but the U.S. has not received any positive economic news over the past four months. Tomorrow, the U.S. ISM services PMI will be released, and the market expects a decline for August. As this index hovers near the 50.0 level, below which any reading signals a negative trend, the situation for the U.S. economy and currency is becoming increasingly tense.

On Friday, the fate of the dollar will be decided: either it will get a reprieve or face a significant decline. The Nonfarm Payrolls report needs to exceed 160,000 for the dollar's recovery to continue. The unemployment rate must not rise above 4.3% for the dollar to gain value. In my view, the 1.3000 level is the maximum target for sellers this week.

The wave structure for GBP/USD still suggests a decline. If the upward trend began on April 22, it has already formed a five-wave structure. Therefore, a minimum of a three-wave correction is now expected. I believe selling with targets around 1.2627 is appropriate, at least as long as sellers hold below the 1.3142 level.

On a larger wave scale, the wave structure has evolved. We can now assume the formation of a complex and extended upward corrective structure. Currently, this is a three-wave structure, but it could evolve into a five-wave structure, which may take several months to complete.

InstaForex analytical reviews will make you fully aware of market trends! Being an InstaForex client, you are provided with a large number of free services for efficient trading.

We may place cookies for analysis of our visitor data, to improve our website and measure advertising performance. Overall this data is used to provide a better website experience. More information

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of Instant Trading EU Ltd including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaForex anyway.

We are sorry for any inconvenience caused by this message.

Stay

Stay