This information is provided to retail and professional clients as part of marketing communication. It does not contain and should not be construed as containing investment advice or investment recommendation or an offer or solicitation to engage in any transaction or strategy in financial instruments. Past performance is not a guarantee or prediction of future performance. Instant Trading EU Ltd. makes no representation and assumes no liability as to the accuracy or completeness of the information provided, or any loss arising from any investment based on analysis, forecast or other information provided by an employee of the Company or otherwise. Full disclaimer is available here.

Analytics today

Popular analytics

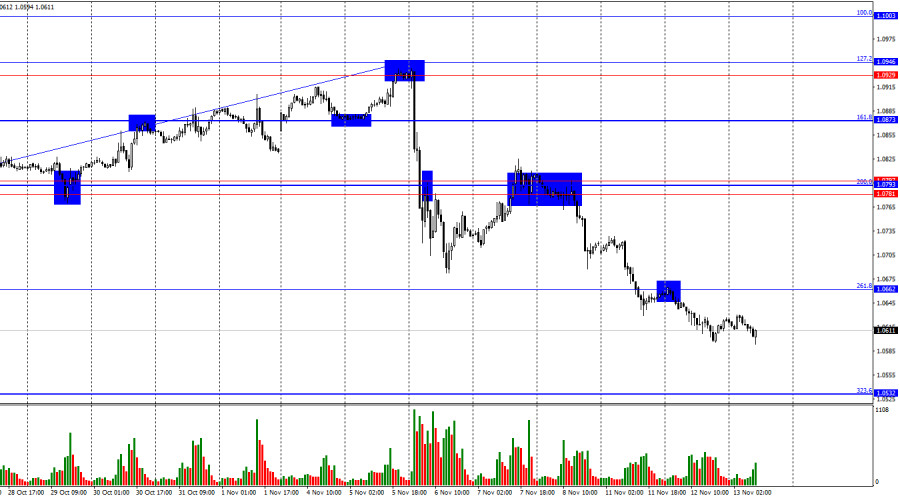

On Tuesday, the EUR/USD pair rebounded from the 261.8% Fibonacci level at 1.0662 and continued its decline towards the 323.6% Fibonacci level at 1.0532. Bullish traders remain on the defensive.

USDJPY: Simple Trading Tips for Beginner Traders on November 13. Review of Yesterday's Forex Trades

Analysis of Trades and Trading Tips for the Japanese Yen The test of the price level at 154.22 coincided with the MACD indicator being significantly above the zero mark, which.

Crisis on the Horizon? Politics and Economics Drown Dow, Nasdaq, Tesla

Novavax Falls 6% on Full-Year Revenue Forecast Cut Honeywell Jumps to Record High as Elliott Reveals Stake Tesla Ends 5-Day Rally with 6% Loss Indices Fall: Dow 0.86%, S&P.

What to Watch on November 13? Analysis of Fundamental Events for Beginners

There are relatively few macroeconomic events scheduled for Wednesday. No significant or secondary reports are expected in the Eurozone or the UK, leaving the spotlight on the U.S. inflation report.

How to Trade the GBP/USD Pair on November 13? Simple Tips and Trade Analysis for Beginners

Analysis of Tuesday's Trades: 1H Chart of GBP/USD Pair On Tuesday, the GBP/USD pair experienced another sharp decline. The price had been trading in a flat, horizontal channel for several.

How to Trade the EUR/USD Pair on November 13? Simple Tips and Trade Analysis for Beginners

Analysis of Tuesday's Trades: 1H Chart of EUR/USD Pair On Tuesday, the EUR/USD currency pair continued its downward trajectory. Despite the lack of significant reports or events in the U.S.

Technical Analysis of Intraday Price Movement of EUR/JPY Cross Currency Pairs, Wednesday November 13, 2024.

If we look at the 4-hour chart of the EUR/JPY cross currency pair, it appears that there are two quite interesting patterns, the first is Head & Shoulders and Rising.

Technical Analysis of Intraday Price Movement of AUD/JPY Cross Currency Pairs, Wednesday November 13, 2024.

With the Golden Cross condition of the EMA 50 above the EMA 200 and the appearance of the Bullish 123 pattern followed by several Bullish Ross Hook (RH) and also.

Hot Forecast for EUR/USD on November 13, 2024

Although the counting of votes for the House of Representatives is not yet complete, there is no longer any doubt that the Republican Party has achieved a resounding victory, securing.

Forecast for USD/JPY on November 13, 2024

The USD/JPY pair has consolidated above the 153.60 level on the daily chart, opening the path toward the target of 165.30. However, the Marlin oscillator remains weak, continuing its sideways.

Trading Recommendations and Analysis for GBP/USD on November 13; The Pound Stalled, Then Collapsed

The GBP/USD pair continued its decline on Tuesday. Just yesterday, we noted that the pause in the pound's fall couldn't last long. Tuesday proved us right. The pound had risen.

Trading Recommendations and Analysis for EUR/USD on November 13; The Euro Has Nothing to Counter the Dollar

The EUR/USD pair continued its decline calmly on Tuesday, though calling this movement a "decline" may now seem insufficient. It is closer to a relentless collapse without corrections. While.

Show more

This section is updated daily and contains market analysis prepared by professional analysts on behalf of InstaForex. Each of the specialists presents analytical reviews in accordance with his/her vision of the current situation on the foreign exchange and other markets. However, the outlooks below are neither recommendations nor instructions to any actions. They contain analysis of the current situation on financial markets. In some cases, analysts' opinions about current market conditions may differ.

Stay

Stay