This information is provided to retail and professional clients as part of marketing communication. It does not contain and should not be construed as containing investment advice or investment recommendation or an offer or solicitation to engage in any transaction or strategy in financial instruments. Past performance is not a guarantee or prediction of future performance. Instant Trading EU Ltd. makes no representation and assumes no liability as to the accuracy or completeness of the information provided, or any loss arising from any investment based on analysis, forecast or other information provided by an employee of the Company or otherwise. Full disclaimer is available here.

Analytics today

Popular analytics

On Monday, the EUR/USD pair rebounded again from the 323.6% Fibonacci corrective level at 1.0532 and began a new upward movement toward the 261.8% Fibonacci level at 1.0662. However.

USD/JPY: Analysis and Forecast

Today, the Japanese yen is losing most of its intraday gains against the U.S. dollar. Uncertainty about the timing of the next interest rate hike by the Bank of Japan.

Trading Recommendations for the Cryptocurrency Market on November 19

Bitcoin and Ethereum continue to consolidate, trading near monthly highs, hinting at the potential continuation of the bull market—if not today, then certainly soon. Meanwhile, Donald Trump's appointments of crypto.

USD/JPY: Simple Trading Tips for Beginner Traders on November 19. Analysis of Yesterday's Forex Trades

The test of the 155.25 price level occurred when the MACD indicator had moved significantly above the zero mark, which limited the pair's upward potential, especially under the pressure.

EUR/USD: Simple Trading Tips for Beginner Traders on November 19. Analysis of Yesterday's Forex Trades

The test of the 1.0564 level coincided with the moment when the MACD indicator had moved significantly above the zero mark, which limited the pair's upward potential. For this reason.

How to Trade the EUR/USD Pair on November 19? Simple Tips and Trade Analysis for Beginners

Analysis of Monday's Trades 1H Chart of EUR/USD On Monday, the EUR/USD currency pair recently attempted to correct for the third time. As shown on the chart, the attempt once.

Technical Analysis of Intraday Price Movement of USD/CAD Commodity Currency Pairs, Tuesday November 19, 2024.

With the appearance of deviations between the price movement of the USD/CAD commodity currency pair and the Stochastic Oscillator indicator and also confirmed by the price movement of USD/CAD which.

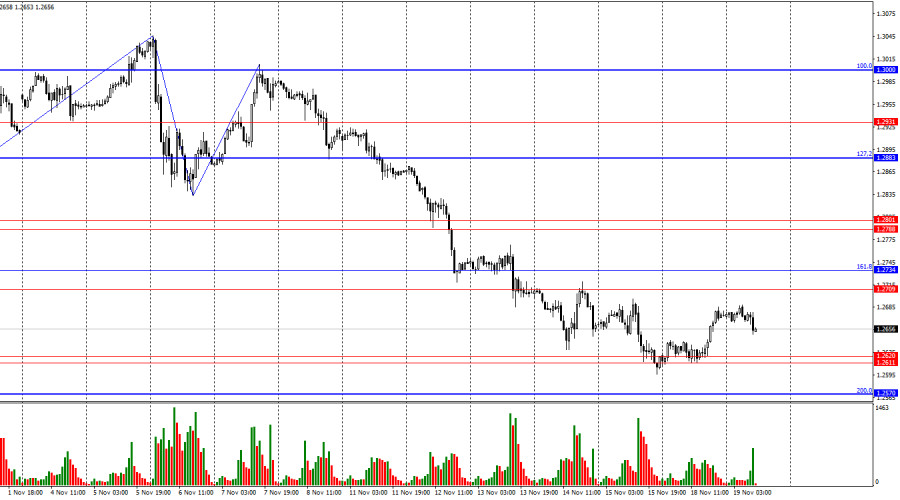

Technical Analysis of Intraday Price Movement of GBP/AUD Cross Currency Pairs, Tuesday November 19, 2024.

If we look at the 4-hour chart of the GBP/AUD cross currency pair, we will see a deviation between the GBP/AUD price movement and the Stochastic Oscillator indicator.

Forecast for EUR/USD on November 19, 2024

During yesterday's 0.55% rise, the euro reached the target resistance level 1.0590. The Marlin oscillator signals a weakening of the corrective potential as it begins a smooth downward reversal.

Overview of GBP/USD Pair on November 19: The Pound Teeters Between Life and Death

The GBP/USD pair showed little inclination for significant movement on Monday, marking a rare calm day in recent months. While the session was relatively uneventful, the British pound's volatility.

Overview of EUR/USD Pair on November 19: A Calm Start to the Week

The EUR/USD pair mainly remained stagnant throughout Monday. This is unsurprising since no macroeconomic events except European Central Bank President Christine Lagarde's speech were scheduled for the day. However.

Show more

This section is updated daily and contains market analysis prepared by professional analysts on behalf of InstaForex. Each of the specialists presents analytical reviews in accordance with his/her vision of the current situation on the foreign exchange and other markets. However, the outlooks below are neither recommendations nor instructions to any actions. They contain analysis of the current situation on financial markets. In some cases, analysts' opinions about current market conditions may differ.

Stay

Stay