This information is provided to retail and professional clients as part of marketing communication. It does not contain and should not be construed as containing investment advice or investment recommendation or an offer or solicitation to engage in any transaction or strategy in financial instruments. Past performance is not a guarantee or prediction of future performance. Instant Trading EU Ltd. makes no representation and assumes no liability as to the accuracy or completeness of the information provided, or any loss arising from any investment based on analysis, forecast or other information provided by an employee of the Company or otherwise. Full disclaimer is available here.

Analytics today

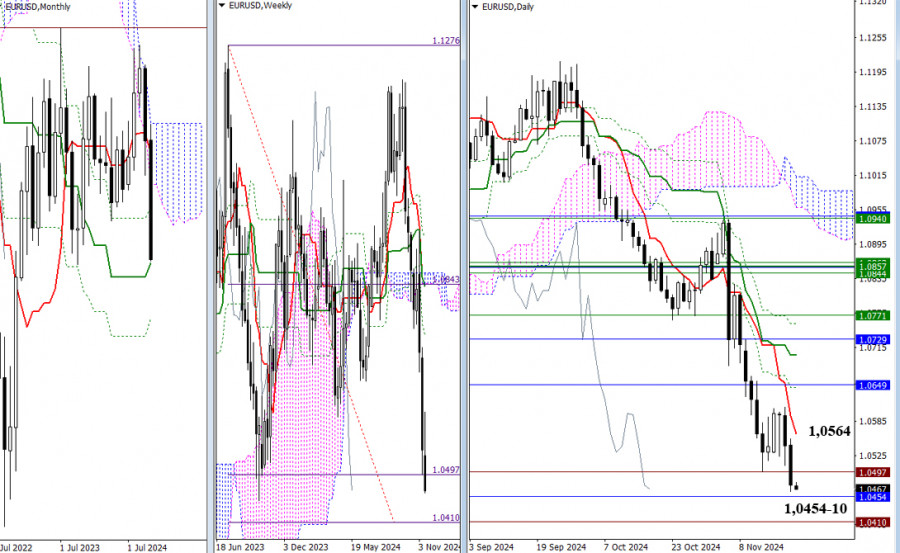

Bearish players renewed the minimum consolidation low yesterday, resuming the downward movement. The following downside targets on the chart are the monthly medium-term trend (1.0454) and the 100% completion level.

Hot Forecast for EUR/USD on November 22, 2024

On Wednesday, representatives of the European Central Bank warned about the risks of a debt crisis in the eurozone. Yesterday, they shifted to assuring markets of further monetary policy easing.

Overview of GBP/USD Pair for November 22, 2024: The Pound Gradually Slides Down

The GBP/USD currency pair initiated a new wave of downward movement on Wednesday and Thursday. Over the past week, the trend has been mostly sideways, making it uncertain whether.

Overview of EUR/USD Pair for November 22, 2024: The Euro Targets Further Decline

The EUR/USD currency pair traded monotonously and uneventfully on Wednesday and Thursday. After reaching the Murray level "2/8" at 1.0498, the price neither corrected upward nor moved significantly, instead consolidating.

Forecast for GBP/USD on November 22, 2024

The British pound broke below the 1.2612 support level yesterday, but the Marlin oscillator did not confirm the move. Instead, it reversed and formed a weak convergence with the price.

USD/JPY: All Eyes on Inflation

In mid-September, the USD/JPY pair hit a 2.5-month low at 139.60, then reversed to climb over 1,500 points, reaching 156.76 last week. A notable 250-pip correction followed this rally. This.

Forecast for EUR/USD on November 21, 2024

On Wednesday, the EUR/USD pair reversed in favor of the US dollar, returning to the 323.6% corrective level at 1.0532. While the lower boundary of the sideways range is likely.

GBP/USD: Simple Trading Tips for Beginners on November 21st (U.S. Session)

The price test at 1.2640 occurred when the MACD indicator had moved significantly below the zero mark, which limited the pair's bearish potential. For this reason, I did not sell.

EUR/USD: Simple Trading Tips for Beginners on November 21st (U.S. Session)

The price test at 1.0541 coincided with the MACD indicator moving significantly below the zero mark, which, in my view, limited the pair's bearish potential. For this reason.

GBP/USD: Trading Plan for the U.S. Session on November 21st (Morning Trade Analysis). The Pound Continues Its Decline

In my morning forecast, I focused on the level of 1.2632 and planned to make decisions regarding market entry at this level. Let us examine the 5-minute chart and analyze.

Show more

This section is updated daily and contains market analysis prepared by professional analysts on behalf of InstaForex. Each of the specialists presents analytical reviews in accordance with his/her vision of the current situation on the foreign exchange and other markets. However, the outlooks below are neither recommendations nor instructions to any actions. They contain analysis of the current situation on financial markets. In some cases, analysts' opinions about current market conditions may differ.

Stay

Stay