Trading Conditions

Products

Tools

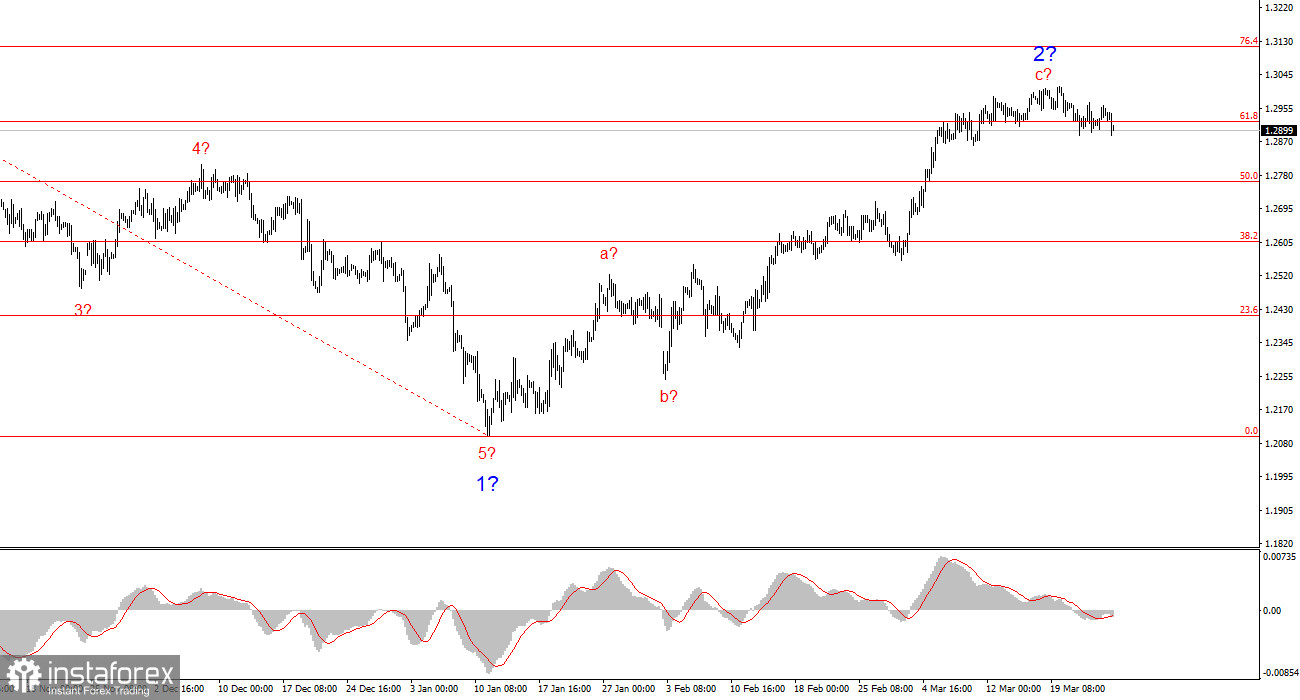

The wave pattern for GBP/USD remains somewhat ambiguous but overall workable. There is still a high probability of a long-term bearish trend forming. Wave 5 has taken a clear shape, so I consider the larger wave 1 to be complete. If this assumption is correct, wave 2 is currently unfolding, with targets around the 1.2600 and 1.2800 areas. The first two subwaves of wave 2 appear complete. The third one could finish at any moment.

Demand for the pound had been growing recently solely due to the "Trump factor," which remains the primary support for the British currency. However, in the longer term—beyond a few days—the pound still lacks a fundamental basis for growth. The Bank of England's and the Fed's positions have shifted in favor of the pound recently, as the BoE is now also reluctant to cut interest rates quickly. The current wave pattern remains intact for now, but another upward move would raise serious concerns.

The GBP/USD rate dropped by 55 basis points on Wednesday, marking the week's most significant movement. While news flow isn't absent this week, the reports have been mixed, and the market has shown little enthusiasm to trade actively. This results in stagnation. The pound is declining slightly—possibly as part of a corrective wave or the first wave of a future wave 3 in the bearish trend. In any case, everything may be decided next week, which we'll discuss further.

I won't go into the importance of Nonfarm Payrolls, unemployment rate, ISM indexes, and so on. This week, we also expect the U.S. GDP report. These are all undoubtedly important, but the market is awaiting developments regarding Trump's trade tariffs. Next week, the U.S. president may issue a new "verdict" against a number of countries, though his rhetoric has recently softened. Some concessions may be made, and the tariffs may not be as severe as the market fears or as Trump originally promised. Let's not forget that the U.S. president is fond of issuing threats and ultimatums, then assessing whether opponents fear them. If they do, he continues the threats to achieve his goals; if not, he eases pressure and settles for a basic set of "sanctions."

Therefore, if next week reveals mild tariffs, I believe demand for the U.S. dollar will rise. The wave pattern still suggests a bearish trend is developing, and next week may become the starting point for wave 3.

The wave pattern for GBP/USD indicates that the bearish trend continues, along with its second wave. I would advise looking for new short entry points, as the current wave count still suggests a bearish trend that began last autumn. However, how Donald Trump and his policies will continue to affect market sentiment—and for how long—remains uncertain. The pound's recent rally looks excessive relative to the wave pattern. The BoE and FOMC meetings could have launched wave 3, but apparently did not.

On the higher wave scale, the structure has evolved. We can now assume the bullish three-wave sequence is complete, and a bearish trend may be forming. If this assumption is correct, we should expect a corrective wave 2 or b, followed by an impulsive wave 3 or c.

Core Principles of My Analysis:

InstaForex analytical reviews will make you fully aware of market trends! Being an InstaForex client, you are provided with a large number of free services for efficient trading.

We may place cookies for analysis of our visitor data, to improve our website and measure advertising performance. Overall this data is used to provide a better website experience. More information

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of Instant Trading EU Ltd including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaForex anyway.

We are sorry for any inconvenience caused by this message.

Stay

Stay