Trading Conditions

Products

Tools

S&P 500

Overview for March 31

US market sees steep decline. Indices hit one-year lows on Trump's tariff moves.

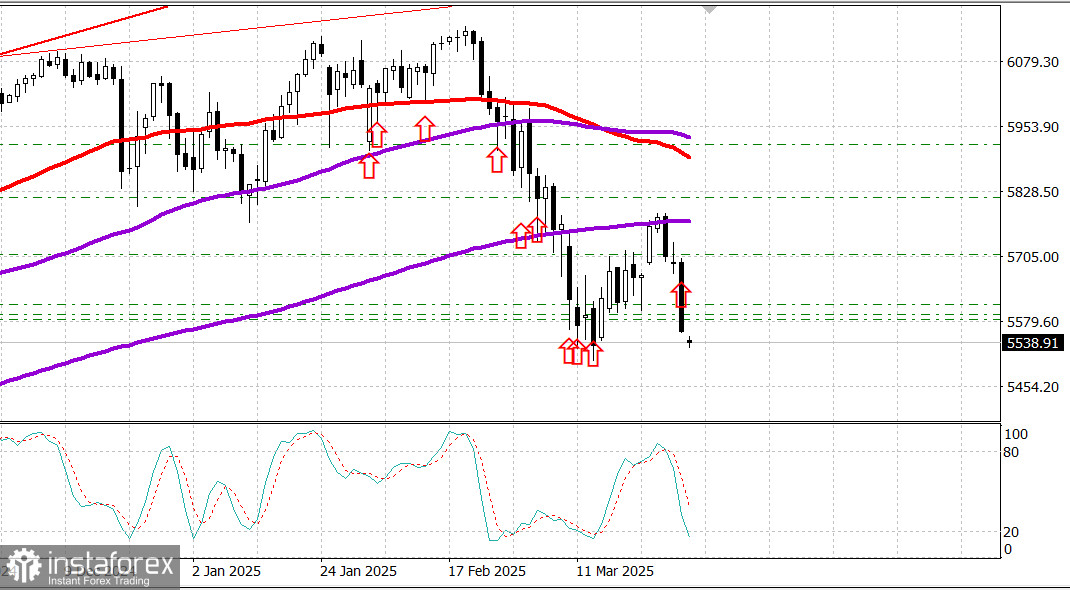

Major US indices on Friday: Dow: -1.7%, NASDAQ: -2.7%, S&P 500: -2.0%, S&P 500: 5,580, trading range: 5,500–6,000.

US stock indices posted sharp losses on Friday, driven by mounting inflation concerns and a marked deterioration in consumer sentiment. The immediate trigger came from Donald Trump's announcement of plans to impose 25% tariffs on all imported automobiles.

The Dow Jones Industrial Average fell 1.7%, the S&P 500 lost 2.0%, and the Nasdaq Composite dropped 2.7%.

The core Personal Consumption Expenditures (PCE) Price Index, the Federal Reserve's preferred inflation gauge, rose 0.4% in February, pushing the annual rate to 2.8%, up from 2.7% in January.

Adding to the pressure, the final reading of the University of Michigan Consumer Sentiment Index fell to 57.0 in March, reflecting deteriorating expectations regarding personal finances, business conditions, unemployment, and inflation.

Negative corporate headlines also fueled selling. Lululemon Athletica (LULU 293.06, -48.47, -14.2%) shares plunged 14% after issuing a disappointing earnings outlook.

Ten of the 11 S&P 500 sectors ended the day in the red, led by communication services (-3.8%), consumer discretionary (-3.3%), and technology (-2.4%). The utilities sector was the sole gainer, rising 0.8% as investors rotated into safe-haven assets.

Treasury bond buying also intensified, signaling deeper economic concerns. The 2-year yield fell 9 basis points to 3.91%, while the 10-year yield declined 11 basis points to 4.26%. For the week, the 2-year yield dropped 4 basis points, and the 10-year yield rose by 1 basis point.

Year-to-date performance: Dow Jones Industrial Average: -2.3% S&P 500: -5.1% S&P Midcap 400: -6.6% Russell 2000: -9.3% Nasdaq Composite: -8.4%

Economic data overview:February Personal Income: 0.8% (consensus: 0.4%); previous revised down from 0.9% to 0.7%February Personal Spending: 0.4% (consensus: 0.6%); previous revised down from -0.2% to -0.3%February PCE Price Index: 0.3% (consensus: 0.3%); previous: 0.3%February Core PCE Price Index: 0.4% (consensus: 0.4%); previous: 0.3%

The key takeaway from the report is that it was strong on income, modest on spending (the real PCE rose just 0.1%), and unfavorable on inflation, given the acceleration in the core PCE price index.

This mixed picture — with possible stagflation implications — is likely to prompt the Federal Reserve to take a wait-and-see approach, especially as short-term price adjustments are expected as Trump's tariffs take effect.

University of Michigan Consumer Sentiment Index (March, Final): 57.0 (consensus: 57.9); previous: 57.9

The main takeaway is that the expectations index has dropped more than 30% since November 2024.

March's decline was broad-based, with a clear consensus across demographic and political groups, showing deteriorating expectations on personal finances, business conditions, unemployment, and inflation.

Looking ahead, Monday's economic calendar is light, with the focus on the Chicago PMI for March due out at 9:45 a.m. ET (previous reading: 45.5).

Energy market: Brent crude: $72.80 — Oil fell by roughly $1.50 amid the broader US market sell-off. However, geopolitical tensions surrounding Iran are offering support. Over the weekend, Trump made a direct threat to deliver devastating strikes on Iran if it refuses to reach a nuclear deal with the US.

Iran has already responded, with its president stating that Tehran will not engage in direct talks with the US but remains open to mediated negotiations. Meanwhile, US strikes continue on Houthi targets in Yemen, Iran's de facto proxy in the region. The Houthis have launched powerful missiles at Israel, though Israel's defenses have so far intercepted them successfully.

Conclusion: Despite a down week, a rebound in the US market is still possible. Current levels offer attractive entry points for S&P 500 exposure via the SPX instrument. However, a break below current levels cannot be ruled out.

InstaForex analytical reviews will make you fully aware of market trends! Being an InstaForex client, you are provided with a large number of free services for efficient trading.

We may place cookies for analysis of our visitor data, to improve our website and measure advertising performance. Overall this data is used to provide a better website experience. More information

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of Instant Trading EU Ltd including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaForex anyway.

We are sorry for any inconvenience caused by this message.

Stay

Stay