Trading Conditions

Products

Tools

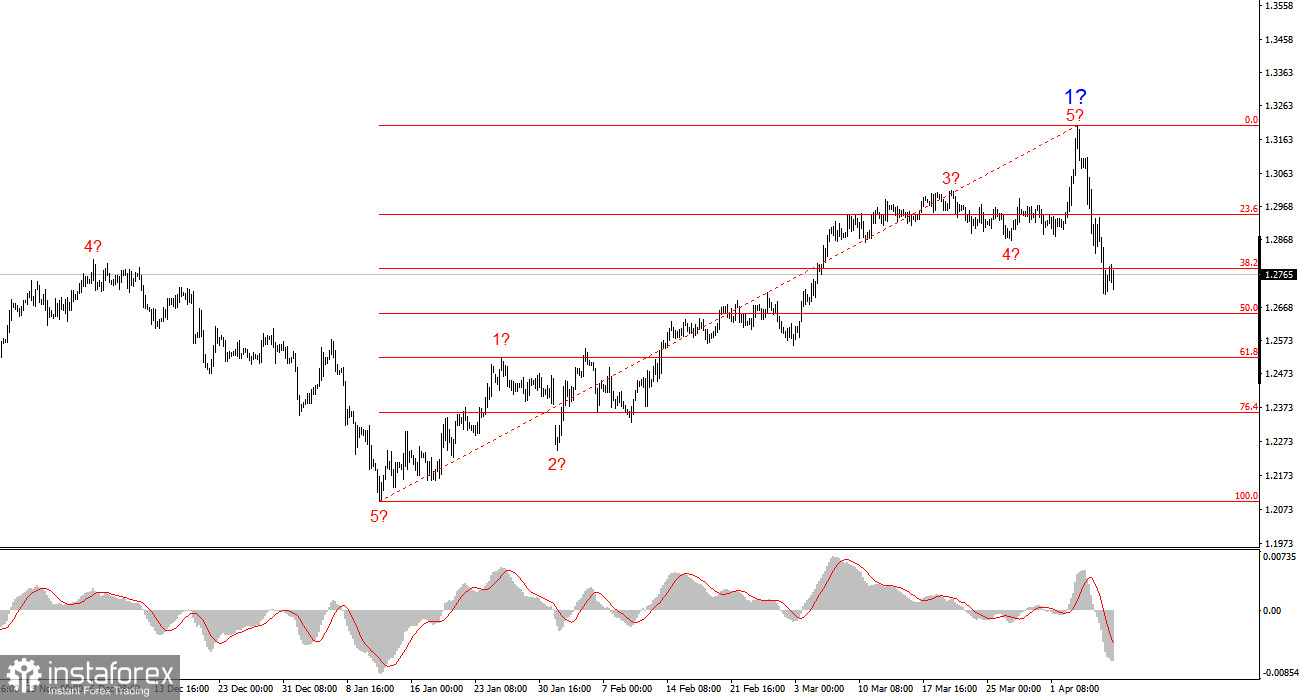

The wave pattern for GBP/USD has also transformed into a bullish, impulsive structure — "thanks" to Donald Trump. The wave formation is nearly identical to that of EUR/USD. Until February 28, we observed the development of a convincing corrective structure that raised no concerns. However, demand for the US dollar then began to fall rapidly. As a result, a five-wave bullish structure was formed. Consequently, we should now expect a three- or five-wave corrective phase, followed by wave 3 of a new global bullish trend segment.

Given that the news background from the UK had no influence on the pound's sharp rally, the conclusion is clear — currency movements are being dictated by Donald Trump. If (theoretically) Trump changes course on trade policy, the trend itself may also reverse — this time to the downside. Therefore, in the coming months (or even years), it will be essential to closely monitor all actions coming from the White House.

The GBP/USD pair dropped by a total of 180 basis points on Monday and rose by 60 points on Tuesday. Let's now take a closer look at the wave picture on the daily chart (at the bottom of the analysis). We have five waves down, five waves up. Both are impulsive structures. Then came a 500-point collapse — what does that represent? If this is the start of wave 2 of a new bullish trend segment, then this wave is already too strong and also looks impulsive. At the same time, the losses of the euro were much more modest. Why did the pound suddenly start losing ground so sharply?

If Donald Trump softens his stance, can the pound expect the bullish trend to continue? In my view, no. And what then? Will a new bearish trend begin? I believe the market is confused. At the moment, wave analysis is less useful than before. Everything depends not just on the general news background, but specifically on developments coming out of the White House. I have no doubt that if Trump continues expanding tariffs, demand for the US dollar will continue to decline. But in that case, the US economy will not just "potentially fall into recession" — it will do so this very year.

The Fed's position also remains unclear. Last Friday, Powell stated that interest rates would remain unchanged until economic statistics begin to show shifts that require regulatory intervention. However, yesterday it was revealed that the Fed is planning an emergency meeting. And why hold such a meeting? Clearly not to raise rates, which means a rate cut might be under discussion. If the Fed resumes policy easing, this could become a strong factor in the formation of bullish wave 3.

The wave pattern for GBP/USD has transformed. We are now dealing with a bullish, impulsive trend segment. Unfortunately, under Donald Trump, markets may experience many more shocks and reversals that do not conform to wave patterns or any form of technical analysis. Therefore, at present, we should expect a corrective wave set, the magnitude of which will depend on Trump — on how soon the next tariffs are introduced. After that, we can anticipate the formation of bullish wave 3, but only if Trump's stance on trade policy does not change radically.

On the higher wave scale, the wave pattern has also shifted to bullish. We can now expect the development of a bullish trend segment. The nearest targets are 1.2782 and 1.2650.

Core Principles of My Analysis:

InstaForex analytical reviews will make you fully aware of market trends! Being an InstaForex client, you are provided with a large number of free services for efficient trading.

We may place cookies for analysis of our visitor data, to improve our website and measure advertising performance. Overall this data is used to provide a better website experience. More information

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of Instant Trading EU Ltd including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaForex anyway.

We are sorry for any inconvenience caused by this message.

Stay

Stay