Trading Conditions

Products

Tools

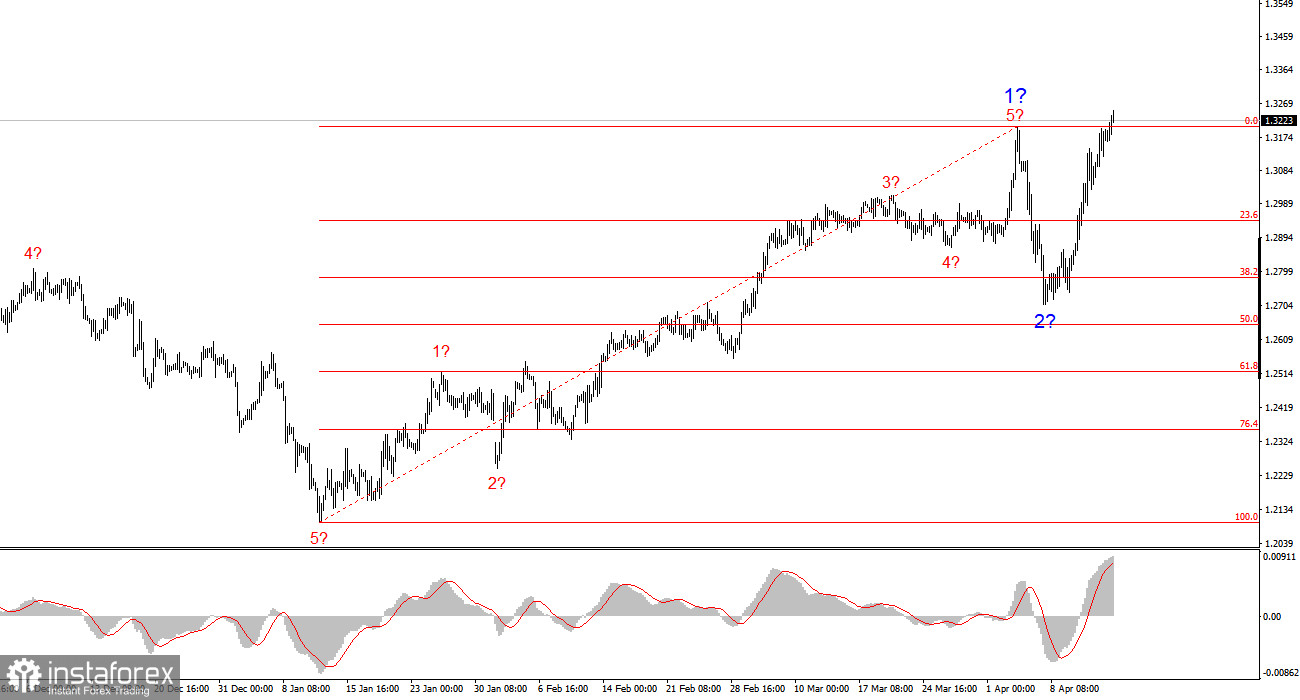

The wave structure for GBP/USD has also transformed into a bullish, impulsive formation — "thanks" to Donald Trump. The wave pattern is almost identical to that of EUR/USD. Until February 28, we were observing the construction of a convincing corrective structure that didn't raise any concerns. However, demand for the US dollar began to decline rapidly, resulting in the formation of a five-wave bullish structure. Consequently, we can now expect the development of a three-wave correction, followed by wave 3 of a new global bullish trend. Wave 2 may also take the form of a single-wave correction. If that is the case, it is already complete.

Considering the fact that the UK news flow had no influence on the pound's strong growth, we can conclude that it is Donald Trump alone who currently drives the forex market. If (theoretically) Trump's trade policy course changes, it's likely that the trend will reverse too — this time to bearish. Therefore, in the coming months (or even years), close attention should be paid to all actions taken by the White House.

The GBP/USD exchange rate rose another 40 basis points on Tuesday. While that's not much, it's another day the pound closed in the green. The GBP/USD pair continues to rise on nearly any pretext. If Trump imposes tariffs — the dollar falls. If UK statistics are released — the pound rallies. If there's no news at all — the market buys the pound just in case. Today, for example, the UK released February unemployment data. The unemployment rate remained unchanged, which probably pleased market participants, as the British economy hasn't provided much positive data lately. At the same time, the increase in the number of unemployed was smaller than expected, which also plays in favor of the pound and its buyers.

However, on paper, everything always looks clean and logical. The pound has been rising without pause for six straight days. It's unlikely that traders found hidden positivity in UK statistics today that pushed buyers to act. What I mean is that the pound's movements currently show little consistency or pattern. On any given day, if the pound rises, one could simply attribute the move to the trade war or market participants' pessimism toward the U.S. economy — and that would be fair.

In reality, however, the market rarely trades so one-sidedly. I believe that trying to explain daily movements in isolation is futile. Right now, there is a general trend supported almost exclusively by Donald Trump and his protectionist policies. If the U.S. policy course turns 180 degrees (which is very hard to believe at this point), then the bullish trend will end quickly — regardless of how well-formed wave 3 may appear. Beautiful wave structures are not something we can expect in the current environment.

The wave structure for GBP/USD has transformed. We are now dealing with a bullish, impulsive trend segment. Unfortunately, under Donald Trump, markets may experience numerous shocks and reversals that don't align with any wave markup or technical analysis. The presumed wave 2 is considered complete, as the pair has surpassed the peak of wave 1. Therefore, we should now expect the development of wave 3 with the nearest targets at 1.3345 and 1.3541 — but only if Trump's trade policy position doesn't change drastically, for which there are currently no indications.

On the higher wave scale, the structure has also shifted to bullish. We may now anticipate the construction of a bullish trend segment. Near-term targets are 1.2782 and 1.2650.

My Key Analytical Principles:

InstaForex analytical reviews will make you fully aware of market trends! Being an InstaForex client, you are provided with a large number of free services for efficient trading.

We may place cookies for analysis of our visitor data, to improve our website and measure advertising performance. Overall this data is used to provide a better website experience. More information

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of Instant Trading EU Ltd including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaForex anyway.

We are sorry for any inconvenience caused by this message.

Stay

Stay