#BIDU (Baidu, Inc.). Exchange rate and online charts

Currency converter

18 Sep 2025 22:59

(1.42%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

BIDU is a ticker symbol for the shares of China’s Internet company Baidu, traded on NASDAQ.

Nowadays, Baidu captures 80% of China's mobile search market with more than 465 million users. It ranks 4th among search engines (1.06%). It is gradually expanding its market presence.

History

Baidu was established in 2000 by Robin Li and Eric Xu (Li Yanhong and Xu Yong) with headquarters in Beijing and registration in the Cayman Islands. They met in the US where they both received education. Robin Lee had worked for several American IT companies. At that time, he developed and patented Randex (1996), an algorithm for ranking search results. This algorithm is also used in Baidu. The name of the startup is borrowed from a poem written more than 800 years ago. It means "hundreds of times", symbolizing the constant and persistent search for the ideal.

Services and products

The company primarily focuses on its main service - a search platform on the website baidu.com.

Baidu also develops additional services, including a news feed, social networks, Q&A software, MP3 search, the largest open Internet encyclopedia in Chinese, etc.

The company provides a platform for business through keyword-based targeted marketing services, transaction services (Nuomi, Takeout Delivery, Maps, Connect, Wallet, and others), an online video platform iQiy with a content library.

Baidu is also engaged in such areas as AI, self-driving vehicles, the construction of the world's largest testing ground for autonomous vehicles in Beijing, etc.

Considering peculiarities of China’s market

Private users receive various information on the network. A huge part of the Baidu traffic (about 40%) accounts for the service for finding direct links to download audio tracks. This causes a wave of complaints from record companies from all over the world, but the situation remains unchanged.

The company also takes into account the peculiarities of the Chinese political system when promoting its products. For example, Baidu excluded links to anti-government resources, pornography and suspicious websites from the search results. It actively cooperates with the authorities. The government appreciated the willingness of the company to make compromises and offered its full support. For example, a competing Google search engine was repeatedly blocked in China. For this reason, many users shifted their attention to the more reliable Baidu Wany Pan service at a time when Google Drive was blocked by a state decision.

Profit

The start-up capital of $1.2 million was raised by partners from American venture capital companies. A year later, Baidu got another $10 million investment. The founders of the company were largely betting on hiring highly qualified personnel.

In 2002, Baidu controlled 50% of China's online search market. In 2004, baidu.com became the number one search engine in the country. The high income of the company was also associated with the original method to optimize monetization. In order to reach a wider audience and build brand awareness, advertisers should pay fees for entering the Top. This led to a series of high-profile scandals (2007-2008) and the creation of a paid advertising platform Phoenix Nest.

In 2005, the company made an initial public offering debut on NASDAQ. BIDU set a record for the decade. By the end of the trading session, its shares had risen fourfold. The company earned $124 million during the IPO. In 2005, the profit came in at $13.2 million.

In 2007, BIDU was included in the NASDAQ-100 index.

Currently, 98% of Baidu's revenue comes from the Chinese market. The company has about 40,000 employees. Its net worth totals $23.69 billion and the number of shares is 34,582,875. Its market cap amounts to $43.896 billion (as of 1.09.2020).

See Also

- Technical analysis / Video analytics

Forex forecast 18/09/2025: EUR/USD, GBP/USD, USD/JPY, USDX and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/JPY, USDX and BitcoinAuthor: Sebastian Seliga

10:14 2025-09-18 UTC+2

4210

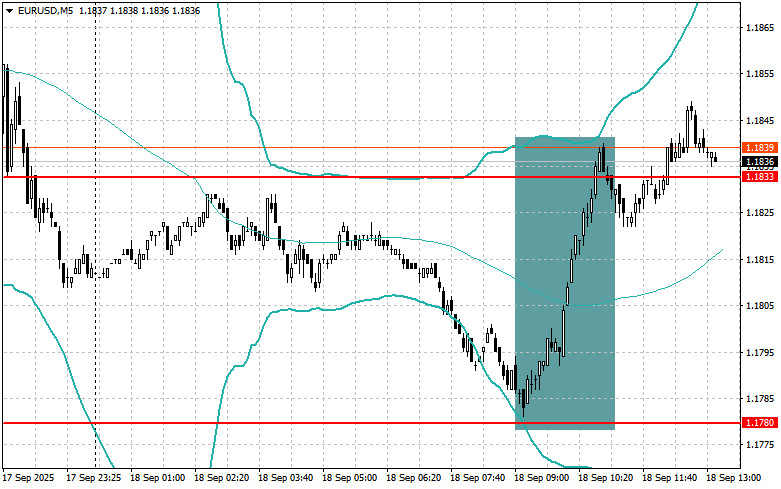

EUR/USD: simple trading tips for beginner traders on September 18th (U.S. session)Author: Jakub Novak

13:19 2025-09-18 UTC+2

1975

US stock market: rate cut opens door to new record highsAuthor: Natalya Andreeva

15:46 2025-09-18 UTC+2

1945

- Level and Target Adjustments for the U.S. Session – September 18th

Author: Miroslaw Bawulski

12:45 2025-09-18 UTC+2

1735

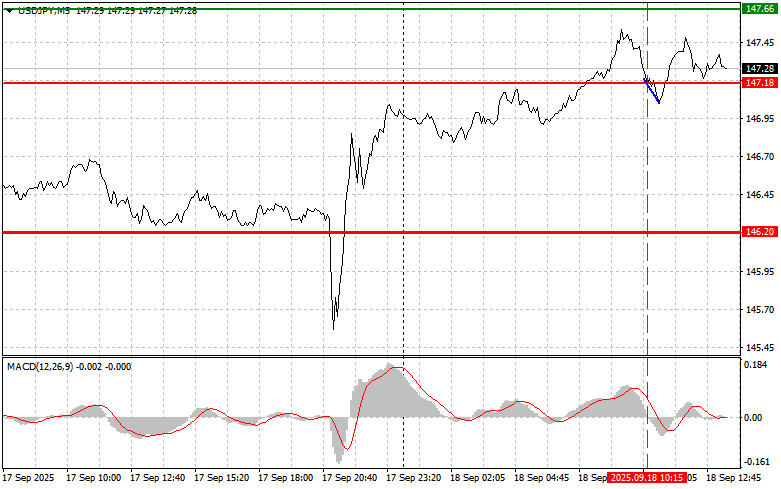

USD/JPY: simple trading tips for beginner traders on September 18th (U.S. session)Author: Jakub Novak

13:24 2025-09-18 UTC+2

1660

Bears still cannot count on a trendAuthor: Samir Klishi

12:17 2025-09-18 UTC+2

1600

- The GBP/USD pair reverses intraday losses amid renewed U.S. dollar selling.

Author: Irina Yanina

13:28 2025-09-18 UTC+2

1585

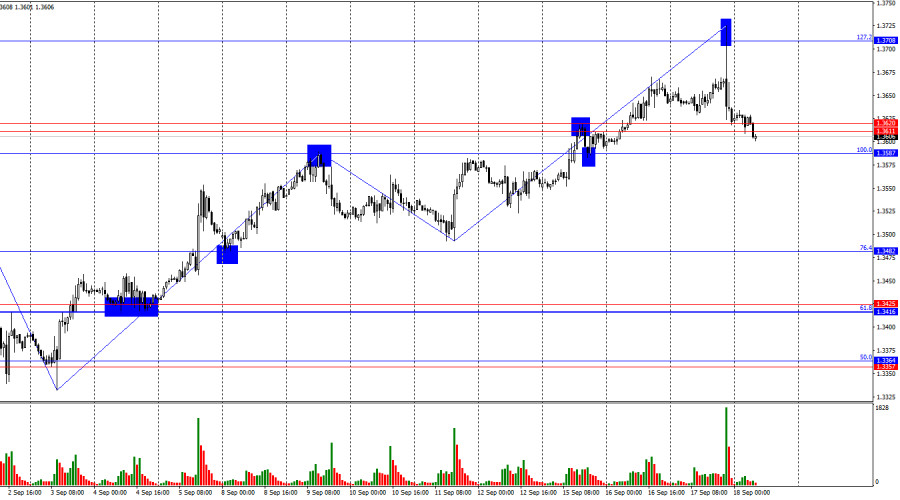

On Wednesday, the pair moved upward to resistance at 1.3725 (blue dotted line), then turned downward, closing the daily candle at 1.3622. Today, it may continue moving lower. On Thursday, strong news is expected.Author: Stefan Doll

11:59 2025-09-18 UTC+2

1570

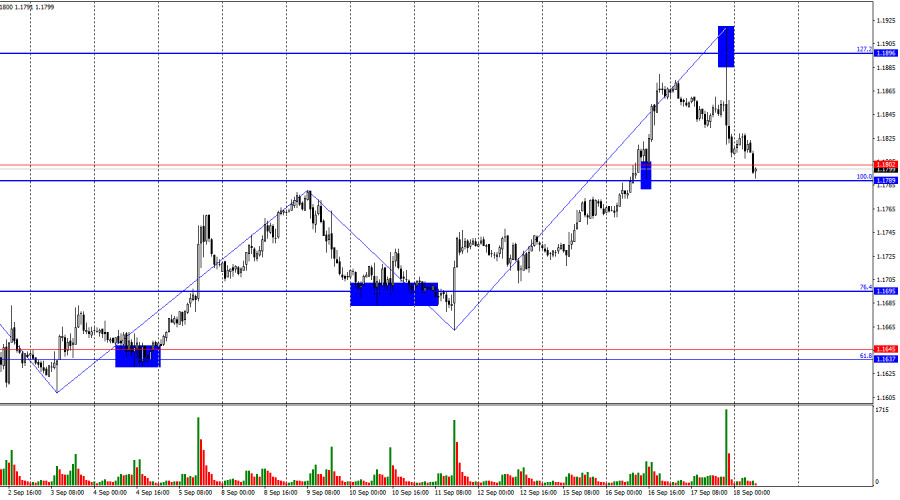

Bullish traders have not left the market; they have only retreated temporarily.Author: Samir Klishi

12:21 2025-09-18 UTC+2

1480

- Technical analysis / Video analytics

Forex forecast 18/09/2025: EUR/USD, GBP/USD, USD/JPY, USDX and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/JPY, USDX and BitcoinAuthor: Sebastian Seliga

10:14 2025-09-18 UTC+2

4210

- EUR/USD: simple trading tips for beginner traders on September 18th (U.S. session)

Author: Jakub Novak

13:19 2025-09-18 UTC+2

1975

- US stock market: rate cut opens door to new record highs

Author: Natalya Andreeva

15:46 2025-09-18 UTC+2

1945

- Level and Target Adjustments for the U.S. Session – September 18th

Author: Miroslaw Bawulski

12:45 2025-09-18 UTC+2

1735

- USD/JPY: simple trading tips for beginner traders on September 18th (U.S. session)

Author: Jakub Novak

13:24 2025-09-18 UTC+2

1660

- Bears still cannot count on a trend

Author: Samir Klishi

12:17 2025-09-18 UTC+2

1600

- The GBP/USD pair reverses intraday losses amid renewed U.S. dollar selling.

Author: Irina Yanina

13:28 2025-09-18 UTC+2

1585

- On Wednesday, the pair moved upward to resistance at 1.3725 (blue dotted line), then turned downward, closing the daily candle at 1.3622. Today, it may continue moving lower. On Thursday, strong news is expected.

Author: Stefan Doll

11:59 2025-09-18 UTC+2

1570

- Bullish traders have not left the market; they have only retreated temporarily.

Author: Samir Klishi

12:21 2025-09-18 UTC+2

1480

Stay

Stay