#PEP (PepsiCo Inc.). Exchange rate and online charts

Currency converter

18 Sep 2025 22:59

(0.06%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

PepsiCo Inc. (#PEP) is a world’s leading multinational food and beverage corporation. The company was founded in 1965 in the US. It is the second largest corporation in the global food business in terms of net revenue.

PepsiCo produces and sells fizzy and still drinks, snacks, and other products in the US and around the world. The company owns several popular brands such as Pepsi, 7Up, Gatorade, Tropicana, Lay’s, Cheetos and others. At present, the company is committed to healthy nutrition, thus reducing dubious ingredients in its products.

In the 2008 fiscal year, PepsiCo revenues surged 9.6% to $43,251 billion whereas net profits on the contrary slumped 9.1% to $5,142 billion. Nowadays, its market capitalization equals $9,773.06 billion.

PepsiCo is included in the S&P 500 index. The company’s shares are traded on the NYSE under the #PEP ticker. In 2017, 99.57% of PepsiCo shares have been in free circulation.

The global producer of soft drinks and snacks suggests lucrative investment opportunities. According to expert estimates, PepsiCo’s shares gain 1.54% on average per month.

See Also

- Technical analysis / Video analytics

Forex forecast 18/09/2025: EUR/USD, GBP/USD, USD/JPY, USDX and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/JPY, USDX and BitcoinAuthor: Sebastian Seliga

10:14 2025-09-18 UTC+2

4210

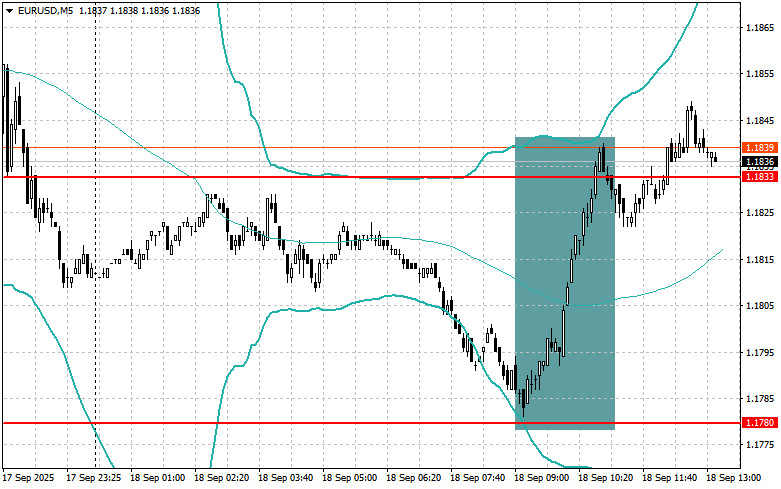

EUR/USD: simple trading tips for beginner traders on September 18th (U.S. session)Author: Jakub Novak

13:19 2025-09-18 UTC+2

1975

US stock market: rate cut opens door to new record highsAuthor: Natalya Andreeva

15:46 2025-09-18 UTC+2

1945

- Level and Target Adjustments for the U.S. Session – September 18th

Author: Miroslaw Bawulski

12:45 2025-09-18 UTC+2

1735

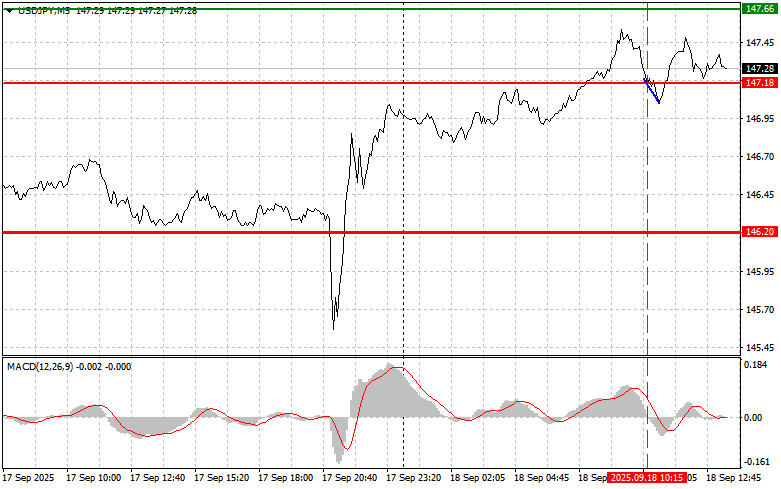

USD/JPY: simple trading tips for beginner traders on September 18th (U.S. session)Author: Jakub Novak

13:24 2025-09-18 UTC+2

1660

Bears still cannot count on a trendAuthor: Samir Klishi

12:17 2025-09-18 UTC+2

1600

- The GBP/USD pair reverses intraday losses amid renewed U.S. dollar selling.

Author: Irina Yanina

13:28 2025-09-18 UTC+2

1585

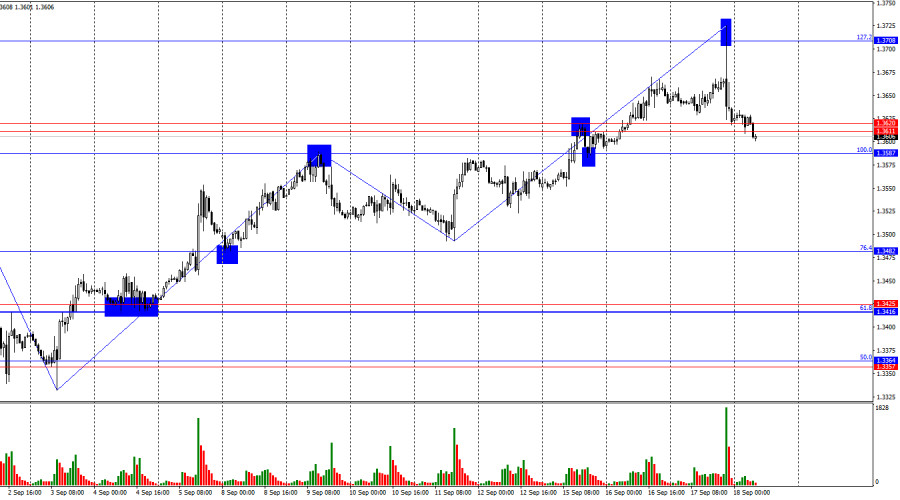

On Wednesday, the pair moved upward to resistance at 1.3725 (blue dotted line), then turned downward, closing the daily candle at 1.3622. Today, it may continue moving lower. On Thursday, strong news is expected.Author: Stefan Doll

11:59 2025-09-18 UTC+2

1570

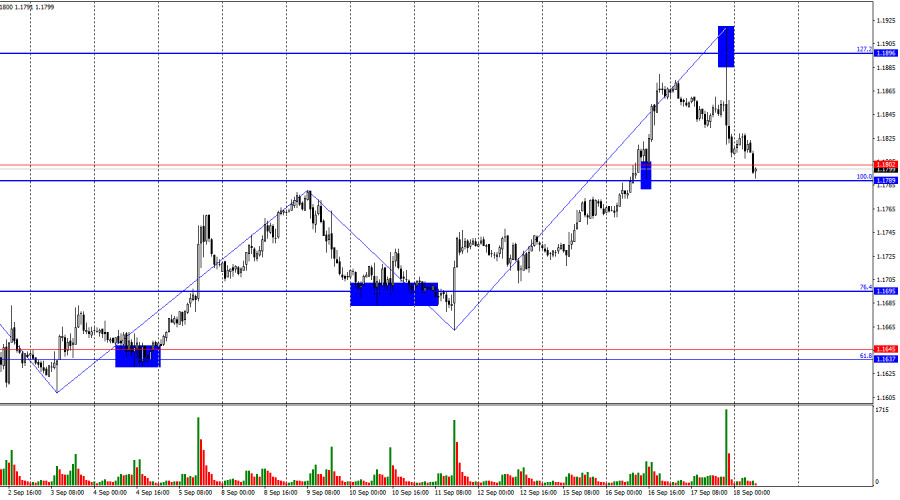

Bullish traders have not left the market; they have only retreated temporarily.Author: Samir Klishi

12:21 2025-09-18 UTC+2

1480

- Technical analysis / Video analytics

Forex forecast 18/09/2025: EUR/USD, GBP/USD, USD/JPY, USDX and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/JPY, USDX and BitcoinAuthor: Sebastian Seliga

10:14 2025-09-18 UTC+2

4210

- EUR/USD: simple trading tips for beginner traders on September 18th (U.S. session)

Author: Jakub Novak

13:19 2025-09-18 UTC+2

1975

- US stock market: rate cut opens door to new record highs

Author: Natalya Andreeva

15:46 2025-09-18 UTC+2

1945

- Level and Target Adjustments for the U.S. Session – September 18th

Author: Miroslaw Bawulski

12:45 2025-09-18 UTC+2

1735

- USD/JPY: simple trading tips for beginner traders on September 18th (U.S. session)

Author: Jakub Novak

13:24 2025-09-18 UTC+2

1660

- Bears still cannot count on a trend

Author: Samir Klishi

12:17 2025-09-18 UTC+2

1600

- The GBP/USD pair reverses intraday losses amid renewed U.S. dollar selling.

Author: Irina Yanina

13:28 2025-09-18 UTC+2

1585

- On Wednesday, the pair moved upward to resistance at 1.3725 (blue dotted line), then turned downward, closing the daily candle at 1.3622. Today, it may continue moving lower. On Thursday, strong news is expected.

Author: Stefan Doll

11:59 2025-09-18 UTC+2

1570

- Bullish traders have not left the market; they have only retreated temporarily.

Author: Samir Klishi

12:21 2025-09-18 UTC+2

1480

Stay

Stay