This information is provided to retail and professional clients as part of marketing communication. It does not contain and should not be construed as containing investment advice or investment recommendation or an offer or solicitation to engage in any transaction or strategy in financial instruments. Past performance is not a guarantee or prediction of future performance. Instant Trading EU Ltd. makes no representation and assumes no liability as to the accuracy or completeness of the information provided, or any loss arising from any investment based on analysis, forecast or other information provided by an employee of the Company or otherwise. Full disclaimer is available here.

Analytics today

Popular analytics

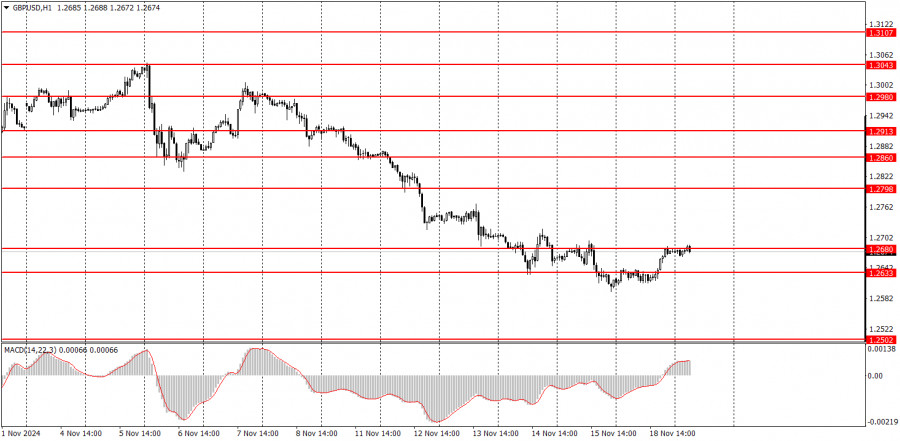

Analysis of Monday's Trades 1H Chart of GBP/USD On Monday, the GBP/USD pair also attempted a correction but failed to break even the nearest resistance level at 1.2680. Thus.

How to Trade the EUR/USD Pair on November 19? Simple Tips and Trade Analysis for Beginners

Analysis of Monday's Trades 1H Chart of EUR/USD On Monday, the EUR/USD currency pair recently attempted to correct for the third time. As shown on the chart, the attempt once.

Technical Analysis of Intraday Price Movement of USD/CAD Commodity Currency Pairs, Tuesday November 19, 2024.

With the appearance of deviations between the price movement of the USD/CAD commodity currency pair and the Stochastic Oscillator indicator and also confirmed by the price movement of USD/CAD which.

Technical Analysis of Intraday Price Movement of GBP/AUD Cross Currency Pairs, Tuesday November 19, 2024.

If we look at the 4-hour chart of the GBP/AUD cross currency pair, we will see a deviation between the GBP/AUD price movement and the Stochastic Oscillator indicator.

Forecast for USD/JPY on November 19, 2024

After reaching the target level of 156.79 on Friday, the pair showed no intention of resuming growth on Monday, as reflected by a candlestick with a small body. This morning.

Overview of GBP/USD Pair on November 19: The Pound Teeters Between Life and Death

The GBP/USD pair showed little inclination for significant movement on Monday, marking a rare calm day in recent months. While the session was relatively uneventful, the British pound's volatility.

Overview of EUR/USD Pair on November 19: A Calm Start to the Week

The EUR/USD pair mainly remained stagnant throughout Monday. This is unsurprising since no macroeconomic events except European Central Bank President Christine Lagarde's speech were scheduled for the day. However.

Trading Recommendations and Trade Analysis for GBP/USD on November 19: The 26th Level Held Firm Against Decline

The GBP/USD pair attempted a correction on Monday. The 1.2605-1.2620 zone was tested accurately, followed by a notable rebound. This provided an opportunity for cautious long positions. However, Monday lacked.

GBP cannot benefit from its safety cushion

Disappointment is a harsh word for a currency. It seemed that the sterling's lower vulnerability to Donald Trump's trade tariffs, the stability of Labour Party politics, and the Bank.

EUR/USD: Simple Trading Tips for Beginners on November 18th (U.S. Session)

The test of the 1.0551 price occurred when the MACD indicator had already moved significantly above the zero line, limiting the pair's upward potential—especially in such a bearish market.

EUR/USD: November 18 - Euro Awaits Support from Christine Lagarde

On Friday, the EUR/USD pair returned to the 323.6% Fibonacci corrective level at 1.0532, but bears once again failed to achieve a close below it. This rebound suggests the possibility.

Show more

This section is updated daily and contains market analysis prepared by professional analysts on behalf of InstaForex. Each of the specialists presents analytical reviews in accordance with his/her vision of the current situation on the foreign exchange and other markets. However, the outlooks below are neither recommendations nor instructions to any actions. They contain analysis of the current situation on financial markets. In some cases, analysts' opinions about current market conditions may differ.

Stay

Stay