Trading Conditions

Products

Tools

Overview:

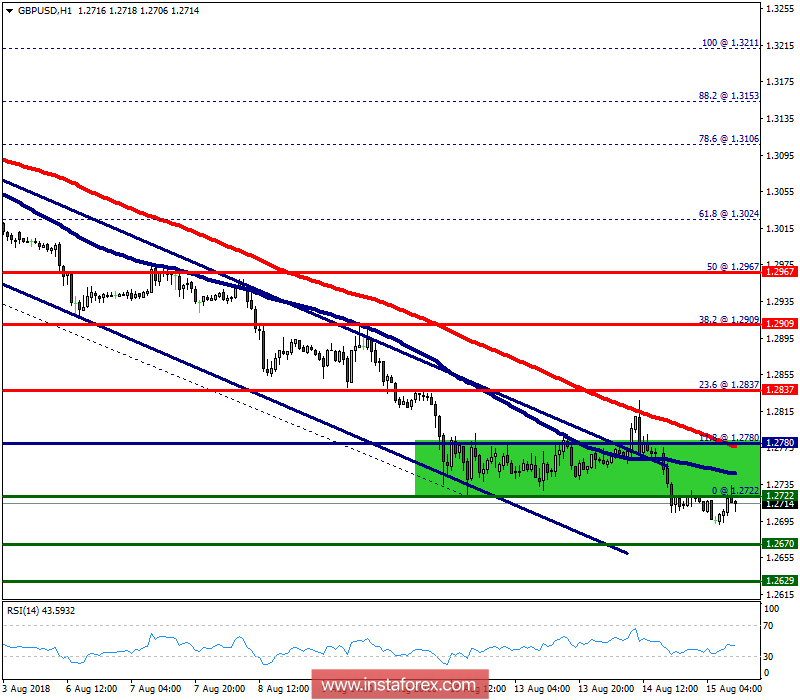

The daily pivot point is seen at the price of 0.2780. The GBP/USD pair hit the weekly support levels of 0.2780 and 0.2722 last week. Thus, it dropped down in order to bottom at the point of 1.2780. Today, the pair is trading below its pivot point (1.2780). It is likely to trade in a higher range as long as it remains below the level of 1.2780. Hence, the minor resistance was already set at the level of 1.2780. Moreover, the weekly resistance is also coinciding around the major support around the area of 1.2837. Additionally, the RSI is still calling for a strong bearish market as well as the current price is also below the moving average 100. Therefore, it will be advantageous to sell below the current level of 1.2780 with the first target at 1.2700. From this point, if the pair closes below the dily support of 1.2700 on the H1 chart, the GBP/USD pair may resume its movement to 1.2670 in order to retest the weekly support 2. On the other hand, stop loss should always be taken into account, accordingly, it will be beneficial to set the stop loss below the last bullish wave at 1.2840.

InstaForex analytical reviews will make you fully aware of market trends! Being an InstaForex client, you are provided with a large number of free services for efficient trading.

We may place cookies for analysis of our visitor data, to improve our website and measure advertising performance. Overall this data is used to provide a better website experience. More information

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of Instant Trading EU Ltd including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaForex anyway.

We are sorry for any inconvenience caused by this message.

Stay

Stay