This information is provided to retail and professional clients as part of marketing communication. It does not contain and should not be construed as containing investment advice or investment recommendation or an offer or solicitation to engage in any transaction or strategy in financial instruments. Past performance is not a guarantee or prediction of future performance. Instant Trading EU Ltd. makes no representation and assumes no liability as to the accuracy or completeness of the information provided, or any loss arising from any investment based on analysis, forecast or other information provided by an employee of the Company or otherwise. Full disclaimer is available here.

Analytics today

Popular analytics

On the hourly chart, GBP/USD rose on Thursday to the resistance zone of 1.2709 – 1.2734, which includes the peak of the most recent wave. A close above this zone.

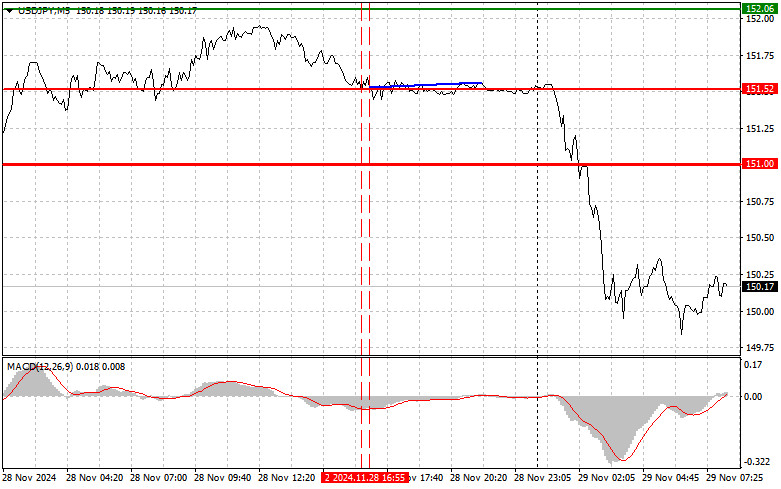

USD/JPY: Simple Trading Tips for Beginner Traders on November 29th. Analysis of Yesterday's Forex Deals

The 151.52 level test in the second half of the day coincided with the MACD indicator dropping significantly below the zero line, limiting the pair's downward potential, particularly during.

GBP/USD: Simple Trading Tips for Beginner Traders on November 29th. Analysis of Yesterday's Forex Deals

The test of the 1.2643 level occurred when the MACD indicator had already moved significantly above the zero mark, limiting the pair's upward potential. For this reason, I didn't.

EUR/USD: Simple Trading Tips for Beginner Traders on November 29th. Analysis of Yesterday's Forex Deals

No tests of the specified levels occurred yesterday during the second half of the day. This was due to Thanksgiving in the US, which significantly reduced market volatility and trading.

How to Trade the GBP/USD Currency Pair on November 29th: Simple Tips and Deal Analysis for Beginners

Thursday's Deal Analysis 1H Chart for GBP/USD The GBP/USD pair continued its upward movement on Thursday. There were no macroeconomic or fundamental drivers behind this rise in the British currency.

How to Trade the EUR/USD Currency Pair on November 29th: Simple Tips and Deal Analysis for Beginners

Analysis of Thursday's Deals 1H Chart for EUR/USD On Thursday, the EUR/USD currency pair maintained a corrective sentiment. Volatility remained very low throughout the day due to Thanksgiving.

EUR/USD Forecast for November 29, 2024

The euro closed yesterday with a slight decline, indicating the start of a potential consolidation phase below the 1.0590 resistance level. The price may attempt to break this level, move.

EUR/USD Analysis for November 29th: The Euro Remains Under Pressure

The EUR/USD pair remained above the moving average line for most of Thursday. While the euro shows some potential for further growth, holding above the moving average line alone does.

Technical Analysis of Intraday Price Movement of Doge Cryptocurrency, Friday November 29, 2024.

Although on the 4-hour chart the Doge cryptocurrency looks stronger and is supported by confirmation of a BUY crossing from the Stochastic Oscillator indicator, the price movement moving within.

Technical Analysis of Intraday Price Movement of Litecoin Ethereum Cryptocurrency, Friday November 29, 2024.

With the detection of hidden deviations between the price movement of the Litecoin cryptocurrency and the Stochastic Oscillator indicator on its 4-hour chart, as long as there is no significant.

Trading Signals for EUR/USD for November 28-29, 2024: buy above 1.0550 (21 SMA - 2/8 Murray)

Early in the American session, the euro is trading around 1.0551, above the 21 SMA, and above the 2/8 Murray which represents an important support. Yesterday during the American session.

USD/JPY: Simple Trading Tips for Beginner Traders on November 28th (U.S. Session)

Analysis of Trades and Trading Advice for the Japanese Yen The test of the 151.74 price level in the first half of the day coincided with the MACD indicator beginning.

Show more

This section is updated daily and contains market analysis prepared by professional analysts on behalf of InstaForex. Each of the specialists presents analytical reviews in accordance with his/her vision of the current situation on the foreign exchange and other markets. However, the outlooks below are neither recommendations nor instructions to any actions. They contain analysis of the current situation on financial markets. In some cases, analysts' opinions about current market conditions may differ.

Stay

Stay