This information is provided to retail and professional clients as part of marketing communication. It does not contain and should not be construed as containing investment advice or investment recommendation or an offer or solicitation to engage in any transaction or strategy in financial instruments. Past performance is not a guarantee or prediction of future performance. Instant Trading EU Ltd. makes no representation and assumes no liability as to the accuracy or completeness of the information provided, or any loss arising from any investment based on analysis, forecast or other information provided by an employee of the Company or otherwise. Full disclaimer is available here.

Analytics today

Popular analytics

On Tuesday, the British pound precisely tested both boundaries of the consolidation range at 1.2510-1.2612. Despite the currency's seemingly neutral stance, the Marlin oscillator continued its upward movement. The price.

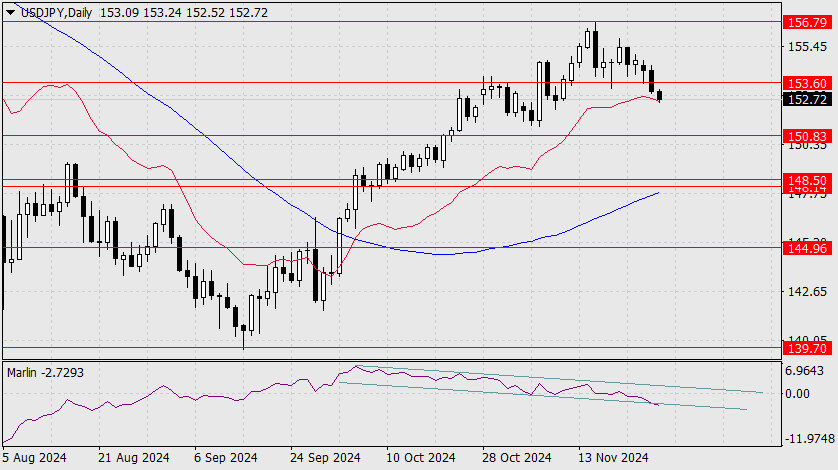

Forecast for USD/JPY on November 27, 2024

After a month and a half of unclear dollar growth against the yen and a consistently declining Marlin oscillator, the situation finally resolved with a significant shift yesterday and this.

Overview of the GBP/USD Pair for November 27: The British Pound Continues Its Humorous Attempts at a Correction

On Tuesday, the GBP/USD currency pair tried to correct but failed even decisively to overcome the moving average. In the article on the euro, we already explained that all indicators.

Overview of the EUR/USD Pair for November 27: The Euro May Resume Falling Today

The EUR/USD currency pair once again attempted to consolidate above the moving average on Tuesday, but we cannot say it succeeded. Let us remind you that crossing the moving average.

Trading Recommendations and Analysis for GBP/USD on November 27: The Pound Stands No Chance

Once again, the GBP/USD pair attempted to correct on Tuesday but failed to consolidate above either the critical line or the 1.2605–1.2620 area. As a result, the decline in quotes.

Trading Recommendations and Analysis for EUR/USD on November 27: Another Failed Attempt at Correction

On Tuesday, the EUR/USD pair attempted another correction and even broke through the trendline. However, the upward movement ended as quickly as it began. Essentially, we continue to observe weak.

NZD/USD: Preview of the November RBNZ Meeting

On November 27, the Reserve Bank of New Zealand (RBNZ) will conclude its final meeting of the year. According to most experts, the RBNZ is expected to cut the interest.

USD/JPY: Simple Trading Tips for Beginner Traders on November 26th (U.S. Session)

Analysis of Trades and Tips for Trading the Japanese Yen The test of the 154.07 level in the first half of the day occurred as the MACD indicator had already.

GBP/USD: Trading Plan for the U.S. Session on November 26th (Review of Morning Trades)

In my morning forecast, I highlighted the 1.2561 level and planned to make trading decisions around it. Let's review the 5-minute chart and analyze the developments. A breakout and subsequent.

AU/USD: Analysis and Forecast

Today, gold continues its negative trend for the second consecutive day, trading slightly above the weekly low. Increasing anticipation that the expansionist policies of US President-elect Donald Trump will reignite.

EUR/USD and GBP/USD: technical analysis for November 26

Currently, the EUR/USD pair is moving as a result of interaction with the support levels after the weekly target was hit. Wat exactly was broken are the Ichimoku cloud (1.0410.

Donald Trump promises to fire Gary Gensler! Gensler's resignation and expectations of Trump's presidency sparks BTC rally.

Trump's second term as president begins on January 20. Gary Gensler has long been a strong advocate for regulating the cryptocurrency industry. His actions were met with criticism and unrest.

Show more

This section is updated daily and contains market analysis prepared by professional analysts on behalf of InstaForex. Each of the specialists presents analytical reviews in accordance with his/her vision of the current situation on the foreign exchange and other markets. However, the outlooks below are neither recommendations nor instructions to any actions. They contain analysis of the current situation on financial markets. In some cases, analysts' opinions about current market conditions may differ.

Stay

Stay