Trading Conditions

Products

Tools

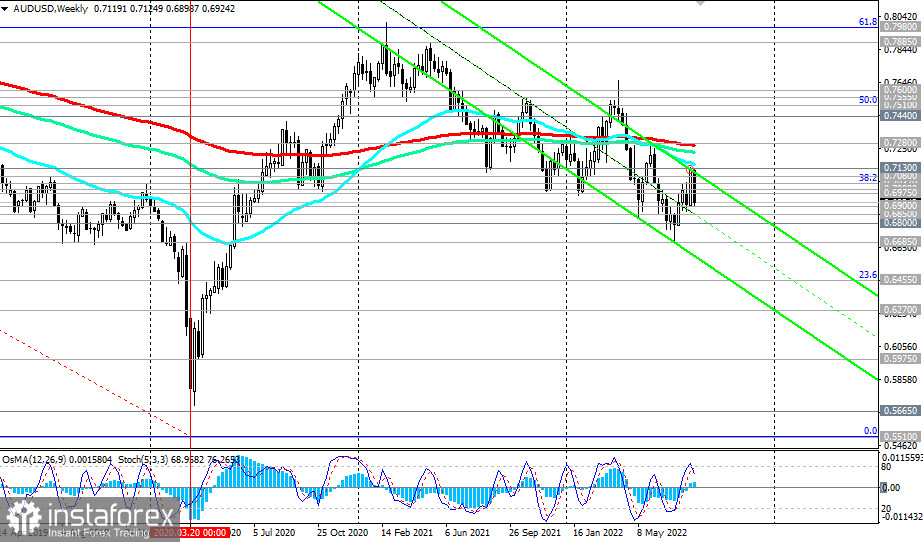

As we have already mentioned in our fundamental analysis, AUD/USD is likely to continue its decline amid a rate hike by the Fed and a more moderate approach by the Reserve Bank of Australia.

The pair is trading near the level of 0.6927 at the moment of writing. The price is still in the bear market, staying below the key resistance levels of 0.7130 (EMA 200 on the daily chart) and 0.7280 (EMA 200 on the weekly chart).

On lower time frames, AUD/USD is also holding below the key resistance zones of 0.6970 (EMA 200 on H4) and 0.7000 (EMA 200 on H1).

The most probable scenario is a breakout of the local support level of 0.6900 and a further decline of the price within the descending channel on the weekly chart. The lower boundary of the channel is found below the 0.6600 mark and below the 2-year low reached last month.

In an alternative scenario, AUD/USD will head towards the resistance levels of 0.7080 and 0.7130 after breaking through 0.6975 and 0.7000.

A breakout of the resistance level of 0.7280 will mean the resumption of the long-term bullish trend for the AUD/USD pair.

Yet, the main scenario is the decline of the AUD/USD pair.

(read more about how to trade AUD/USD in the article AUD/USD: main features and trading tips)

Support levels: 0.6900, 0.6850, 0.6800, 0.6700, 0.6685, 0.6660, 0.6500, 0.6455, 0.6270, 0.5975, 0.5665, 0.5510

Resistance levels: 0.6975, 0.7000, 0.7037, 0.7080, 0.7100, 0.7130, 0.7200, 0.7280

Trading recommendations:

Sell Stop 0.6890. Stop Loss 0.6960. Take Profit 0.6850, 0.6800, 0.6700, 0.6685, 0.6660, 0.6500, 0.6455, 0.6270, 0.5975, 0.5665, 0.5510

Buy Stop 0.6960. Stop Loss 0.6890. Take Profit 0.6975, 0.7000, 0.7037, 0.7080, 0.7100, 0.7130, 0.7200, 0.7280

InstaForex analytical reviews will make you fully aware of market trends! Being an InstaForex client, you are provided with a large number of free services for efficient trading.

We may place cookies for analysis of our visitor data, to improve our website and measure advertising performance. Overall this data is used to provide a better website experience. More information

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of Instant Trading EU Ltd including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaForex anyway.

We are sorry for any inconvenience caused by this message.

Stay

Stay