This information is provided to retail and professional clients as part of marketing communication. It does not contain and should not be construed as containing investment advice or investment recommendation or an offer or solicitation to engage in any transaction or strategy in financial instruments. Past performance is not a guarantee or prediction of future performance. Instant Trading EU Ltd. makes no representation and assumes no liability as to the accuracy or completeness of the information provided, or any loss arising from any investment based on analysis, forecast or other information provided by an employee of the Company or otherwise. Full disclaimer is available here.

Analytics today

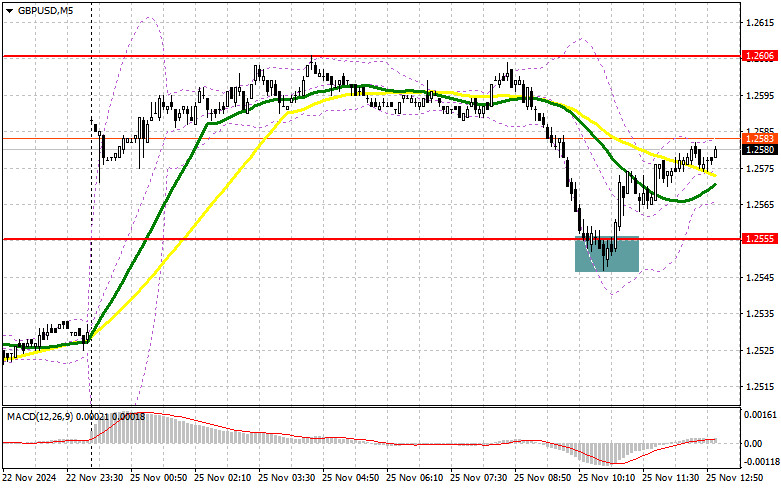

The test of the 1.2583 level occurred as the MACD indicator began its downward movement from the zero line, confirming a valid entry point for selling the pound. Consequently.

EUR/USD: Trading Plan for the U.S. Session on November 25th (Analysis of Morning Trades). Euro Hopes for Growth

In my morning forecast, I highlighted the level of 1.0441 and planned to base my market entry decisions on its behavior. Let's review the 5-minute chart and analyze the developments.

EUR/USD: Simple Trading Tips for Beginner Traders on November 25. Analysis of Forex Trades

The test of the 1.0429 price level coincided with the moment when the MACD indicator started moving upward from the zero line, confirming a valid entry point.

Technical Analysis of Intraday Price Movement of Crude Oil Commodity Asset, Monday November 25, 2024.

On the 4-hour chart, the Crude Oil commodity asset can be seen when #CL moves harmoniously in the Bullish Pitchfork channel that is diving upwards and above.

How to Trade the EUR/USD Pair on November 25? Simple Tips and Trade Analysis for Beginners

Analysis of Friday's Trades 1H Chart of EUR/USD The EUR/USD pair experienced another sharp decline on Friday, dropping 150 pips in just a few hours. For novice traders, it's important.

EUR/USD: End of November: FOMC Minutes, Core PCE Index, and Eurozone Inflation Report on Deck

The final week of November promises to be both intense and volatile. As is customary, critical macroeconomic data are released at the end of each month, and this November will.

Forecast for USD/JPY on November 25, 2024

The Marlin oscillator has made a strong and prolonged effort to move into bearish territory. This morning, it successfully consolidated below the zero line. As a result, the likelihood.

Show more

This section is updated daily and contains market analysis prepared by professional analysts on behalf of InstaForex. Each of the specialists presents analytical reviews in accordance with his/her vision of the current situation on the foreign exchange and other markets. However, the outlooks below are neither recommendations nor instructions to any actions. They contain analysis of the current situation on financial markets. In some cases, analysts' opinions about current market conditions may differ.

Stay

Stay