Trading Conditions

Products

Tools

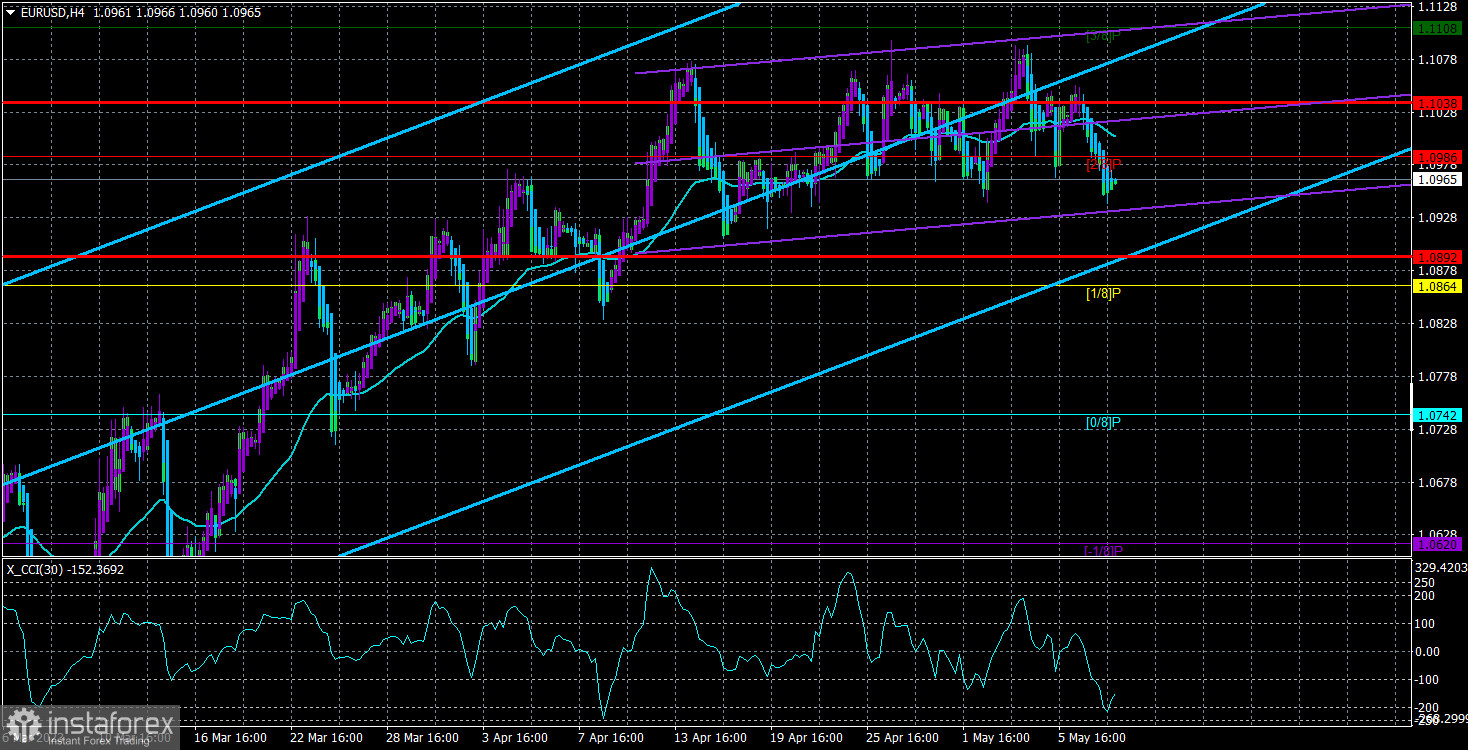

The EUR/USD currency pair started the new week very calmly and steadily, but it showed a decent downward movement on Tuesday. Since we do not have a clear lower boundary of the sideways channel, and we do not even have a clear sideways channel, it won't be easy to determine whether the flat is over. However, each new attempt by the pair to start forming a downward trend on the 4-hour TF increases the probability that it will eventually begin. The price has again overcome the moving average, which could signal new pair growth in the coming days. Let us remind you that growth was restored each time in the last two months when the price went below the moving average line. In other words, every sell signal indicated the imminent growth of the pair. This time, it will be different.

The macroeconomic background on Monday and Tuesday was virtually absent. One could only pay attention to the report on industrial production in Germany, but even the market itself did not pay attention to it. There were no important publications in the EU or the US on Tuesday. During the day, several representatives of the ECB and the Fed spoke, but the Americans spoke in the evening, and the Europeans tightened their "hawkish" stance on interest rates. Thus, yesterday, the European currency showed growth.

However, I remind you that the euro has risen almost without corrections for two months. It is heavily overbought. It is overbought to such an extent that its slight decline has brought the CCI indicator close to the oversold area. But we, of course, remember that earlier, it visited the overbought area twice, and each of these signals is strong. Thus, we are still waiting for the pair to fall, and it should be strong. We also believe that the market has long since worked out all the "hawkish" factors and "bullish" news. The illustration above shows how the upward impulse slowed down over the past month. This means that buyers are still looking for new reasons for purchases. And if so, sooner or later, they should start fixing profits on longs.

US inflation should support the dollar

On Wednesday, the first more or less significant report this week will be published - on inflation in the US. In principle, there is nothing special for traders to expect from this report, but it can support the US currency. According to expert forecasts, inflation will decrease by 0.1% in annual terms at best. Or will it stay the same compared to March? Thus, there will be no changes in the indicator, which means the market will have nothing to react to. If Tuesday's movement is not another downward movement within the flat, the pair's decline may continue, signaling the end of the "hour of the euro." The time when the European Union currency showed growth, often without having any basis for it.

At the same time, the inflation report may bring a "surprise." The dollar may depreciate again if inflation declines more than 0.3–0.4%. This will not be critical for the current sideways channel, as it is unlikely to climb above the last local maximum based on a single report. But it will still be a new reason to sell the dollar rather than buy it. If, on the other hand, inflation suddenly rises in April, it will be the best option for the dollar, as the Fed may decide on another rate hike in 2023. It will likely not happen earlier than a few months from now and will largely depend on subsequent inflation reports. But the likelihood of another increase will grow, creating a basis for the dollar's growth, which we have frankly longed for.

The average volatility of the euro/dollar currency pair for the last five trading days as of May 10 is 73 points and is characterized as "medium." Thus, we expect the pair to move between levels 1.0892 and 1.1038 on Wednesday. A reversal of the Heiken Ashi indicator upwards will indicate a new round of upward movement within the flat.

Nearest support levels:

S1 – 1.0864

S2 – 1.0742

S3 – 1.0620

Nearest resistance levels:

R1 – 1.0986

R2 – 1.1108

R3 – 1.1230

Trading recommendations:

The EUR/USD pair is trying to maintain an upward trend but is more flat. Currently, the movement is practically sideways, so trading can only be done based on the reversals of the Heiken Ashi indicator. Or on the youngest TFs, where at least intraday trends can be caught.

Explanations of illustrations:

Linear regression channels - help determine the current trend. If both are directed in one direction, the trend is strong now.

Moving average line (settings 20,0, smoothed) - determines the short-term tendency and direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or overbought area (above +250) means that a trend reversal is approaching in the opposite direction.

InstaForex analytical reviews will make you fully aware of market trends! Being an InstaForex client, you are provided with a large number of free services for efficient trading.

We may place cookies for analysis of our visitor data, to improve our website and measure advertising performance. Overall this data is used to provide a better website experience. More information

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of Instant Trading EU Ltd including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaForex anyway.

We are sorry for any inconvenience caused by this message.

Stay

Stay