This information is provided to retail and professional clients as part of marketing communication. It does not contain and should not be construed as containing investment advice or investment recommendation or an offer or solicitation to engage in any transaction or strategy in financial instruments. Past performance is not a guarantee or prediction of future performance. Instant Trading EU Ltd. makes no representation and assumes no liability as to the accuracy or completeness of the information provided, or any loss arising from any investment based on analysis, forecast or other information provided by an employee of the Company or otherwise. Full disclaimer is available here.

Analytics today

By date

By popularity

For beginners

Candlestick analysis

Crypto-currencies

Forecast

Forex humor

Forex video reviews

Fractal analysis

Fundamental analysis

Hot forecast

Ichimoku Indicator

News

Photonews

Review

Stock Markets

Technical analysis

Trading plan

Trend line

Wave analysis

Instruments:

EURUSD

GBPUSD

USDCHF

USDCAD

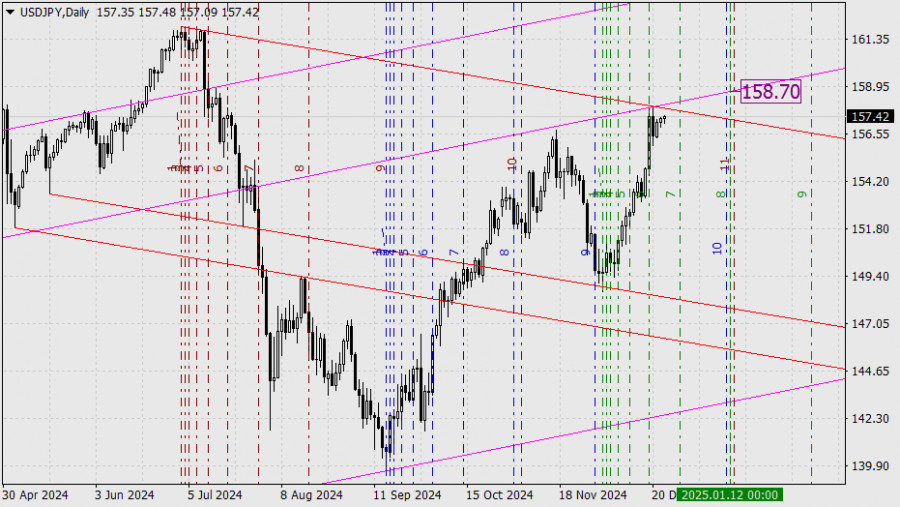

USDJPY

AUDUSD

GBPJPY

EURGBP

EURJPY

NZDUSD

EURNZD

Silver

Gold

#USDX

View more

View more

This section is updated daily and contains market analysis prepared by professional analysts on behalf of InstaForex. Each of the specialists presents analytical reviews in accordance with his/her vision of the current situation on the foreign exchange and other markets. However, the outlooks below are neither recommendations nor instructions to any actions. They contain analysis of the current situation on financial markets. In some cases, analysts' opinions about current market conditions may differ.

Stay

Stay