This information is provided to retail and professional clients as part of marketing communication. It does not contain and should not be construed as containing investment advice or investment recommendation or an offer or solicitation to engage in any transaction or strategy in financial instruments. Past performance is not a guarantee or prediction of future performance. Instant Trading EU Ltd. makes no representation and assumes no liability as to the accuracy or completeness of the information provided, or any loss arising from any investment based on analysis, forecast or other information provided by an employee of the Company or otherwise. Full disclaimer is available here.

Analytics today

Popular analytics

The test of the price level at 1.2628 occurred when the MACD indicator had moved significantly below the zero mark and was in the oversold zone, allowing the scenario.

EUR/USD: Simple Trading Tips for Beginner Traders on November 20. Analysis of Yesterday's Forex Trades

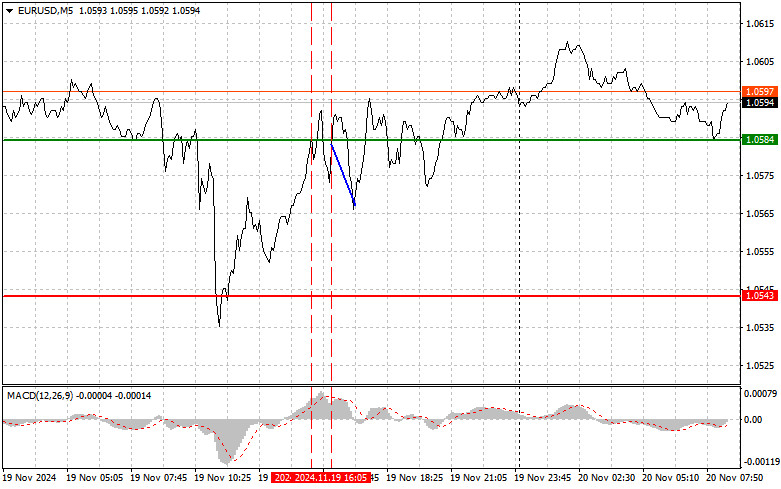

The test of the price level at 1.0584 occurred when the MACD indicator had moved significantly above the zero mark, limiting the pair's upward potential. For this reason.

How to Trade the GBP/USD Pair on November 20? Simple Tips and Trade Analysis for Beginners

Analysis of Tuesday's Trades 1H Chart of GBP/USD On Tuesday, the GBP/USD pair attempted to initiate an upward correction but failed again. Market participants are unwilling to buy the pound.

Hot Forecast for EUR/USD on November 20, 2024

The final inflation data for the Eurozone confirmed the preliminary estimate, showing an acceleration in consumer price growth from 1.7% to 2.0%, entirely in line with expectations. As a result.

How to Trade the EUR/USD Pair on November 20? Simple Tips and Trade Analysis for Beginners

Analysis of Tuesday's Trades 1H Chart of EUR/USD On Tuesday, the EUR/USD currency pair again attempted a correction, only to fail again. The price approached the 1.0596 level.

Technical Analysis of Intraday Price Movement of AUD/JPY Cross Currency Pairs, Wednesday November 20, 2024.

If we look at the 4-hour chart, the AUD/JPY cross currency pair appears to be moving in a Ranging-Sideways condition, but is currently strengthening again after testing the support level.

Technical Analysis of Daily Price Movement of Silver Commodity Asset, Wednesday November 20, 2024.

With the appearance of the Bearish 123 pattern followed by several Bearish Ross Hook (RH) plus confirmation by the appearance of the Bearish Pitchfork channel and silver is moving harmoniously.

Forecast for AUD/USD on November 20, 2024

The Australian dollar has been rising for four consecutive days, outpacing the market, heavily supported by convergence on the daily timeframe. However, signs of exhaustion in this movement are beginning.

Overview of EUR/USD Pair on November 20: Eurozone Inflation Fails to Surprise, and So Does the Euro

The EUR/USD currency pair continued to trade below the moving average line on Tuesday. While it avoided another drop this time, the price still struggles to stage even a minimal.

Trading Signals for GOLD (XAU/USD) for November 19-21, 2024: sell below $2,639 (4/8 Murray - technical correction)

Gold is trading around 2,629 within the bullish trend channel forming since November 13 and reaching a strong resistance zone that coincides with the top of the bullish trend channel.

EUR/USD: Simple Trading Tips for Beginner Traders on November 19th (U.S. Session)

Trade Analysis and Tips for Trading the Euro The test of the price at 1.0577 occurred when the MACD indicator had already moved substantially below the zero line, confirming.

Show more

This section is updated daily and contains market analysis prepared by professional analysts on behalf of InstaForex. Each of the specialists presents analytical reviews in accordance with his/her vision of the current situation on the foreign exchange and other markets. However, the outlooks below are neither recommendations nor instructions to any actions. They contain analysis of the current situation on financial markets. In some cases, analysts' opinions about current market conditions may differ.

Stay

Stay