This information is provided to retail and professional clients as part of marketing communication. It does not contain and should not be construed as containing investment advice or investment recommendation or an offer or solicitation to engage in any transaction or strategy in financial instruments. Past performance is not a guarantee or prediction of future performance. Instant Trading EU Ltd. makes no representation and assumes no liability as to the accuracy or completeness of the information provided, or any loss arising from any investment based on analysis, forecast or other information provided by an employee of the Company or otherwise. Full disclaimer is available here.

Analytics today

Popular analytics

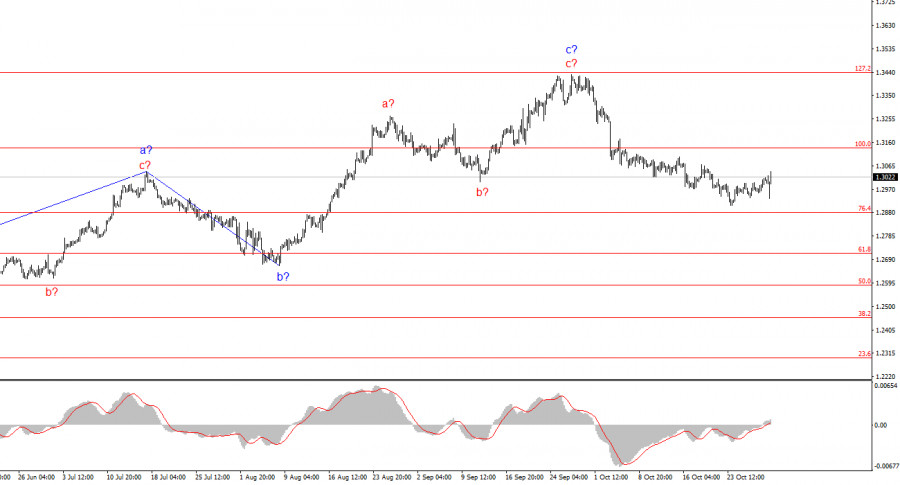

The GBP/USD wave structure remains complex and continues to develop. At one point, the wave pattern appeared convincing, suggesting the formation of a downward wave sequence with targets below.

EUR/USD: Simple Trading Tips for Beginner Traders on October 30th (U.S. Session)

Trade Analysis and Tips for Trading the Euro The test of the 1.0827 price level occurred just as the MACD indicator began rising from the zero line, confirming a strong.

GBP/USD: Trading Plan for the U.S. Session on October 30th (Analysis of Morning Trades)

In my morning forecast, I highlighted the 1.3030 level as a decision point for market entry. Let's look at the 5-minute chart to see what happened. Although the price rose.

Trading Signals for BITCOIN (BTC/USD) for October 30-31, 2024: buy above $71,875 (7/8 Murray - symmetrical triangle)

Bitcoin is trading around $71,900, forming a symmetrical triangle pattern within the bullish trend channel forming since October 23. Bitcoin could break and consolidate above $72,000 in the next.

Alphabet Soars as Nasdaq Hits New High: How Tech Giant Breathed Life into Market

The Nasdaq stock index hit a new record close on Tuesday, while the S&P 500 showed positive dynamics. However, the Dow remained in the red, while investors kept a close.

USD/JPY: Simple Trading Tips for Beginner Traders on October 30. Analysis of Yesterday's Forex Trades

Analysis of Trades and Trading Tips for the Japanese Yen The test at the 153.29 level occurred when the MACD indicator had already moved significantly below the zero line, limiting.

EURUSD: Simple Trading Tips for Beginner Traders on October 30. Analysis of Yesterday's Forex Trades

Trade Analysis and Tips for Trading the Euro The test at the 1.0793 level occurred when the MACD indicator had already moved significantly below the zero mark, which limited.

Technical Analysis of Intraday Price Movement of AUD/JPY Cross Currency Pairs, Wednesday October 30, 2024.

On the 4-hour chart, the AUD/JPY cross currency pair is seen trying to break through above the 101.97 level but seems to have difficulty breaking through it and even seems.

Technical Analysis of Intraday Price Movement of GBP/CHF Cross Currency Pairs, Wednesday October 30, 2024.

GBP/CHF on its 4-hour chart appears to be moving in a Sideways condition in the range of 1.1118 - 1.1366 levels and the volatility is getting smaller going forward, which.

What to Watch on October 30? Analysis of Fundamental Events for Beginners

Many important macroeconomic events are scheduled for Wednesday, and all of them are important. Germany will release data on unemployment, inflation, and GDP. The Eurozone will publish its GDP figures.

How to Trade the GBP/USD Pair on October 30? Simple Tips and Trade Analysis for Beginners

Tuesday's Trade Analysis: 1H Chart of GBP/USD Pair On Tuesday, the GBP/USD pair continued to trade with minimal gains and broke above the descending trendline. However, this doesn't necessarily mean.

Show more

This section is updated daily and contains market analysis prepared by professional analysts on behalf of InstaForex. Each of the specialists presents analytical reviews in accordance with his/her vision of the current situation on the foreign exchange and other markets. However, the outlooks below are neither recommendations nor instructions to any actions. They contain analysis of the current situation on financial markets. In some cases, analysts' opinions about current market conditions may differ.

Stay

Stay