This information is provided to retail and professional clients as part of marketing communication. It does not contain and should not be construed as containing investment advice or investment recommendation or an offer or solicitation to engage in any transaction or strategy in financial instruments. Past performance is not a guarantee or prediction of future performance. Instant Trading EU Ltd. makes no representation and assumes no liability as to the accuracy or completeness of the information provided, or any loss arising from any investment based on analysis, forecast or other information provided by an employee of the Company or otherwise. Full disclaimer is available here.

Analytics today

Popular analytics

On Wednesday, the EUR/USD pair rose to the 161.8% corrective level at 1.0873 and then rebounded. The decline following the rebound was mild, but the uptrend has yet to resume.

Trading Recommendations for the Cryptocurrency Market on October 31

While Bitcoin and Ethereum prices have stabilized after a significant increase observed the previous day, MicroStrategy, one of the largest companies holding Bitcoin, has paused its asset accumulation since mid-September.

USD/JPY: Simple Trading Tips for Beginner Traders on October 31. Analysis of Yesterday's Forex Trades

Analysis of Trades and Trading Tips for the Japanese Yen The test of the 153.15 price level aligned with the MACD indicator just beginning its upward movement from the zero.

GBPUSD: Simple Trading Tips for Beginner Traders on October 31. Analysis of Yesterday's Forex Trades

Trade Analysis and Tips for Trading the British Pound The price test of 1.2959 occurred when the MACD indicator moved significantly below the zero mark, limiting the pair's downward potential.

EURUSD: Simple Trading Tips for Beginner Traders on October 31. Analysis of Yesterday's Forex Trades

Trade Analysis and Tips for Trading the Euro The test of the 1.0820 price level occurred when the MACD indicator had already moved significantly below the zero mark, limiting.

AI Breaks and Breaks: Amazon Spends, Microsoft Gains, Nasdaq Slips

Microsoft Beats Quarterly Revenue Estimates AMD Falls, Putting Pressure on Chip Stocks Alphabet Jumps on Earnings Beat Amazon AI Spending Likely to Rise, Too AI Chip Supply Constraints Stifle Infrastructure.

What to Watch on October 31? Analysis of Fundamental Events for Beginners

There aren't many macroeconomic events scheduled for Thursday, but there will be some genuinely significant releases. The most important report will be on inflation in the Eurozone. Yesterday.

Hot Forecast for EUR/USD on 31.10.2024

Although the preliminary Eurozone GDP estimate accelerated from 0.6% to 0.9%, it was still somewhat below the expected 1.0%. Nevertheless, the euro managed to show a notable rise. This.

Trading Recommendations and Analysis for GBP/USD on October 31; Pound Falls Again Before It Can Begin to Rise

The GBP/USD currency pair showed mixed movements on Wednesday, with an apparent reluctance to rise. Unlike EUR/USD, the GBP/USD pair had a much sparser macroeconomic background. While the euro received.

Trading Recommendations and Analysis for EUR/USD on October 31; The Euro Makes a Second Step Toward Correction

The EUR/USD currency pair attempted another upward correction on Wednesday. The euro gained 50-60 pips throughout the day, but the macroeconomic background, which significantly impacted trader sentiment yesterday, was quite.

Technical Analysis of Intraday Price Movement of S&P 500 Index, Thursday October 31, 2024.

From what we can see on the 4-hour chart, the S&P 500 index appears to be moving in a sideways condition, this is confirmed by the MA (50) condition that.

Technical Analysis of Intraday Price Movement of Nasdaq 100 Index, Thursday October 31, 2024.

With the successful of the Nasdaq 100 index breaking through its Uptrendline and also confirmed by the appearance of deviations between price movements and the MACD Histogram indicator (osMA 12,26,9).

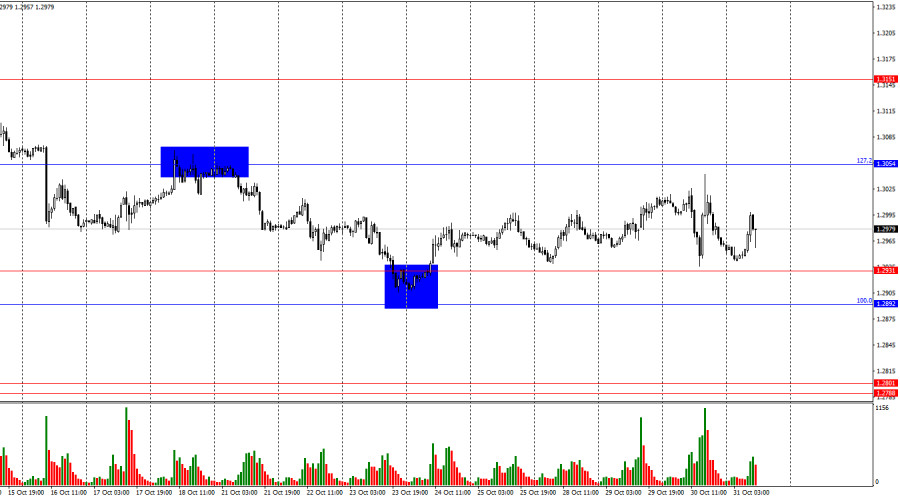

Forecast for GBP/USD on October 31, 2024

Yesterday's trading range for the pound exceeded 100 pips, with the bears emerging victorious. The price is now attempting once again to break through the lower boundary of the green.

Show more

This section is updated daily and contains market analysis prepared by professional analysts on behalf of InstaForex. Each of the specialists presents analytical reviews in accordance with his/her vision of the current situation on the foreign exchange and other markets. However, the outlooks below are neither recommendations nor instructions to any actions. They contain analysis of the current situation on financial markets. In some cases, analysts' opinions about current market conditions may differ.

Stay

Stay