This information is provided to retail and professional clients as part of marketing communication. It does not contain and should not be construed as containing investment advice or investment recommendation or an offer or solicitation to engage in any transaction or strategy in financial instruments. Past performance is not a guarantee or prediction of future performance. Instant Trading EU Ltd. makes no representation and assumes no liability as to the accuracy or completeness of the information provided, or any loss arising from any investment based on analysis, forecast or other information provided by an employee of the Company or otherwise. Full disclaimer is available here.

Popular analytics

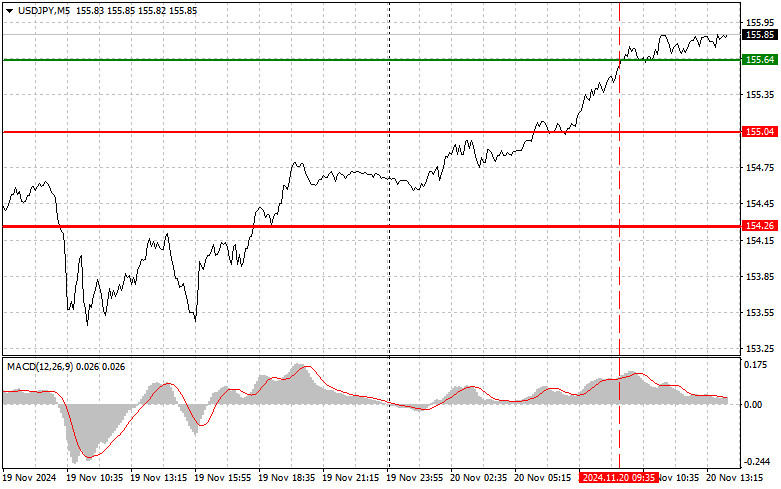

Trade Review and Tips for Trading the Japanese Yen The price test at 155.64 in the first half of the day occurred as the MACD indicator had risen significantly above.

GBP/USD: Trading Plan for the U.S. Session on November 20th (Morning Trade Review). The Pound Reacted to Inflation Growth

In my morning forecast, I highlighted the 1.2761 level as a key point for making market entry decisions. Let us review the 5-minute chart to analyze the developments. The price.

EUR/USD: Trading Plan for the U.S. Session on November 20th (Morning Trade Review). The Euro Returns to Falling

In my morning forecast, I highlighted the 1.0567 level as a key point for making market entry decisions. Let us review the 5-minute chart to analyze the developments. A decline.

Forecast for GBP/USD on November 20, 2024

On the hourly chart, the GBP/USD pair rebounded from the support zone of 1.2611–1.2620 on Tuesday and climbed to the level of 1.2709. The subsequent rebound from 1.2709 favored.

Trading Signals for GOLD (XAU/USD) for November 20-22, 2024: buy above $2,616 (3/8 Murray - 200 EMA)

As long as gold consolidates above 3/8 of Murray, we will look for opportunities to buy with targets at 2,632 and 2,640. The Eagle indicator is showing a positive signal.

EUR/USD and GBP/USD on November 20 – Technical Analysis

EUR/USD Higher Timeframes: After testing the support at the first weekly Ichimoku breakout target (1.0497), the pair slowed down and entered a consolidation phase. Key downside targets such.

USD/JPY: Simple Trading Tips for Beginner Traders on November 20. Analysis of Yesterday's Forex Trades

The test of the price level at 154.14 occurred when the MACD indicator had moved significantly above the zero mark, which limited the pair's upward potential, especially given the pressure.

EUR/USD: Simple Trading Tips for Beginner Traders on November 20. Analysis of Yesterday's Forex Trades

The test of the price level at 1.0584 occurred when the MACD indicator had moved significantly above the zero mark, limiting the pair's upward potential. For this reason.

How to Trade the GBP/USD Pair on November 20? Simple Tips and Trade Analysis for Beginners

Analysis of Tuesday's Trades 1H Chart of GBP/USD On Tuesday, the GBP/USD pair attempted to initiate an upward correction but failed again. Market participants are unwilling to buy the pound.

How to Trade the EUR/USD Pair on November 20? Simple Tips and Trade Analysis for Beginners

Analysis of Tuesday's Trades 1H Chart of EUR/USD On Tuesday, the EUR/USD currency pair again attempted a correction, only to fail again. The price approached the 1.0596 level.

Technical Analysis of Intraday Price Movement of AUD/JPY Cross Currency Pairs, Wednesday November 20, 2024.

If we look at the 4-hour chart, the AUD/JPY cross currency pair appears to be moving in a Ranging-Sideways condition, but is currently strengthening again after testing the support level.

Show more

This section is updated daily and contains market analysis prepared by professional analysts on behalf of InstaForex. Each of the specialists presents analytical reviews in accordance with his/her vision of the current situation on the foreign exchange and other markets. However, the outlooks below are neither recommendations nor instructions to any actions. They contain analysis of the current situation on financial markets. In some cases, analysts' opinions about current market conditions may differ.

Stay

Stay