This information is provided to retail and professional clients as part of marketing communication. It does not contain and should not be construed as containing investment advice or investment recommendation or an offer or solicitation to engage in any transaction or strategy in financial instruments. Past performance is not a guarantee or prediction of future performance. Instant Trading EU Ltd. makes no representation and assumes no liability as to the accuracy or completeness of the information provided, or any loss arising from any investment based on analysis, forecast or other information provided by an employee of the Company or otherwise. Full disclaimer is available here.

Analytics today

Popular analytics

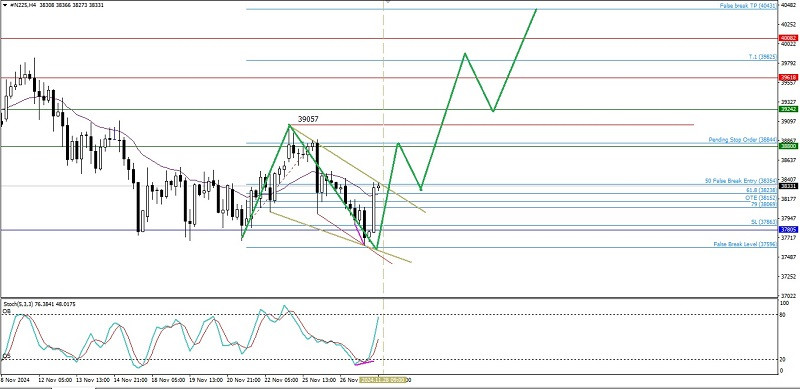

With the appearance of the Failing Wedge pattern followed by the appearance of deviations between the Nikkei 225 index price movement and the Stochastic Oscillator indicator and also confirmed.

Technical Analysis of Intraday Price Movement of NZD/USD Commodity Currency Pairs, Thursday November 28, 2024.

If we look at the 4-hour chart of the NZD/USD commodity currency pair, it appears that there is a deviation between the Kiwi price movement and the Stochastic Oscillator indicator.

Technical Analysis of Intraday Price Movement of USD/JPY Main Currency Pairs, Wednesday November 27, 2024.

If we look at the 4-hour chart of the main USD/JPY currency pair, there are several interesting things, namely, its price movement moves harmoniously within the Bearish Pitchfork channel.

Technical Analysis of Intraday Price Movement of AUD/JPY Cross Currency Pairs, Wednesday November 27, 2024.

After successfully exiting its Ranging condition on its 4-hour chart, the AUD/JPY cross currency pair is now trying to test the 98.29 level, which is confirmed by the AUD/JPY price.

EUR/USD: Simple Trading Tips for Beginner Traders on November 27th (U.S. Session)

The test of the 1.0498 level occurred when the MACD indicator had already moved significantly above the zero line, which, in my view, limited the euro's upward potential. For this.

XAU/USD: Analysis and Forecast

For the second day in a row, gold is gaining traction as concerns over a potential trade war grow. Geopolitical risks and the proposed tariff policies of U.S. President-elect Donald.

Trading Signals for GOLD (XAU/USD) for November 27-29, 2024: sell below $ 2,656 (21 SMA - 200 EMA)

If gold finds a strong rejection around 2,655, we could expect it to fall towards the 23.6% Fibonacci around 2,633. Even if the price breaks above this level, it could.

USD/JPY. Analysis and Forecast: Bulls on the Japanese Yen Maintain Control Amid Tariff Negotiations

The Japanese yen continues its steady intraday ascent, moving the USD/JPY pair closer to the key level of 152.00, amid subdued U.S. dollar price action. Threats from U.S. President.

GBP/USD: Simple Trading Tips for Beginner Traders on November 27th. Analysis of Yesterday's Forex Trades

The test of the 1.2609 level occurred when the MACD indicator had already moved significantly upward from the zero mark, limiting the pair's upward potential. For this reason.

Show more

This section is updated daily and contains market analysis prepared by professional analysts on behalf of InstaForex. Each of the specialists presents analytical reviews in accordance with his/her vision of the current situation on the foreign exchange and other markets. However, the outlooks below are neither recommendations nor instructions to any actions. They contain analysis of the current situation on financial markets. In some cases, analysts' opinions about current market conditions may differ.

Stay

Stay