Trading Conditions

Products

Tools

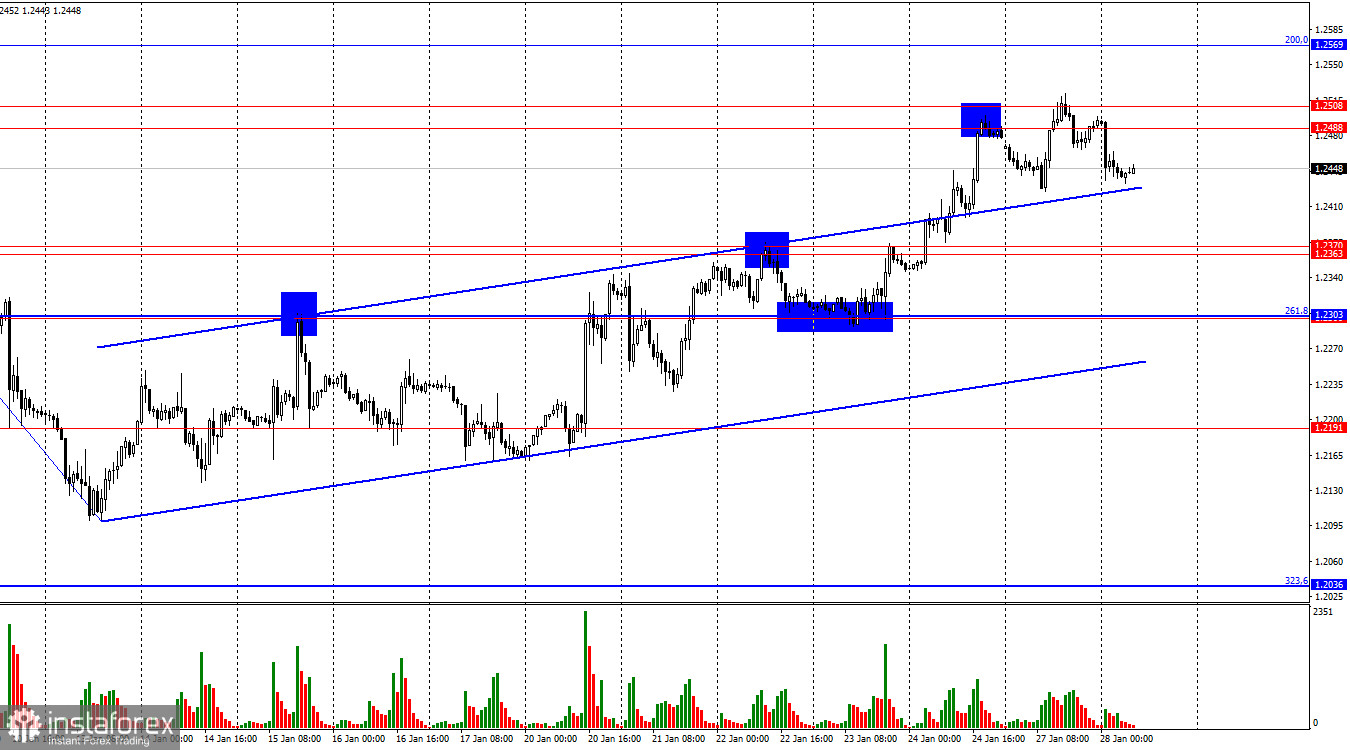

On the hourly chart, the GBP/USD pair on Monday made another attempt to consolidate above the resistance zone of 1.2488–1.2508, which again failed. Bullish traders seem to be running out of steam after three weeks of attacks, often without solid justification. Therefore, I anticipate that this week the pair will continue its decline toward the support zone of 1.2363–1.2370 and the level of 1.2303.

The wave structure remains clear. The last completed downward wave broke the low of the previous wave, while the last upward wave has yet to reach the previous peak. This indicates an ongoing bearish trend with no doubts about its continuation. For this trend to reverse, the pound needs to rise to at least 1.2569 and close confidently above this level. While this is possible, discrepancies between the wave structures of the euro and the pound suggest that one of these structures will prove incorrect.On Monday, there was little news from the UK or the US. However, tomorrow will reveal the outcome of the FOMC meeting, and next week, we'll have the results of the Bank of England meeting, along with the release of the Q4 GDP report for the US on Thursday. If bearish traders aim to seize control, these events could provide the informational backdrop they need. In my opinion, further bullish attempts are doubtful. The market has already priced in all the negative factors for the dollar linked to Trump. From now on, economic factors—Fed and Bank of England monetary policies and the overall state of the US and UK economies—will take precedence. These factors are not favorable for the pound. While there are no significant UK news events this week, Trump's influence on the dollar may continue for a while. However, economic factors tend to outweigh political and geopolitical ones. On higher timeframes, the trend remains bearish. Bulls will need to exert significant effort to reverse it.On the 4-hour chart, the pair continues to rise within a downward trend channel. A rebound from the upper boundary of this channel could lead to a reversal in favor of the US dollar and a decline toward the Fibonacci 100.0% level at 1.2299. Consolidation above the channel could finally drive bears out of the market. However, bulls will require consistent positive news from the UK or negative news from the US, which is currently difficult to expect. No emerging divergences are observed in any indicators today.

The sentiment of the "Non-commercial" category of traders became significantly more bearish during the last reporting week. The number of long positions held by speculators decreased by 4,861, while short positions increased by 3,834. Bulls have lost all advantage in the market, with this process unfolding over several months. The gap between the number of long and short positions is now in favor of the bears: 75,000 vs. 84,000.

In my view, the pound still has room to fall, as COT reports show the growing strength of bearish positions nearly every week. Over the past three months, long positions have dropped from 161,000 to 75,000, while short positions have risen from 67,000 to 84,000. I believe professional traders will continue to reduce long positions or increase short ones, as all potential bullish factors for the pound have already been priced in. Current chart analysis indicates growth, but corrections are also necessary.

Tuesday's economic calendar contains only one event, which bears are relying on. The overall impact of the news on trader sentiment for the rest of the day is expected to be weak.

InstaForex analytical reviews will make you fully aware of market trends! Being an InstaForex client, you are provided with a large number of free services for efficient trading.

We may place cookies for analysis of our visitor data, to improve our website and measure advertising performance. Overall this data is used to provide a better website experience. More information

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of Instant Trading EU Ltd including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaForex anyway.

We are sorry for any inconvenience caused by this message.

Stay

Stay