Trading Conditions

Products

Tools

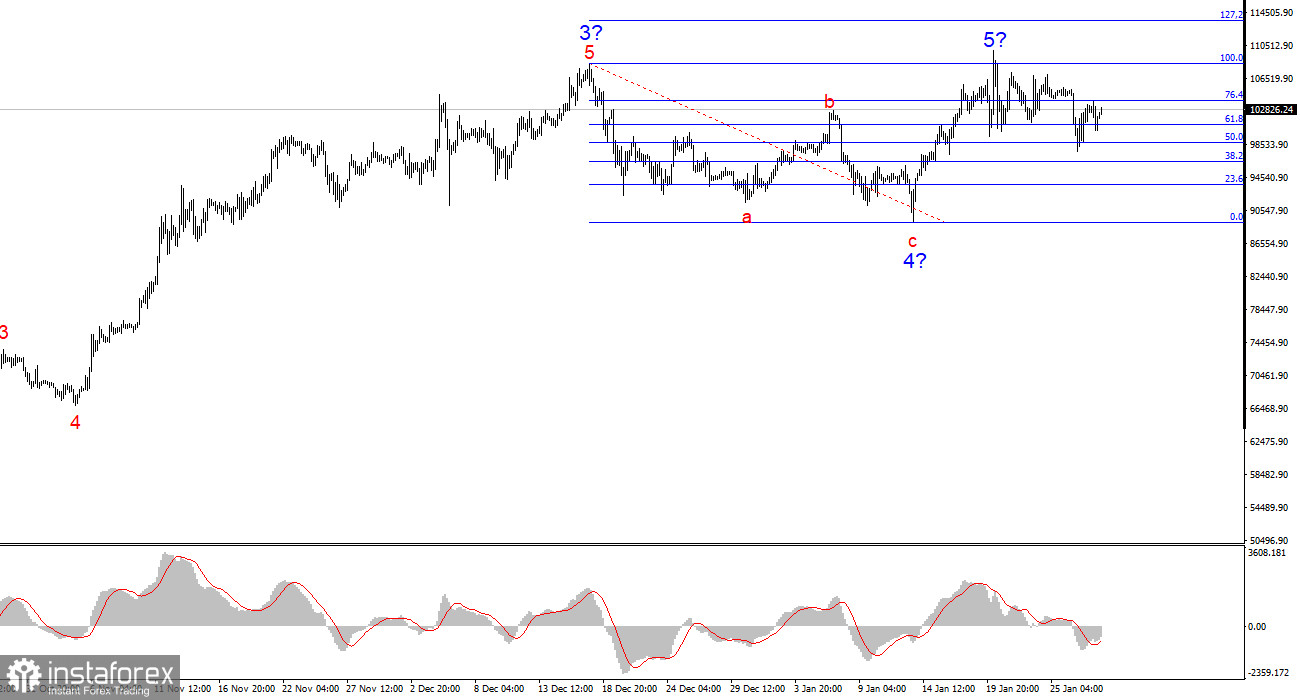

The wave structure on the 4-hour chart for BTC/USD appears completely clear. After a long and complex a-b-c-d-e corrective structure, which developed between March 14 and August 5, a new impulsive wave began to form, already taking on a five-wave structure. Judging by the size of the first wave, the fifth wave may be shortened. Based on this, I do not expect Bitcoin to rise above $110,000–$115,000 in the coming months.

Additionally, wave 4 took a three-wave form, confirming the accuracy of the current wave count. Since the fifth wave is now forming, it makes sense to look for buying opportunities. However, as I mentioned earlier, this wave may complete very soon—or may have already ended.

The news backdrop has supported Bitcoin's rise, fueled by continuous institutional investment inflows, purchases from governments of certain countries, and pension funds. However, Trump's policies could drive investors out of the market, and no trend remains bullish indefinitely.

BTC/USD gained $3,500 on Wednesday and added another $1,800 on Thursday. The catalyst for Bitcoin's latest rally was the Federal Reserve (FOMC) meeting, but in my opinion, the market simply found another excuse to buy Bitcoin.

It wasn't the entire crypto market driving these gains—it was major players leading the move.

The FOMC meeting results were neutral, as Jerome Powell did not change his stance on interest rates. He emphasized that:

If interest rates decline quickly, or even start to decline, the yield on bank deposits and U.S. Treasuries drops.This makes Bitcoin attractive, as low Fed rates encourage capital inflows into risk assets.

Bitcoin has been in demand for the past two years, ever since the Fed managed to lower inflation and the market began anticipating policy easing.

However, even though rate cuts have already begun, Bitcoin and the stock market continue rising. In my view, a bubble is forming in the crypto market—just like in stocks.

There was no fundamental reason to buy BTC yesterday or today.Yet, the market is aggressively buying.

The potential wave 2 within wave 5 is unclear and unconvincing.I still cannot confirm that wave 5 will take a full five-wave structure.

Based on the BTC/USD analysis, I conclude that Bitcoin's rally is nearing its end. This may not be a popular opinion, but the fifth wave may be shortened. What comes next? A crash or a complex correction. Thus, I do not recommend buying Bitcoin at this stage. If wave 5 begins forming an extended five-wave structure, then a strong corrective wave 2 must be visible within it.

At the moment, wave 2 is present on the chart, but it does not look convincing. I believe that at least one more decline is coming. On a higher time frame, the five-wave bullish structure is clear. It is likely that a corrective bearish structure or a downward trend phase will soon begin.

Wave analysis can be combined with other forms of technical analysis and trading strategies to increase accuracy.

InstaForex analytical reviews will make you fully aware of market trends! Being an InstaForex client, you are provided with a large number of free services for efficient trading.

We may place cookies for analysis of our visitor data, to improve our website and measure advertising performance. Overall this data is used to provide a better website experience. More information

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of Instant Trading EU Ltd including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaForex anyway.

We are sorry for any inconvenience caused by this message.

Stay

Stay