Trading Conditions

Products

Tools

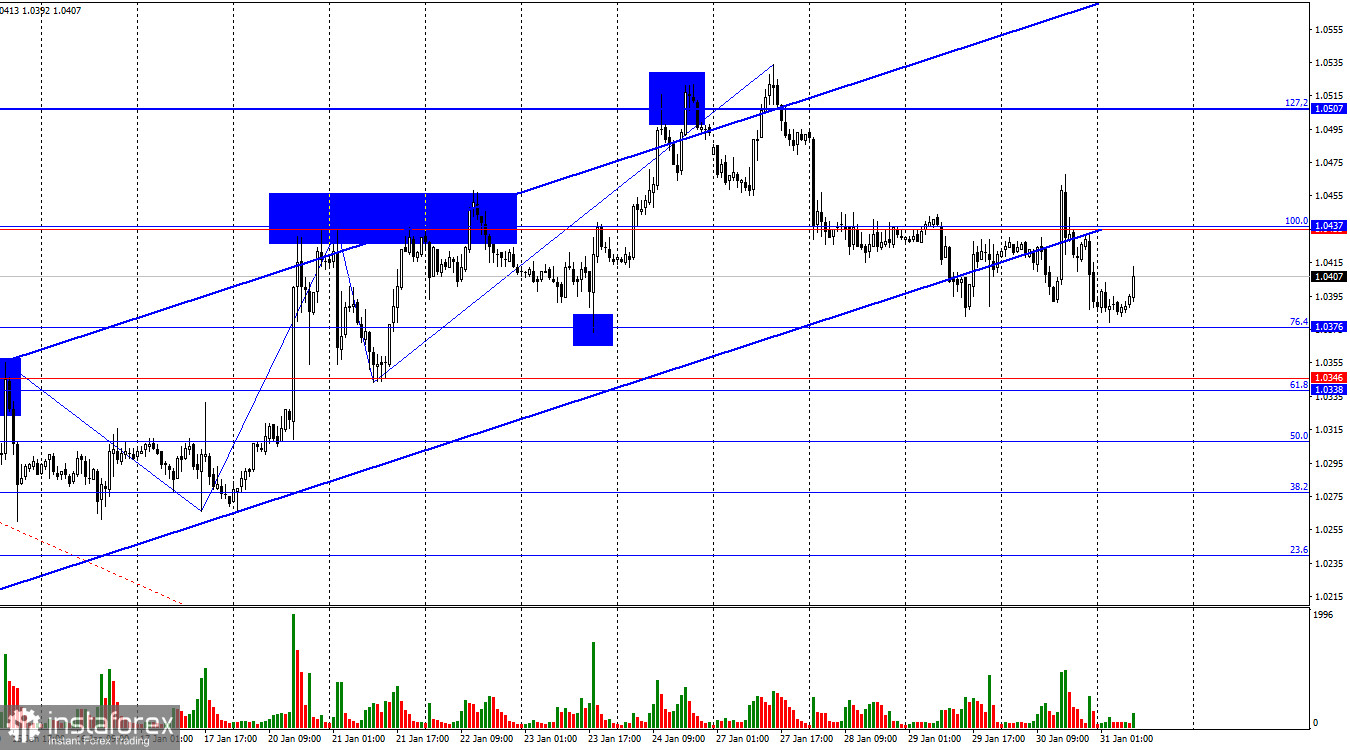

On Thursday, EUR/USD attempted to consolidate above the 100.0% Fibonacci retracement level at 1.0437, but the attempt failed. The bears launched a new offensive, though it lacked strength and confidence. The bullish trend remains intact, despite a decline towards the 76.4% Fibonacci level at 1.0376 and a breakdown below the upward trend channel. While further downside remains possible, the current bearish momentum appears weak.

The wave pattern remains relatively clear. The last completed upward wave surpassed the previous peak, while the current downward wave (still incomplete) has not yet broken the prior low. This suggests that the bullish trend is still forming. However, the waves have been unusually small in recent weeks, making it difficult to confirm the strength of the uptrend. For a full breakdown of the bullish structure, the price would need to fall below the support zone at 1.0338–1.0346.

Despite a series of major economic events on Wednesday and Thursday, traders have largely remained on the sidelines.

None of these events managed to provide a clear direction for the pair. Bulls and bears have been engaged in a tug-of-war for three consecutive days, with no clear winner.

Yesterday's economic data was negative for the euro, but the U.S. dollar also lacked strong bullish momentum.

As a result, traders remain uncertain about which currency is in a worse position. However, today's German economic data could tip the scales in favor of the bears.

On the 4-hour chart, EUR/USD reversed in favor of the U.S. dollar following a bearish divergence on the CCI indicator and a break below the 127.2% Fibonacci level at 1.0436.

This initiated a downward movement towards the 1.0332 level. However, the euro's decline may remain limited, as bulls previously managed to push the price above the downward trend channel. No new divergence signals are forming on key indicators, suggesting that the market may remain in consolidation mode.

During the last reporting week, non-commercial traders increased short positions by 6,994. Long positions increased by only 4,905. Bearish sentiment remains dominant, suggesting further potential declines.

For 18 consecutive weeks, institutional traders have been selling the euro, reinforcing a long-term bearish trend. Occasionally, bulls take temporary control, but these instances have been exceptions rather than the norm.

The key bearish driver for the U.S. dollar—expectations of Federal Reserve monetary policy easing—has already played out. With no new reason to sell the dollar, the greenback's rally remains the more likely scenario.

Technical analysis also supports a continuation of the long-term downtrend in EUR/USD.

Today's economic calendar includes several key releases, which could have a moderate impact on market sentiment.

Trading Recommendations for EUR/USD

Short positions could have been opened targeting 1.0376 and 1.0346, following the break below the upward trend channel on the hourly chart. The first target has nearly been reached. Long positions are not advisable today, as the pair has closed below the ascending trend channel on the hourly chart.

InstaForex analytical reviews will make you fully aware of market trends! Being an InstaForex client, you are provided with a large number of free services for efficient trading.

We may place cookies for analysis of our visitor data, to improve our website and measure advertising performance. Overall this data is used to provide a better website experience. More information

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of Instant Trading EU Ltd including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaForex anyway.

We are sorry for any inconvenience caused by this message.

Stay

Stay