Trading Conditions

Products

Tools

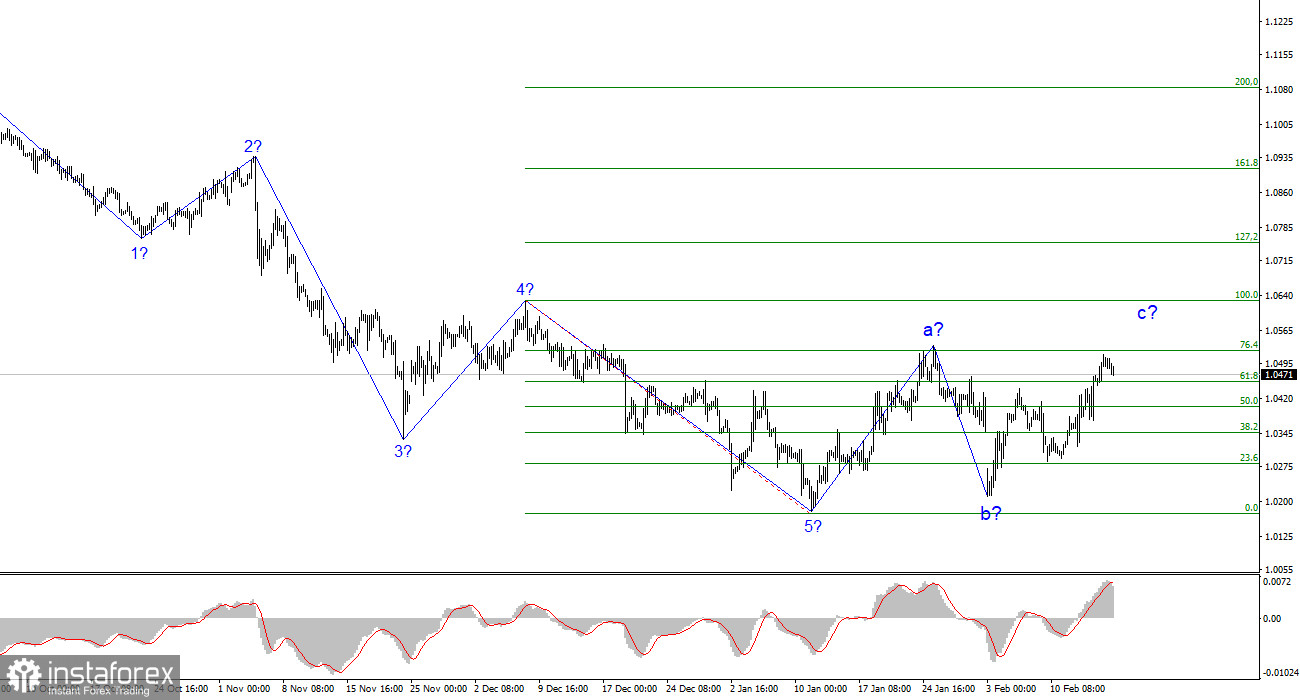

The wave pattern on the 4-hour chart remains clear. Since September 25, a new downward structure has been forming, which took the shape of a five-wave impulse movement. As expected, the fifth wave developed into a convincing structure and now appears complete. If this assumption is correct, then a corrective upward structure has begun, which should consist of at least three waves.

The first wave in this correction formed a clear structure, leading me to believe that the second wave will also take a distinct three-wave form.

Overall, the current wave structure is straightforward, and the fundamental background still favors sellers. Recent U.S. reports indicate that the economy remains strong, with no signs of recession. The Federal Reserve is proceeding cautiously with policy easing, while the ECB remains more aggressive in rate cuts. This divergence suggests that, in the long term, the U.S. dollar should remain in demand. However, for now, the market is undergoing a correction.

On Monday, the EUR/USD pair declined slightly, but further movement remains possible before the day ends. Since there were no major economic releases, I do not expect significant price swings before the market closes.

The current wave (c) remains unfinished because its peak has not yet exceeded wave (a)'s high. Therefore, I anticipate a slight increase in the euro before the correction completes. Once this occurs, the second wave correction could conclude at any moment, forming a convincing three-wave structure.

The next market movement will depend on traders' sentiment. If participants need more time before transitioning into wave 3 of the downtrend, then wave 2 could extend into a five-wave formation.

Last week's price action showed that EUR/USD movements are not entirely dependent on fundamentals. European economic data remained weak, yet euro demand increased. However, I believe that selling opportunities should be considered near the upper points of wave (c) in wave 2 or the potential wave (e) in wave 2 (if formed).

It is also important to note that individual waves can sometimes take unusual shapes. The key is to understand the broader wave structure, which currently remains well-defined.

Based on this EUR/USD analysis, I conclude that the downtrend structure remains intact. Currently, the first wave of this trend appears complete, indicating that the next phase should be a corrective three-wave movement or a more complex formation. Selling opportunities should be sought at the highest points of this correction.

The first wave of the assumed wave 2 has been completed, and wave (b) in wave 2 is also finished. I now expect a convincing wave (c) in wave 2.

On a higher time frame, the wave structure is shifting into an impulsive formation. This suggests a potential long-term bearish cycle, though its length and structure remain uncertain at this stage.

Key Principles of My Analysis:

InstaForex analytical reviews will make you fully aware of market trends! Being an InstaForex client, you are provided with a large number of free services for efficient trading.

We may place cookies for analysis of our visitor data, to improve our website and measure advertising performance. Overall this data is used to provide a better website experience. More information

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of Instant Trading EU Ltd including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaForex anyway.

We are sorry for any inconvenience caused by this message.

Stay

Stay