Trading Conditions

Products

Tools

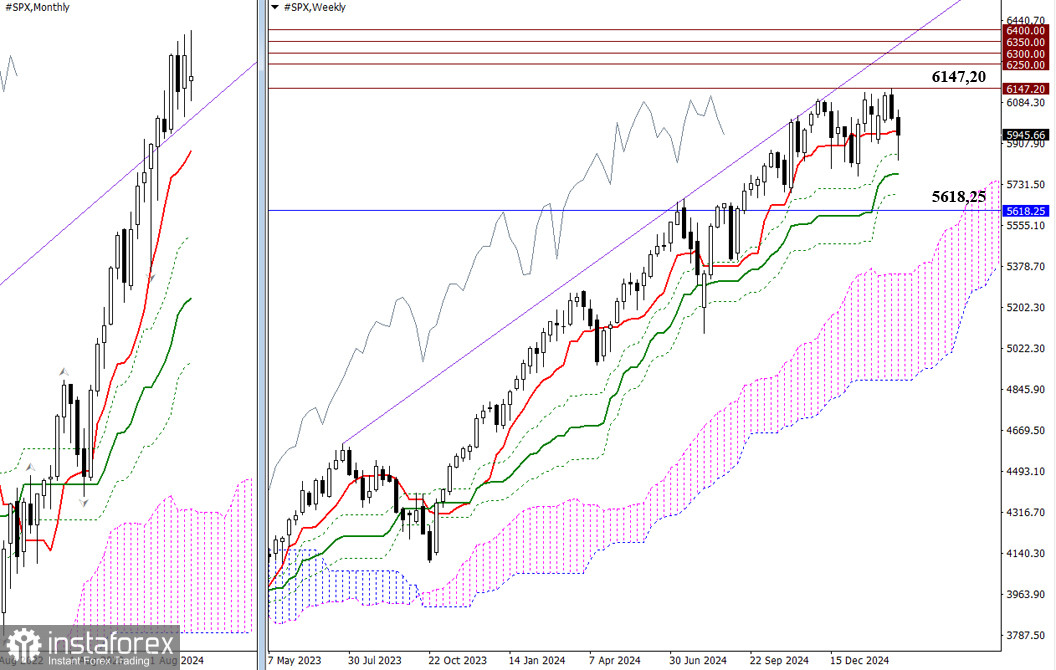

The past session marked not only the end of the trading week but also the month. February set a new high at 6,147.20 but failed to achieve more significant bullish gains. The final February candle signals uncertainty, creating conditions for a continued monthly downward correction. The nearest target on the monthly timeframe is the short-term trend, currently at 5,618.25. On the way to this level, the bears must test the support levels of the weekly Ichimoku golden cross at 5,774.49 – 5,686.52. A breakdown of the monthly short-term trend at 5,618.25 would invalidate the weekly golden cross, opening new downside opportunities for the bears.

If the bulls manage to hold their ground, an update to the current high at 6,147.20 would shift the focus toward psychological resistance levels at 6,250 – 6,300 – 6,350 – 6,400.

On the daily timeframe, the market is currently working on invalidating the daily cross and breaking the Ichimoku cloud at 5,948.02. If the bears continue the decline in the coming days and break weekly support at 5,862.50, the market will likely aim to fulfill the daily breakout target at 5,748.84 and test the weekly medium-term trend at 5,777.11. Alternatively, for the bulls to regain control, they need to re-enter the bullish zone relative to the daily cloud, retest the recently broken daily Ichimoku cross at 5,991.84 – 6,037.49, and consolidate above these resistance levels.

On lower timeframes, the market has closely approached the weekly long-term trend at 5,965.29. The coming trading week may start with a test of this level, which could determine the market's direction. This is the most critical level on lower timeframes, as holding above it favors bullish momentum, with intraday upside targets aligned with classic pivot resistance levels. Conversely, a rejection and move below this level could trigger bearish sentiment, with classic pivot support levels acting as downside targets. These pivot values are updated daily when trading opens.

***

InstaForex analytical reviews will make you fully aware of market trends! Being an InstaForex client, you are provided with a large number of free services for efficient trading.

We may place cookies for analysis of our visitor data, to improve our website and measure advertising performance. Overall this data is used to provide a better website experience. More information

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of Instant Trading EU Ltd including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaForex anyway.

We are sorry for any inconvenience caused by this message.

Stay

Stay