Trading Conditions

Products

Tools

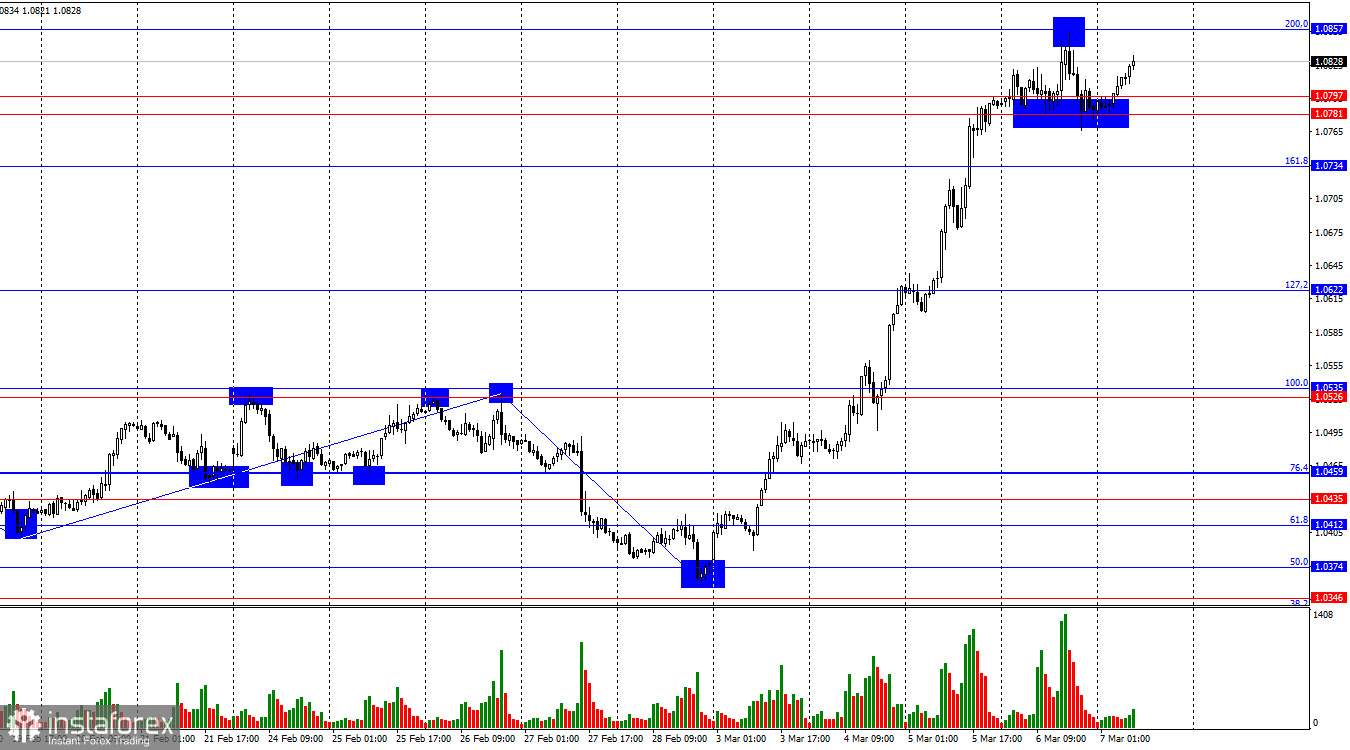

On Thursday, EUR/USD continued its upward movement, reaching the 200.0% Fibonacci retracement level at 1.0857. A rebound from this level favored a return to the support zone of 1.0781–1.0797. A rebound from this area would suggest a resumption of growth toward 1.0857. If the pair consolidates above 1.0857, the likelihood of further gains toward 1.0944 will increase.

The wave structure on the hourly chart has shifted. The last completed downward wave broke the previous low, while the new upward wave has exceeded the prior peak. This confirms a bullish trend, dismissing the notion of horizontal movement. However, the current uptrend is impulsive, driven mainly by fears of a U.S. economic slowdown due to Trump's policies. This remains the primary reason for the dollar's decline this week.

On Thursday, the market once again ignored fundamental data that could have supported dollar bulls. The ECB's policy decision was dovish, as the European regulator further eased monetary policy. However, some hawkish elements were present, as Christine Lagarde hinted at a potential pause in further rate cuts. Yet, she clarified that this pause would be contingent on economic conditions. If the economy grows and inflation continues to decline, additional rate cuts may not be necessary.

However, it remains unclear how the European economy can grow when Donald Trump is preparing to impose tariffs on European imports. Additionally, how can inflation decline when already-implemented tariffs could fuel inflation worldwide? While we are not talking about a major surge in global inflation, it is worth noting that neither the Bank of England, the Fed, nor the ECB has yet managed to bring inflation down to 2%. Thus, I see no reason for the ECB to halt its rate cuts for now.

On the 4-hour chart, the pair has broken above the horizontal range, confirming a bullish trend. The upward trend channel remains intact, with prices breaking key resistance levels one after another. No divergence signals are forming today.

The euro's rally is fueled almost entirely by Trump's policy decisions, but today, a series of important economic events are scheduled. The dollar still has chances for a rebound, though market interest in the U.S. currency remains extremely low.

In the latest reporting week, professional traders opened 12,379 long positions and closed 13,616 short positions. While the non-commercial category remains bearish, sentiment has been softening in recent weeks. The total number of long positions held by speculators now stands at 182,000, while short positions amount to 208,000.

For the past twenty weeks, large players have been selling the euro, reinforcing a bearish trend. Occasionally, bulls dominate during individual weeks, but these instances are exceptions. The difference in monetary policy approaches between the ECB and the Fed continues to favor the U.S. dollar, as rate differentials widen. While the bearish advantage is diminishing, it is still too early to declare the end of the downtrend. Notably, long positions have been increasing for four consecutive weeks.

The economic calendar for March 7 includes six major events, each of critical importance. Market sentiment on Friday is likely to be heavily influenced by the news cycle.

Sell EUR/USD upon a break below the 1.0781–1.0797 zone on the hourly chart, targeting 1.0734 and 1.0622. Alternatively, sell upon a rejection from the 1.0857 level. Buying EUR/USD is an option, but the strong, uninterrupted rally is concerning—it could reverse sharply at any moment.

Fibonacci retracement levels were calculated using 1.0529–1.0213 on the hourly chart and 1.1214–1.0179 on the 4-hour chart.

InstaForex analytical reviews will make you fully aware of market trends! Being an InstaForex client, you are provided with a large number of free services for efficient trading.

We may place cookies for analysis of our visitor data, to improve our website and measure advertising performance. Overall this data is used to provide a better website experience. More information

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of Instant Trading EU Ltd including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaForex anyway.

We are sorry for any inconvenience caused by this message.

Stay

Stay