Trading Conditions

Products

Tools

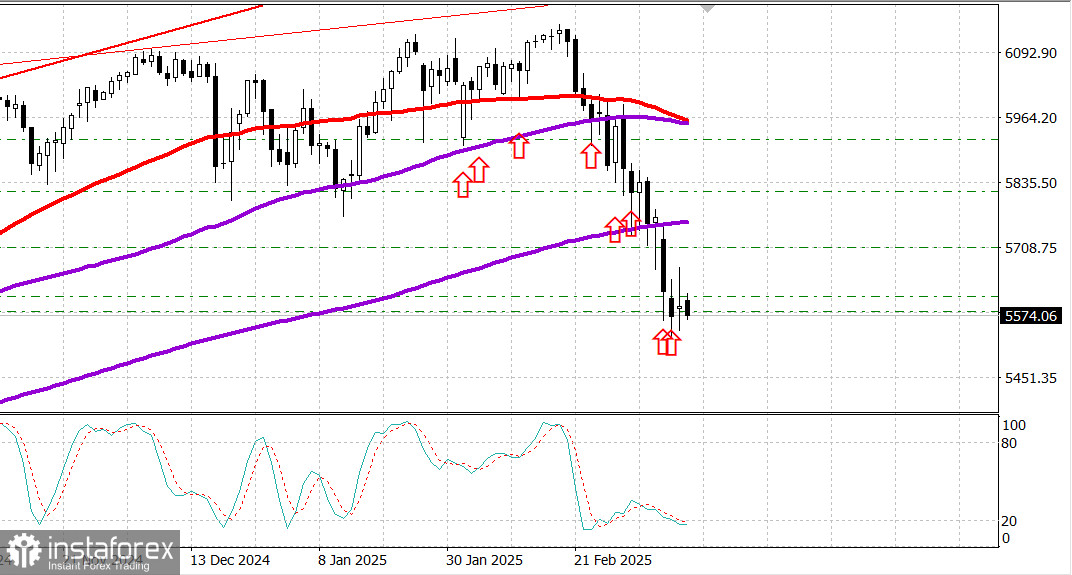

S&P500

Market update on 13.03

Snapshot of benchmark US stock indices on Wednesday:

The S&P 500 (+0.5%) and Nasdaq Composite (+1.2%) closed higher, driven by interest in buying on the dip in the mega-cap space. The rise in NVIDIA (NVDA 115.74, +6.99, +6.4%) played a significant role in this regard. However, buyers were cautious elsewhere. The Invesco S&P 500 Equal Weight ETF (RSP) closed 0.5% lower, and five S&P 500 sectors closed in the red.

Market participants were digesting the Consumer Price Index (CPI) for February, which showed inflation rising slower than expected, providing some relief to the markets after higher-than-expected figures last month.

On a year-over-year basis, the headline CPI increased by 2.8% compared to 3.0% in January, and the core CPI rose by 3.1% compared to 3.2% in January.

Inflation is still above the Federal Reserve's 2.0% target. So, uncertainty regarding US trade policy, potentially putting pressure on prices, somewhat dampened enthusiasm for the report. The US tariffs on steel and aluminum imports led to retaliatory measures, with Canada and the EU announcing counter-tariffs.

Market expectations for a Fed rate cut were little changed in light of the inflation data. There is an 80.0% probability of at least a 25 basis point rate cut to 4.00-4.25% at the June FOMC meeting, compared to an 84.2% probability the previous day and 78.7% the week before, according to the CME FedWatch Tool.

The Treasury market also reacted cautiously to the data. The 10-year Treasury yield rose by three basis points to 4.32%, and the 2-year yield increased by five basis points to 3.99%. As a result, a reissue of $39 billion in 10-year bonds saw steady demand.

Year-to-date:

Economic calendar yesterday

The key takeaway from the report is that overall inflation remains above the Fed's 2.0% target. With rising tariff measures—and the "retaliatory tariffs" that will take effect on April 2—confidence that future inflation reports will provide undoubtedly favorable inflation data has waned.

The Treasury's February budget showed a deficit of $307.0 billion compared to a deficit of $296.3 billion in the same period last year. The February deficit was due to expenses ($603.4 billion) exceeding revenue ($296.4 billion).

Treasury budget data is not seasonally adjusted, so the February deficit cannot be compared to the January deficit of $128.6 billion.

The main takeaway from the report is that the deficit now stands at a record $1.15 trillion for the first five months of the fiscal year, partly due to increased Medicare spending and higher interest payments on government debt.

Looking ahead, market participants will receive the following economic data on Thursday:

Energy market

Brent crude oil is now trading at $70.70 per barrel. The price bounced by about $1 - forming support at $69. Oil rose due to a halt in the US market decline.

Conclusion

The US stock market is trading quietly, but the correction targets have likely been reached. A new bullish wave may be possible. Current market quotes are favorable for buying.

InstaForex analytical reviews will make you fully aware of market trends! Being an InstaForex client, you are provided with a large number of free services for efficient trading.

We may place cookies for analysis of our visitor data, to improve our website and measure advertising performance. Overall this data is used to provide a better website experience. More information

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of Instant Trading EU Ltd including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaForex anyway.

We are sorry for any inconvenience caused by this message.

Stay

Stay