Trading Conditions

Products

Tools

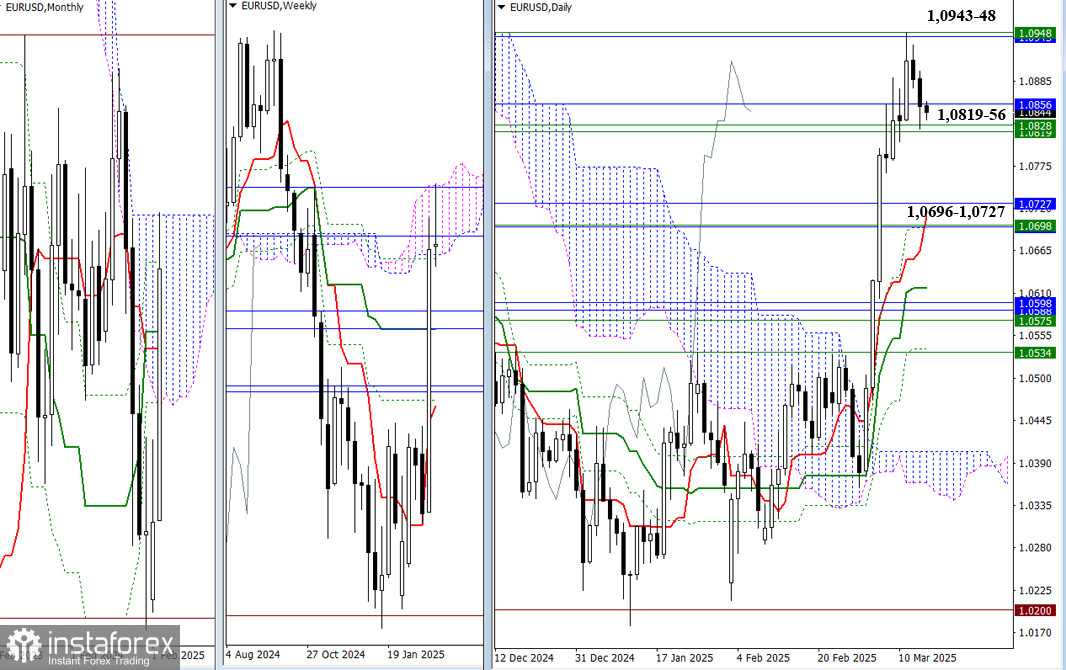

As the week comes to a close, bullish players have tested the upper boundaries of the Ichimoku clouds, with the monthly level at 1.0943 and the weekly level at 1.0948. Currently, the market has returned to a resistance cluster in the range of 1.0819 to 1.0856. A rejection in this area could indicate a shift in market priorities. The nearest downside targets for potential declines are the support levels from various timeframes, converging in the zone of 1.0696 to 1.0727.

On lower timeframes, the bears have consolidated below key levels, specifically at 1.0858 (the central daily Pivot level) and 1.0870 (the weekly long-term trend). Trading below these crucial levels reinforces bearish sentiment and sets the stage for additional downward momentum. The intraday downside targets include classic Pivot support levels at 1.0817, 1.0783, and 1.0743. However, if bullish players regain control, the market focus will shift to the classic Pivot resistance levels at 1.0892, 1.0933, and 1.0967.

***

There have been no significant changes in market conditions throughout the week. The market remains uncertain, influenced by key levels (1.2873 – 1.2923) and the first target level of the daily breakout objective at 1.2952. Due to this uncertainty, expectations remain unchanged. Bullish traders are still aiming to fully achieve the daily target at 1.3047, while bearish traders are looking to develop a corrective decline, potentially reaching the short-term daily trend at 1.2833 and further down to the monthly support levels of 1.2765 – 1.2807.

The market is consolidating around these key levels, using them as support. A breakout of the weekly long-term trend at 1.2929 and a subsequent reversal could shift the balance of power. For further bearish momentum, the intraday downside targets are the classic Pivot support levels at 1.2873, 1.2848, and 1.2825. If bullish traders attempt to regain control, the upside targets will be the classic Pivot resistance levels at 1.2973, 1.2998, and 1.3025.

***

InstaForex analytical reviews will make you fully aware of market trends! Being an InstaForex client, you are provided with a large number of free services for efficient trading.

We may place cookies for analysis of our visitor data, to improve our website and measure advertising performance. Overall this data is used to provide a better website experience. More information

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of Instant Trading EU Ltd including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaForex anyway.

We are sorry for any inconvenience caused by this message.

Stay

Stay