Trading Conditions

Products

Tools

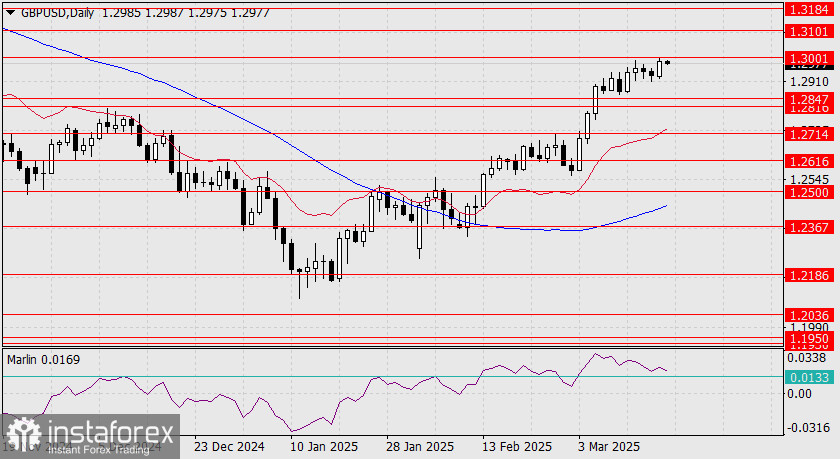

On Monday, the pound rose by 53 pips and is now testing the resistance level at 1.3001. A breakout above this level would propel the pound's growth toward 1.3101. However, the pound must navigate the Federal Reserve's monetary policy decision tomorrow and the Bank of England meeting the following day.

From a technical standpoint, the price could fall to the support range of 1.2816 to 1.2847 due to speculative movements, but for now, the overall trend remains upward.

On the four-hour chart, the Marlin oscillator has broken out of its range to the upside, providing some optimism for the bulls. However, the consolidation range for the next day and a half (until the Fed's announcement) is rather narrow, limited by the MACD line at 1.2953 (a span of just 44 pips). The price may not be able to sustain this compression and could break out of the range prematurely, resulting in a false move. If the price consolidates above 1.3001, it would pave the way for growth toward 1.3101 and possibly up to 1.3184. From a purely technical perspective, the trend remains bullish and is not yet in an overbought condition.

InstaForex analytical reviews will make you fully aware of market trends! Being an InstaForex client, you are provided with a large number of free services for efficient trading.

We may place cookies for analysis of our visitor data, to improve our website and measure advertising performance. Overall this data is used to provide a better website experience. More information

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of Instant Trading EU Ltd including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaForex anyway.

We are sorry for any inconvenience caused by this message.

Stay

Stay