Trading Conditions

Products

Tools

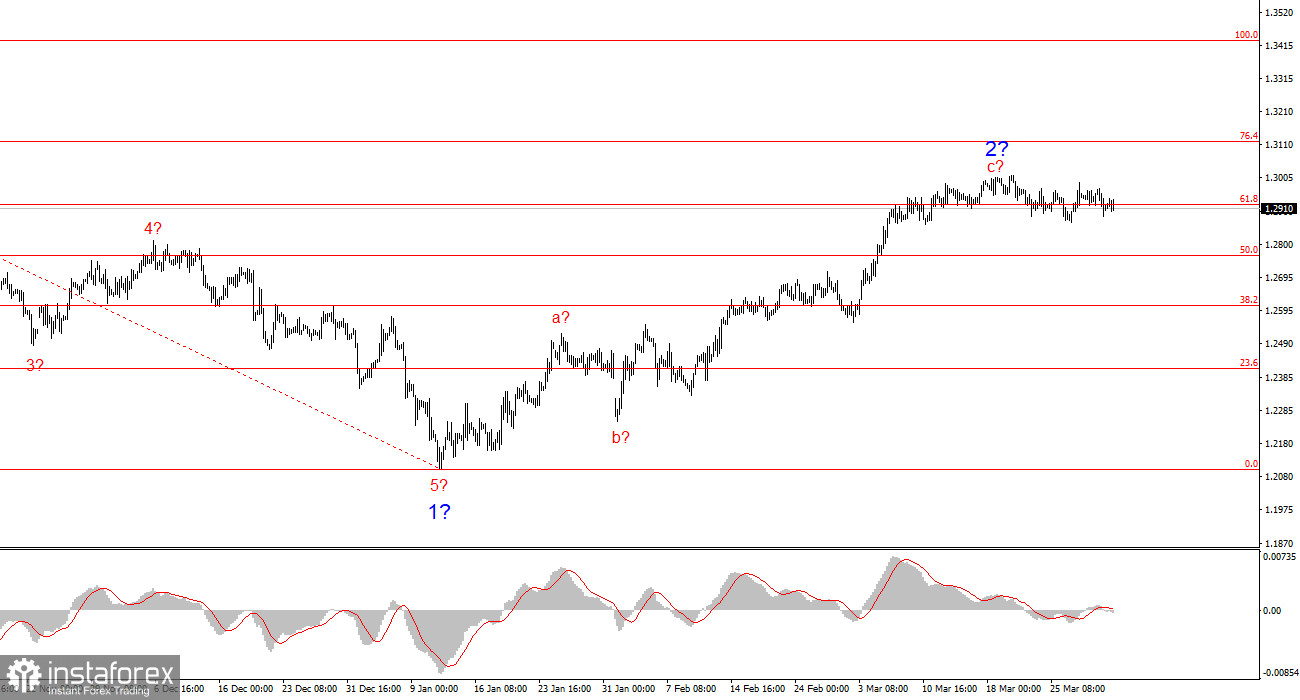

The wave structure for GBP/USD remains somewhat ambiguous but generally manageable. Currently, there is a high probability of a long-term bearish trend formation. Wave 5 has taken on a convincing form, so I consider the larger Wave 1 to be complete. If this assumption is correct, Wave 2 is still in progress. The first two subwaves within Wave 2 appear to be complete. The third could finish at any moment—or may have already ended.

Demand for the British pound has recently been supported primarily by the "Trump factor," which remains the pound's main ally. However, in the longer term—beyond a few days—the pound still lacks any real fundamental basis for growth. The stance of the Bank of England and the Federal Reserve has recently shifted slightly in favor of the pound, as the BoE now also seems in no rush to cut interest rates. The current wave structure hasn't been violated, but a new upward move in the pair would raise serious concerns about its validity.

GBP/USD once again attempted to decline on Tuesday, but the move lacked strength. Essentially, horizontal movement continues, so I see no clear confirmation that the corrective wave is over. Interestingly, despite strong upward movement in recent months, the wave structure has remained intact. The pound has formed a corrective wave up to 61.8% but cannot complete it—mainly because Donald Trump keeps suppressing dollar demand. Many economic reports are simply being ignored by the market, with the "Trump factor" seen as more important.

For example, today's UK Manufacturing PMI fell from 46.9 to 44.9. Remember: any reading below 50 is considered weak and negative. Over the past three years, this index has only briefly risen above the 50 mark. And the problem of weak industrial production is not unique to the UK.

Still, with yesterday's data release from the UK, one might have expected a decline in demand for the pound. Of course, it's not a key figure that would justify a 100-point drop—especially with new tariffs from Donald Trump looming, which could pressure the pound even more. However, in recent weeks, the market has found no reason at all to reduce demand for the pound. How to adjust for this, and what to do with the wave count, remains unclear. Today, U.S. manufacturing activity indexes will be released, as well as the JOLTs job openings report for February. The ISM Manufacturing Index would need to come in above 50 to give the dollar a modest boost—but economists expect a decline to 49.8.

The wave pattern for GBP/USD indicates that a bearish trend segment is still underway, as is its second wave. At this point, I would advise looking for new short entry points, as the current wave count still supports the formation of a downward trend that began last autumn. However, how long Donald Trump's policies will continue to influence market sentiment remains a mystery. The current appreciation of the pound appears excessive relative to the existing wave structure, but I still anticipate a decline toward the 1.20 level and possibly lower.

On a higher wave scale, the structure has shifted. We may now be seeing the beginning of a new downward trend segment, as the previous upward three-wave pattern appears to be complete. If that assumption holds, we should expect a corrective wave 2 or b, followed by an impulsive wave 3 or c.

Key Principles of My Analysis:

InstaForex analytical reviews will make you fully aware of market trends! Being an InstaForex client, you are provided with a large number of free services for efficient trading.

We may place cookies for analysis of our visitor data, to improve our website and measure advertising performance. Overall this data is used to provide a better website experience. More information

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of Instant Trading EU Ltd including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaForex anyway.

We are sorry for any inconvenience caused by this message.

Stay

Stay