Trading Conditions

Products

Tools

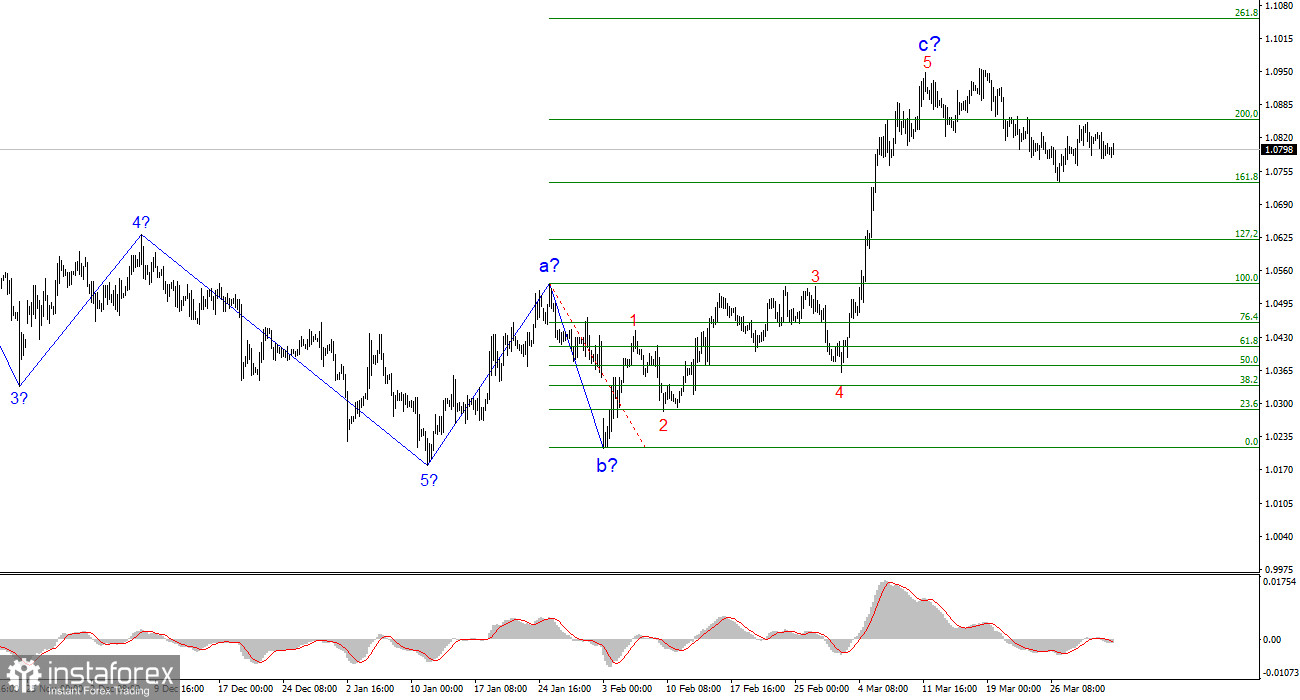

The wave pattern on the 4-hour EUR/USD chart is on the verge of transforming into a more complex structure. Since September 25 of last year, a new downward wave structure began to form, taking the shape of a five-wave impulse. Three months ago, a corrective upward structure began forming, which should consist of at least three waves. The first wave of this correction was well-formed, so I still expect the second wave to follow a clear structure. However, this second wave has become so large that a significant transformation of the overall wave count is now a real risk.

From a fundamental standpoint, recent news continues to support sellers more than buyers. All recent U.S. economic reports have signaled that the economy is not facing serious problems and shows no signs of slowing to levels that would cause concern. However, the situation in the U.S. economy could change dramatically in 2025 due to Donald Trump's policy. The Fed may cut rates multiple times, while tariffs and retaliatory tariffs could weigh on economic growth. If not for recent developments, I would have continued expecting a euro decline with a 90% probability — but now, it's no longer that clear-cut.

EUR/USD remained virtually unchanged over Monday, Tuesday, and Wednesday. Market movements are almost non-existent, and trader activity is close to zero. Why is this happening, despite what seems like a jam-packed economic calendar? As usual, the answer lies with Donald Trump. He is scheduled to speak during the U.S. session today, and the market is waiting to hear which new trade tariffs might be introduced. Until the new "tariff plan" is announced, market participants see little reason to enter trades.

There are a few speculations about what the new tariffs might look like. Some economists believe Trump may impose a 20–25% tariff on all imported goods from all countries. Others think the plan could be more complex, with different rates for different countries. Trump has frequently stated that he is most concerned about the U.S. trade balance with countries where the deficit is too large. Therefore, it's plausible that over the past few weeks, the president and his sizable team have been working on a customized tariff plan rather than a one-size-fits-all 20% hike.

Personally, I don't see the point in speculating. Even major global analysts and banks are refraining from betting on any particular scenario. Trump is too unpredictable, and his actions often defy logic. That's why I suggest simply waiting for this crucial announcement and only then drawing conclusions.

Based on the current EUR/USD analysis, I conclude that the instrument is still forming a downward segment of the trend — although in the near future, it could shift to an upward trend. A renewed rise in the euro would transform the entire wave pattern. Since the fundamental backdrop currently contradicts the wave count, I cannot recommend short positions — even though the current price levels look extremely attractive for selling with targets below the 1.0200 area, provided the wave picture remains intact.

At the higher wave scale, the structure has evolved into an impulse wave. It is likely that we are entering a new long-term downward series of waves, though the news flow — especially from Donald Trump — has the potential to turn everything upside down.

Core Principles of My Analysis:

InstaForex analytical reviews will make you fully aware of market trends! Being an InstaForex client, you are provided with a large number of free services for efficient trading.

We may place cookies for analysis of our visitor data, to improve our website and measure advertising performance. Overall this data is used to provide a better website experience. More information

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of Instant Trading EU Ltd including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaForex anyway.

We are sorry for any inconvenience caused by this message.

Stay

Stay