Trading Conditions

Products

Tools

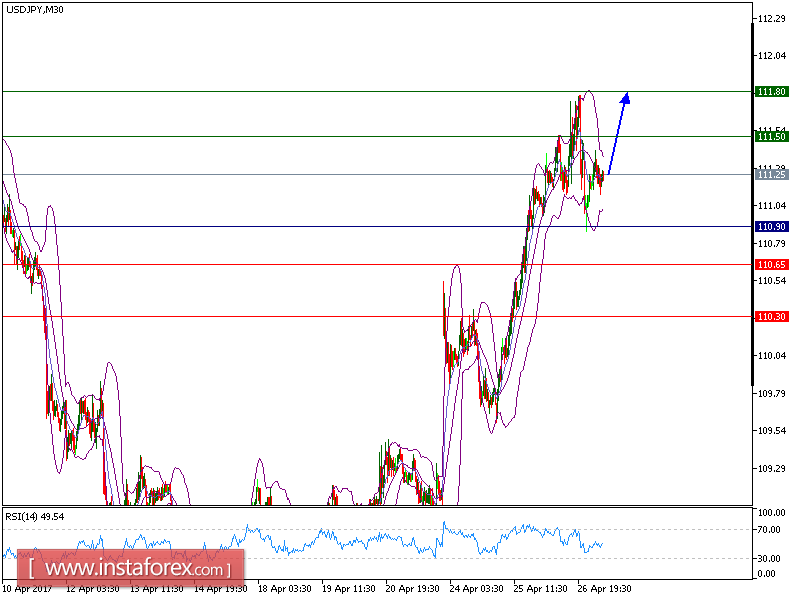

USD/JPY is expected to trade with bullish bias above 110.90. The pair has bounced up from another test of support at 110.90 and is likely to challenge its 50-period moving average in sight. The relative strength index is below its neutrality level at 50 but reversing up.

As long as the key level at 110.90 is not broken, we keep our positive view unchanged with an up target at 110.65. A break above this level would call for a further upside toward 110.30.

The pair is trading above its pivot point. It is likely to trade in a wider range as long as it remains above its pivot point. Therefore, long positions are recommended with the first target at 111.50 and the second one at 111.80. In the alternative scenario, short positions are recommended with the first target at 110.65 if the price moves below its pivot points. A break of this target may push the pair further downwards, and one may expect the second target at 110.30. The pivot point is at 110.90.

Resistance levels: 111.50, 111.80, and 112.00

Support levels: 110.65, 110.30, and 109.85

InstaForex analytical reviews will make you fully aware of market trends! Being an InstaForex client, you are provided with a large number of free services for efficient trading.

We may place cookies for analysis of our visitor data, to improve our website and measure advertising performance. Overall this data is used to provide a better website experience. More information

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of Instant Trading EU Ltd including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaForex anyway.

We are sorry for any inconvenience caused by this message.

Stay

Stay