This information is provided to retail and professional clients as part of marketing communication. It does not contain and should not be construed as containing investment advice or investment recommendation or an offer or solicitation to engage in any transaction or strategy in financial instruments. Past performance is not a guarantee or prediction of future performance. Instant Trading EU Ltd. makes no representation and assumes no liability as to the accuracy or completeness of the information provided, or any loss arising from any investment based on analysis, forecast or other information provided by an employee of the Company or otherwise. Full disclaimer is available here.

Analytics today

Popular analytics

On Friday, the British pound reached its target support level of 1.2612. With the next target at 1.2510, just over 100 pips away, the price opted for a corrective move.

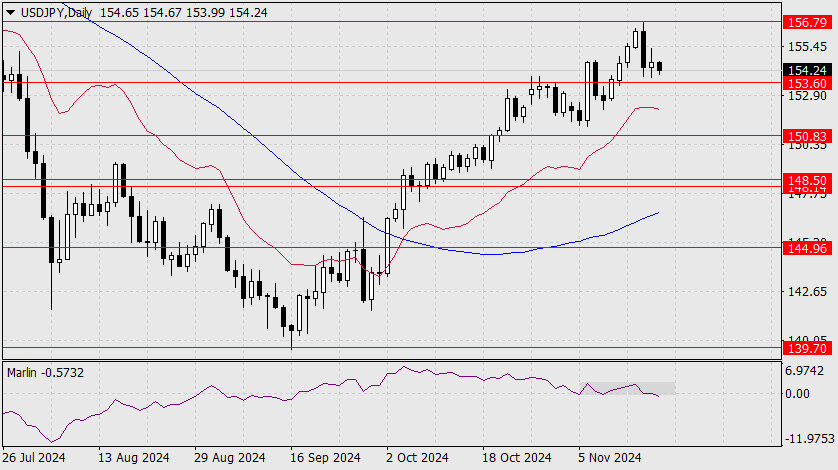

Forecast for USD/JPY on November 19, 2024

After reaching the target level of 156.79 on Friday, the pair showed no intention of resuming growth on Monday, as reflected by a candlestick with a small body. This morning.

Overview of GBP/USD Pair on November 19: The Pound Teeters Between Life and Death

The GBP/USD pair showed little inclination for significant movement on Monday, marking a rare calm day in recent months. While the session was relatively uneventful, the British pound's volatility.

Overview of EUR/USD Pair on November 19: A Calm Start to the Week

The EUR/USD pair mainly remained stagnant throughout Monday. This is unsurprising since no macroeconomic events except European Central Bank President Christine Lagarde's speech were scheduled for the day. However.

Trading Recommendations and Trade Analysis for GBP/USD on November 19: The 26th Level Held Firm Against Decline

The GBP/USD pair attempted a correction on Monday. The 1.2605-1.2620 zone was tested accurately, followed by a notable rebound. This provided an opportunity for cautious long positions. However, Monday lacked.

EUR to hit rock bottom

While the Bundesbank warns of risks of global economic fragmentation, Germany is sliding into a recession. Besides, rising political risks in the country weigh heavily on EUR/USD. According to recent.

GBP/USD: Simple Trading Tips for Beginners on November 18th (U.S. Session)

The price test at 1.2621 occurred as the MACD indicator began moving downward from the zero line, confirming a valid entry point for selling the pound in line with.

EUR/USD: Trading Plan for the U.S. Session on November 18th (Morning Trade Analysis) - Euro Remains in Range

In my morning forecast, I identified the 1.0539 level as a key area for market entry. The 5-minute chart shows that a decline and a false breakout at this level.

USD/JPY: Analysis and Forecast

The Japanese yen remains under pressure despite concerns about potential intervention. Today, ahead of the European session, the yen attempted to recover much of its earlier losses against the U.S.

XAU/USD: Analysis and Forecast

Today, on the first day of the week, gold is attempting to gain positive momentum, breaking a six-day losing streak, but remains below $2600. Expectations that U.S. President-elect Donald Trump's.

Weekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, AUD/JPY, EUR/CHF, US Dollar Index, and Ethereum on November 18

In the next couple of days, the British pound is likely to continue its downward trend before transitioning into a sideways movement near the resistance zone. In the second half.

Weekly Forecast Based on Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, EUR/GBP, Gold, and #Bitcoin on November 18

At the beginning of the upcoming week, the chart for the European major pair is expected to exhibit a flat sideways movement. An upward vector toward the resistance zone.

Show more

This section is updated daily and contains market analysis prepared by professional analysts on behalf of InstaForex. Each of the specialists presents analytical reviews in accordance with his/her vision of the current situation on the foreign exchange and other markets. However, the outlooks below are neither recommendations nor instructions to any actions. They contain analysis of the current situation on financial markets. In some cases, analysts' opinions about current market conditions may differ.

Stay

Stay