This information is provided to retail and professional clients as part of marketing communication. It does not contain and should not be construed as containing investment advice or investment recommendation or an offer or solicitation to engage in any transaction or strategy in financial instruments. Past performance is not a guarantee or prediction of future performance. Instant Trading EU Ltd. makes no representation and assumes no liability as to the accuracy or completeness of the information provided, or any loss arising from any investment based on analysis, forecast or other information provided by an employee of the Company or otherwise. Full disclaimer is available here.

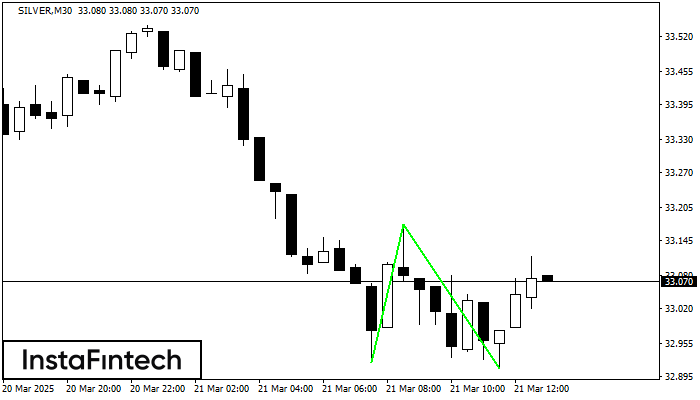

Double Bottom

was formed on 21.03 at 13:00:55 (UTC+0)

signal strength 3 of 5

was formed on 21.03 at 13:00:55 (UTC+0)

signal strength 3 of 5

The Double Bottom pattern has been formed on SILVER M30. This formation signals a reversal of the trend from downwards to upwards. The signal is that a buy trade should be opened after the upper boundary of the pattern 33.17 is broken. The further movements will rely on the width of the current pattern 255 points.

Figure

Instrument

Timeframe

Trend

Signal Strength

Stay

Stay