Forex calculator

Trader Calculator:

On this page you can find formula for calculating the value of one pip. The value of a pip is calculated on the basis of the current rate of a given currency pair.

Note that 1 InstaForex lot is 10000 units of base currency.

Please find below a formula to calculate the value of one pip for currency pairs and CFDs:

Calculation of 1 pip value:

- 1. XXX/USD

- p.v. = 0,1 * (trade volume)

- 2. USD/XXX

- p.v. = 0,1 / (USD/XXX) * (trade volume)

- For USD/JPY p.v. = 10 / (USD/JPY) * (trade volume)

- For USD/RUB and EUR/RUB p.v. = 10 / (USD/RUB) * (trade volume)

- 3. AAA/BBB

- p.v. = 0,1 * (AAA/USD) / (AAA/BBB) * (trade volume)

Calculation of 1 pip value for a CFD:

p.v. = volume * contract size * minimum price change

See Also

- 2025-03-07 19:41:30Mauritius Sees a Nosedive in Inflation, CPI Drops to 0.10% in FebruaryQuick show2025-03-07 19:41:30Greek Unemployment Rate Rises to 9.5% in Fourth Quarter 2024Quick show2025-03-07 19:41:30Euro Zone GDP Growth Slows to 0.2% in Q4 2024Quick show2025-03-07 19:41:30Euro Zone Employment Growth Stagnates at Lower Level in Q4 2024Quick show2025-03-07 19:41:30Euro Zone Employment Growth Slows in Fourth QuarterQuick show2025-03-07 19:41:30UK Mortgage Rates Ease Slightly in February, Offering a Glimpse of Relief for HomeownersQuick show2025-03-07 19:41:30Ukraine's Foreign Reserves Dip in February Amid Economic PressuresQuick show2025-03-07 19:41:30Philippines' Foreign Exchange Reserves Climb to $106.70 Billion in FebruaryQuick show2025-03-07 19:41:30Czech Republic Bolsters FX Reserves to $148.7 Billion in FebruaryQuick show2025-03-07 19:41:30Czech Republic's FX Reserves Inch Up Slightly in FebruaryQuick show

- 2025-03-07 19:41:30Turkish Treasury's Cash Balance Deteriorates Further in February to -397.602BQuick show2025-03-07 19:41:30US Unemployment Rate Creeps Up to 4.1% in February 2025Quick show2025-03-07 19:41:30U.S. U6 Unemployment Rate Climbs to 8.0% in FebruaryQuick show2025-03-07 19:41:30U.S. Private Nonfarm Payrolls Show Promising Growth in FebruaryQuick show2025-03-07 19:41:30US Labor Market Sees a Dip in Participation Rate for February 2025Quick show2025-03-07 19:41:30U.S. Manufacturing Payrolls Rebound: February Sees 10,000 Job IncreaseQuick show2025-03-07 19:41:30U.S. Government Payrolls Experience Sharp Decline in February 2025Quick show2025-03-07 19:41:30U.S. Average Weekly Hours Steady in February, Holding Firm at 34.1Quick show2025-03-07 19:41:30U.S. Average Hourly Earnings Rise to 4.0% in February, Outpacing January GrowthQuick show2025-03-07 19:41:30U.S. February Nonfarm Payrolls See a Surge, Hit 151KQuick show

- 2025-03-07 19:41:30U.S. Average Hourly Earnings Growth Slows to 0.3% in FebruaryQuick show2025-03-07 19:41:30Canada's Labor Force Participation Drops Slightly in FebruaryQuick show2025-03-07 19:41:30Part-Time Employment Growth Slows Down in Canada: February Figures RevealQuick show2025-03-07 19:41:30Canada's Employment Numbers See Significant Dip in FebruaryQuick show2025-03-07 19:41:30Canadian Permanent Employee Wages Climb to 4.0% in FebruaryQuick show2025-03-07 19:41:30Canada's Capacity Utilization Rate Experiences a Slight Uptick in Q4 2024Quick show2025-03-07 19:41:30Canada's Unemployment Rate Holds Steady in February as Economic Stability PersistsQuick show2025-03-07 19:41:30Canadian Employment Surge Hits the Brakes with Modest Increase in FebruaryQuick show2025-03-07 19:41:30Poland's FX Reserves Climb in February, Surpassing January LevelsQuick show2025-03-07 19:41:30Mexico's Producer Price Index Rises to 8.00% in February, Continuing Upward TrendQuick show

- 2025-03-07 19:41:30Mexico's Producer Price Index Experiences Slight Dip in FebruaryQuick show2025-03-07 19:41:30Brazil's GDP Growth Declines to 3.6% in Q4 2024, Reflecting Economic HeadwindsQuick show2025-03-07 19:41:30Brazil's Economic Growth Slows to 0.2% in Fourth QuarterQuick show2025-03-07 19:41:30Mexico's Core Inflation Inches Down Slightly Amid Economic AdjustmentsQuick show2025-03-07 19:41:30Mexico's February CPI Inches Up to 3.77%, Reflecting Rising CostsQuick show2025-03-07 19:41:30Mexico's Consumer Prices Slow in February as Inflation Shows Slight EaseQuick show2025-03-07 19:41:30Mexico Sees Uptick in Core CPI as February Rates Climb to 0.48%Quick show2025-03-07 19:41:30Chile's Imports Experience Notable Decline in February 2025Quick show2025-03-07 19:41:30Chile's Exports Experience Significant Decline in February 2025Quick show2025-03-07 19:41:30Slight Decline in India's Deposit Growth with Current Rate at 10.3%Quick show

- 2025-03-07 19:41:30India's Bank Loan Growth Slows to 11.0% in March 2025Quick show2025-03-07 19:41:30Chile's Copper Exports Slip in February Amid Global Economic ShiftsQuick show2025-03-07 19:41:30India's Forex Reserves See Slight Decline in Latest UpdateQuick show2025-03-07 19:41:30Chile's Trade Balance Takes a Hit in February 2025, Drops to $1.63 BillionQuick show2025-03-07 19:41:30Chile's Inflation Cools Off: Core CPI Drops to 0.3% in FebruaryQuick show2025-03-07 19:41:30Chile Sees Significant Drop in CPI Growth for FebruaryQuick show2025-03-07 19:41:30Euro Zone Employment Sees Modest Growth in Q4 2024Quick show2025-03-07 19:41:30Euro Zone GDP Growth Accelerates to 1.2% in Fourth QuarterQuick show2025-03-07 19:41:30Greece's GDP Growth Accelerates in Fourth Quarter of 2024Quick show2025-03-07 19:41:30Greek Economy Shows Steady Growth: GDP Rises to 2.6% in Fourth QuarterQuick show

- 2025-03-07 19:41:30Mauritius Sees a Nosedive in Inflation, CPI Drops to 0.10% in FebruaryQuick show2025-03-07 19:41:30Greek Unemployment Rate Rises to 9.5% in Fourth Quarter 2024Quick show2025-03-07 19:41:30Euro Zone GDP Growth Slows to 0.2% in Q4 2024Quick show2025-03-07 19:41:30Euro Zone Employment Growth Stagnates at Lower Level in Q4 2024Quick show2025-03-07 19:41:30Euro Zone Employment Growth Slows in Fourth QuarterQuick show2025-03-07 19:41:30UK Mortgage Rates Ease Slightly in February, Offering a Glimpse of Relief for HomeownersQuick show2025-03-07 19:41:30Ukraine's Foreign Reserves Dip in February Amid Economic PressuresQuick show2025-03-07 19:41:30Philippines' Foreign Exchange Reserves Climb to $106.70 Billion in FebruaryQuick show2025-03-07 19:41:30Czech Republic Bolsters FX Reserves to $148.7 Billion in FebruaryQuick show2025-03-07 19:41:30Czech Republic's FX Reserves Inch Up Slightly in FebruaryQuick show

- 2025-03-07 19:41:30Turkish Treasury's Cash Balance Deteriorates Further in February to -397.602BQuick show2025-03-07 19:41:30US Unemployment Rate Creeps Up to 4.1% in February 2025Quick show2025-03-07 19:41:30U.S. U6 Unemployment Rate Climbs to 8.0% in FebruaryQuick show2025-03-07 19:41:30U.S. Private Nonfarm Payrolls Show Promising Growth in FebruaryQuick show2025-03-07 19:41:30US Labor Market Sees a Dip in Participation Rate for February 2025Quick show2025-03-07 19:41:30U.S. Manufacturing Payrolls Rebound: February Sees 10,000 Job IncreaseQuick show2025-03-07 19:41:30U.S. Government Payrolls Experience Sharp Decline in February 2025Quick show2025-03-07 19:41:30U.S. Average Weekly Hours Steady in February, Holding Firm at 34.1Quick show2025-03-07 19:41:30U.S. Average Hourly Earnings Rise to 4.0% in February, Outpacing January GrowthQuick show2025-03-07 19:41:30U.S. February Nonfarm Payrolls See a Surge, Hit 151KQuick show

- The test of 147.41 occurred when the MACD indicator had already moved significantly below the zero mark, limiting the pair's downward potential. For this reason, I refrained from selling

Author: Jakub Novak

14:55 2025-03-07 UTC+2

13

The test of the 1.2892 level occurred when the MACD indicator had already moved significantly above the zero mark, limiting the pair's upward potential. For this reason, I refrained fromAuthor: Jakub Novak

14:50 2025-03-07 UTC+2

17

The test of the 1.0831 level occurred when the MACD indicator had already moved significantly above the zero mark, limiting the pair's upward potential. For this reason, I refrained fromAuthor: Jakub Novak

14:46 2025-03-07 UTC+2

19

- In my morning forecast, I highlighted the 1.2919 level as a key entry point. Let's take a look at the 5-minute chart and analyze what happened. The rise and formation

Author: Miroslaw Bawulski

14:41 2025-03-07 UTC+2

19

Trading planEUR/USD: Trading Plan for the U.S. Session on March 7th (Review of Morning Trades). The Euro Hits Another Weekly High

In my morning forecast, I focused on the 1.0852 level, planning to make trading decisions based on it. Looking at the 5-minute chart, we can see what happened. The riseAuthor: Miroslaw Bawulski

14:35 2025-03-07 UTC+2

11

Fundamental analysisWill the Euro Rally Continue in the Forex Market? (There is a chance of continued growth in gold and WTI crude oil prices)

On Thursday, the euro attempted to extend the rally that began on March 4, fueled by news that EU leaders have decided to significantly increase funding for the creationAuthor: Pati Gani

14:30 2025-03-07 UTC+2

8

- The USD/JPY pair remains at October levels, driven by a weakening U.S. dollar. The yen's strength is primarily due to hawkish expectations regarding the Bank of Japan's monetary policy

Author: Irina Yanina

14:25 2025-03-07 UTC+2

10

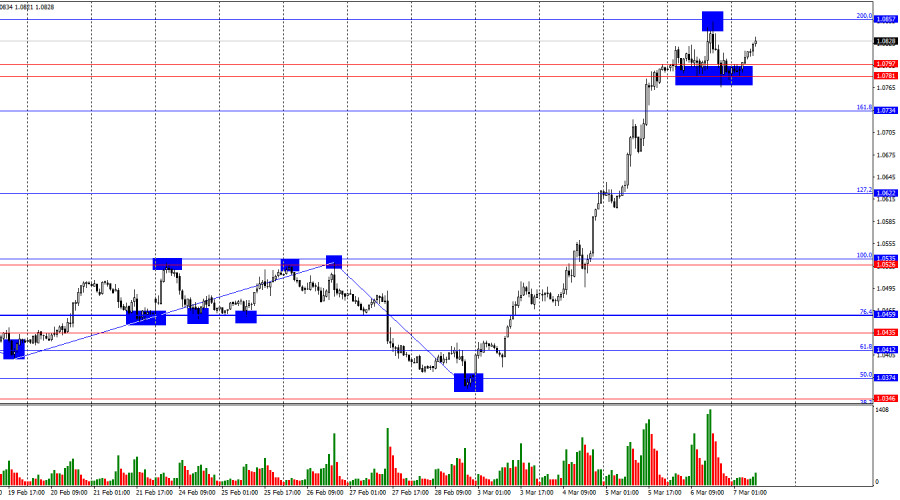

On Thursday, EUR/USD continued its upward movement, reaching the 200.0% Fibonacci retracement level at 1.0857. A rebound from this level favored a return to the support zone of 1.0781–1.0797Author: Samir Klishi

14:18 2025-03-07 UTC+2

9

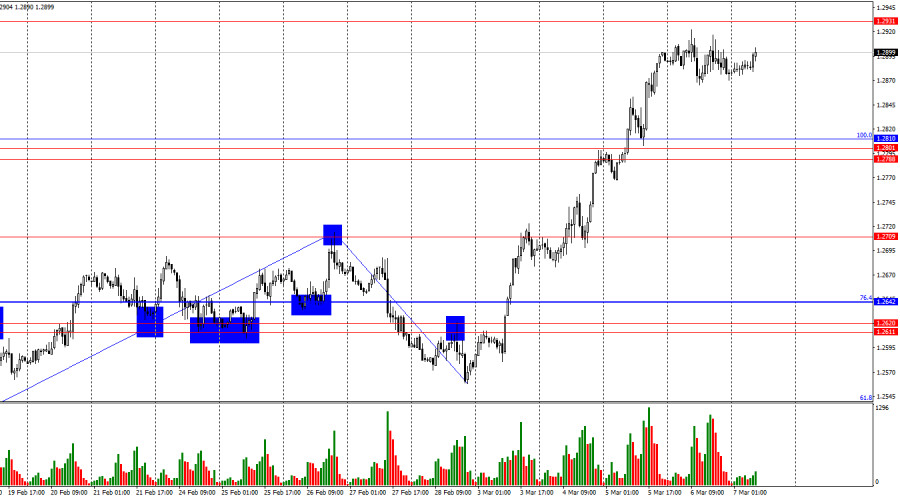

On the hourly chart, GBP/USD continued its upward movement on Thursday, but by the end of the day, it failed to close above Wednesday's level. However, no pullback or correctionAuthor: Samir Klishi

14:04 2025-03-07 UTC+2

18

Stay

Stay