Forex calculator

Trader Calculator:

On this page you can find formula for calculating the value of one pip. The value of a pip is calculated on the basis of the current rate of a given currency pair.

Note that 1 InstaForex lot is 10000 units of base currency.

Please find below a formula to calculate the value of one pip for currency pairs and CFDs:

Calculation of 1 pip value:

- 1. XXX/USD

- p.v. = 0,1 * (trade volume)

- 2. USD/XXX

- p.v. = 0,1 / (USD/XXX) * (trade volume)

- For USD/JPY p.v. = 10 / (USD/JPY) * (trade volume)

- For USD/RUB and EUR/RUB p.v. = 10 / (USD/RUB) * (trade volume)

- 3. AAA/BBB

- p.v. = 0,1 * (AAA/USD) / (AAA/BBB) * (trade volume)

Calculation of 1 pip value for a CFD:

p.v. = volume * contract size * minimum price change

See Also

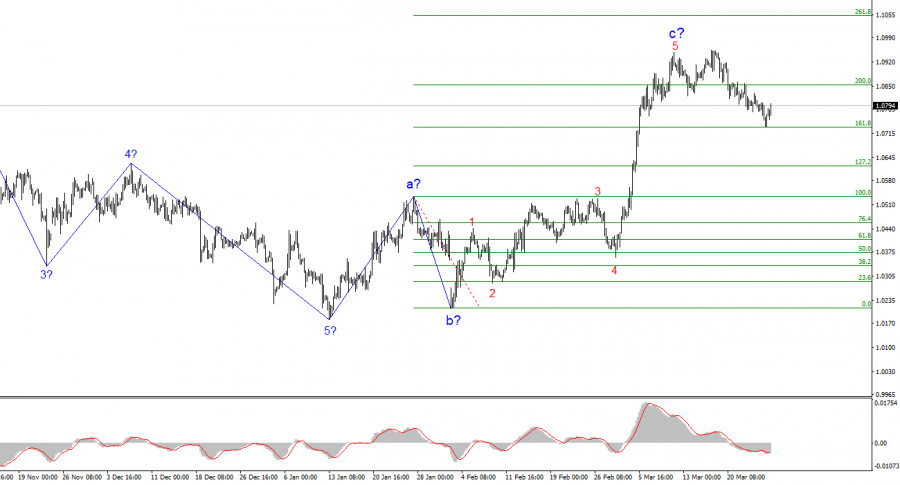

- The wave structure on the 4-hour chart for EUR/USD threatens to evolve into a more complex formation. A new downward structure began forming on September 25, taking the shape

Author: Chin Zhao

20:10 2025-03-28 UTC+2

98

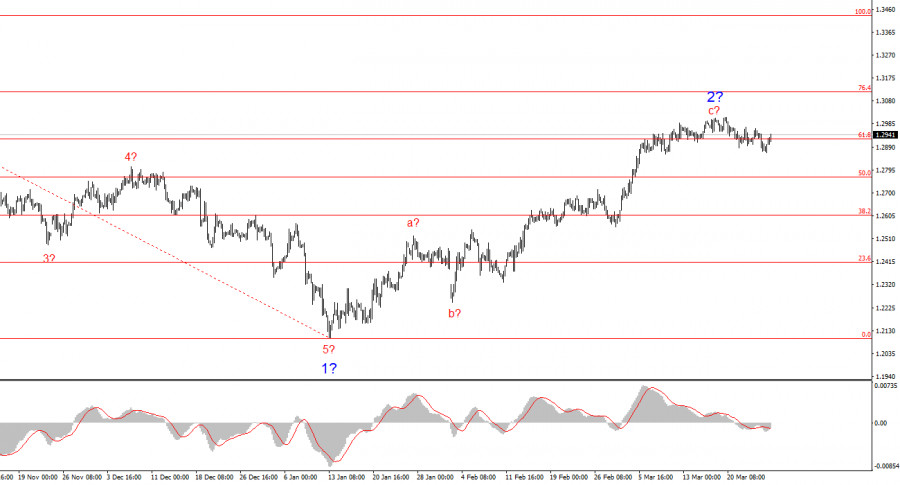

The wave structure of the GBP/USD instrument remains somewhat ambiguous, but overall digestible. At this stage, there is a strong likelihood that a long-term downward trend segment is forming. WaveAuthor: Chin Zhao

20:07 2025-03-28 UTC+2

79

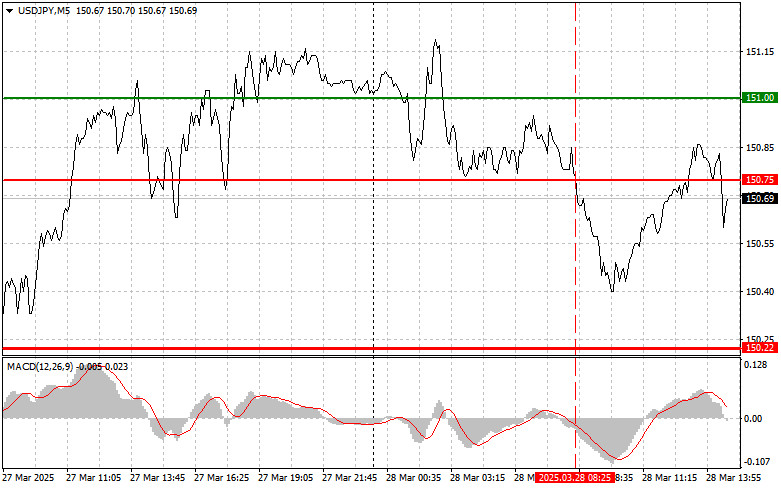

Trade Analysis and Tips for Trading the Japanese Yen The test of the 150.75 level occurred when the MACD indicator had already moved significantly below the zero line, which limitedAuthor: Jakub Novak

20:04 2025-03-28 UTC+2

83

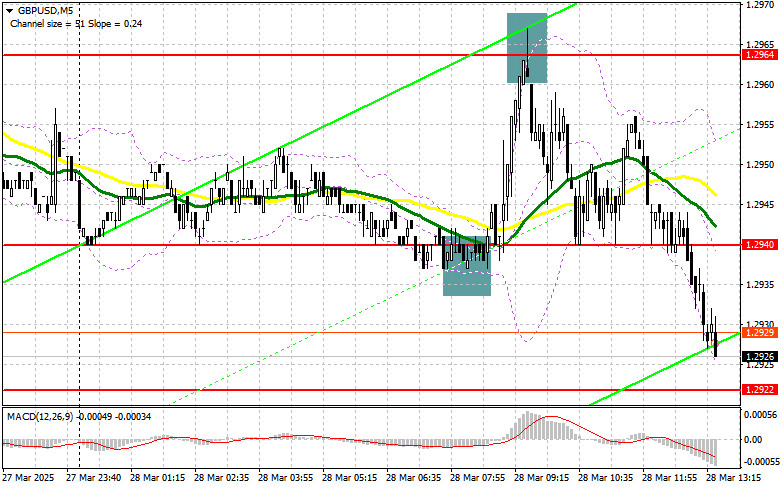

- Trade Analysis and Tips for the British Pound The test of the 1.2950 level occurred just as the MACD indicator began to rise from the zero line, confirming a valid

Author: Jakub Novak

20:00 2025-03-28 UTC+2

70

Trade Analysis and Tips for the Euro The price test at 1.0785 occurred when the MACD indicator had already moved significantly below the zero line, which limited the pair's downwardAuthor: Jakub Novak

19:57 2025-03-28 UTC+2

68

In my morning forecast, I focused on the level of 1.2964 and planned to make market entry decisions based on it. Let's look at the 5-minute chart and break downAuthor: Miroslaw Bawulski

19:54 2025-03-28 UTC+2

69

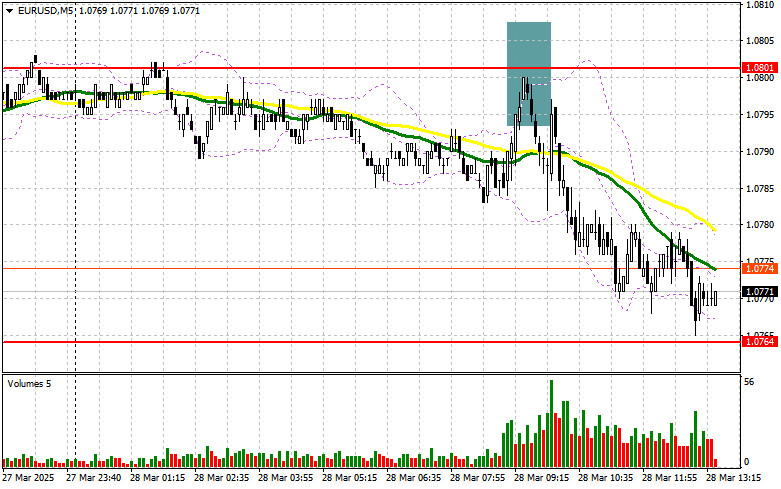

- In my morning forecast, I highlighted the level of 1.0801 and planned to base my market entries on it. Let's look at the 5-minute chart to see what happened

Author: Miroslaw Bawulski

19:52 2025-03-28 UTC+2

69

Technical analysisTrading Signals for GOLD (XAU/USD) for March 28-31, 2025: sell below $3,078 (technical correction - 21 SMA)

Important support is located around the 21 SMA at 3,035. This level coincides with the bottom of the uptrend channel, which could suggest a technical rebound in the coming daysAuthor: Dimitrios Zappas

15:12 2025-03-28 UTC+2

103

Technical analysisTrading Signals for EUR/USD for March 28-31, 2025: sell below 1.0775 (21 SMA - 6/8 Murray)

Early in the American session, the euro is trading around 1.0771, below the 21SMA, and within the downtrend channel forming since March 14. The bias is bearish. Yesterday, EUR/USD attemptedAuthor: Dimitrios Zappas

15:09 2025-03-28 UTC+2

72

- 2025-03-30 20:30:33Ghana's Prime Interest Rate Climbs to 28%, An Increase from January's RateQuick show2025-03-30 20:30:33Canada’s Budget Balance Worsens in January, Revealing Deeper DeficitQuick show2025-03-30 20:30:33Canada's Budget Balance Plummets to -$5.13 Billion in January 2025Quick show2025-03-30 20:30:33Baltic Dry Index Continues to FallQuick show2025-03-30 20:30:33US Michigan Consumer Sentiment Revised LowerQuick show2025-03-30 20:30:33Brazilian Real Slides as Labor Market Weakens and Trade Risks MountQuick show2025-03-30 20:30:33US Year-Ahead Inflation Expectations Revised Slightly UpQuick show2025-03-30 20:30:33Michigan Consumers Maintain a Steady Outlook Amid UncertaintyQuick show2025-03-30 20:30:33Consumer Sentiment Dips: Michigan Index Shows Decline in MarchQuick show2025-03-30 20:30:33Michigan 5-Year Inflation Expectations Rise to 4.1% in March 2025Quick show

- 2025-03-30 20:30:33Mexico's Fiscal Balance Worsens Significantly in FebruaryQuick show2025-03-30 20:30:33US Stocks Tumble on Inflation Concerns and Trade DisruptionsQuick show2025-03-30 20:30:33TSX Retreats Amid Trade Tensions and Economic HeadwindsQuick show2025-03-30 20:30:33Crude Oil Eases, But Posts 3rd Weekly GainQuick show2025-03-30 20:30:33Stagnation in CFTC Gold Speculative Net Positions: No Change Observed in Latest Data UpdateQuick show2025-03-30 20:30:33Semi-Stable Shores: New Zealand Dollar Speculative Net Positions Remain UnchangedQuick show2025-03-30 20:30:33Stability in CFTC JPY Speculative Net Positions Marks a Steady Signal Amid Economic VolatilityQuick show2025-03-30 20:30:33CFTC BRL Speculative Net Positions Hold Steady at 40.7K as of March 28, 2025Quick show2025-03-30 20:30:33Australian Dollar Positions Hold Steady Amid Market Speculation: CFTC Data RevealsQuick show2025-03-30 20:30:33Swiss CHF Speculative Net Positions Hold Steady at -34.4K, CFTC ReportsQuick show

- 2025-03-30 20:30:33Stability Mark: CFTC MXN Speculative Net Positions Hold Steady at 56.0KQuick show2025-03-30 20:30:33Canadian Dollar Speculation Remains Stable as CFTC Reports Unchanged Net PositionsQuick show2025-03-30 20:30:33Sharp Decline in Wheat Speculative Positions Reflects Market UncertaintyQuick show2025-03-30 20:30:33CFTC Reports Significant Drop in Soybean Speculative Net Positions as Market Dynamics ShiftQuick show2025-03-30 20:30:33No Change in CFTC Silver Speculative Net Positions Amid Market UncertaintyQuick show2025-03-30 20:30:33Stability in the Market: CFTC Reports Unchanged S&P 500 Speculative Net PositionsQuick show2025-03-30 20:30:33Speculative Net Short Positions in U.S. Natural Gas Widen Further to -131.9KQuick show2025-03-30 20:30:33Speculative Net Positions in Nasdaq 100 Remain Steady at 23.0K, Says CFTCQuick show2025-03-30 20:30:33Crude Oil Speculative Net Positions Surge as Traders Bet on Rising PricesQuick show2025-03-30 20:30:33CFTC Reports Significant Decline in Corn Speculative Net PositionsQuick show

- 2025-03-30 20:30:33Stability in Copper Market as CFTC Speculative Net Positions Hold SteadyQuick show2025-03-30 20:30:33U.S. CFTC Aluminium Speculative Net Positions Hold Steady at 1.9KQuick show2025-03-30 20:30:33Euro Zone's CFTC EUR Speculative Net Positions Steady at 59.4KQuick show2025-03-30 20:30:33GBP Speculative Net Positions Hold Steady Amid Market StabilityQuick show2025-03-30 20:30:33Paraguay GDP Annual Growth Accelerates in Q4Quick show2025-03-30 20:30:33Brazil Economy Adds More Jobs than ExpectedQuick show2025-03-30 20:30:33Brazil's Labor Market Surges: CAGED Net Payroll Jobs Jump to 432K in FebruaryQuick show2025-03-30 20:30:33Wall Street Sinks on Inflation and Trade WorriesQuick show2025-03-30 20:30:33European Stocks End Week LowerQuick show2025-03-30 20:30:33U.S. Baker Hughes Rig Count Drops Slightly, Signaling Stabilization in Oil MarketQuick show

- 2025-03-30 20:30:33U.S. Baker Hughes Oil Rig Count Slips to 484, Reflecting Subtle Dips in Drilling ActivityQuick show2025-03-30 20:30:33FTSE MIB Slides as Trade Concerns, Weak Consumer Confidence WeighQuick show2025-03-30 20:30:33DAX Slumps for Third Day as US Tariff Concerns DeepenQuick show2025-03-30 20:30:33Week Ahead - March 31stQuick show2025-03-30 20:30:33Gold Keeps Smashing RecordsQuick show2025-03-30 20:30:33Ghana Lifts Key Policy Rate to 28%Quick show2025-03-30 20:30:33Dollar Slips Amid Growing Economic ConcernsQuick show2025-03-30 20:30:33Canada Government Budget Gap Widens in JanuaryQuick show2025-03-30 20:30:33Atlanta Fed GDPNow Forecast: U.S. Economic Outlook Dimmed for First Quarter 2025Quick show2025-03-30 20:30:33India Current Account Gap Widens Less than AnticipatedQuick show

- 2025-03-30 20:30:33Ghana's Prime Interest Rate Climbs to 28%, An Increase from January's RateQuick show2025-03-30 20:30:33Canada’s Budget Balance Worsens in January, Revealing Deeper DeficitQuick show2025-03-30 20:30:33Canada's Budget Balance Plummets to -$5.13 Billion in January 2025Quick show2025-03-30 20:30:33Baltic Dry Index Continues to FallQuick show2025-03-30 20:30:33US Michigan Consumer Sentiment Revised LowerQuick show2025-03-30 20:30:33Brazilian Real Slides as Labor Market Weakens and Trade Risks MountQuick show2025-03-30 20:30:33US Year-Ahead Inflation Expectations Revised Slightly UpQuick show2025-03-30 20:30:33Michigan Consumers Maintain a Steady Outlook Amid UncertaintyQuick show2025-03-30 20:30:33Consumer Sentiment Dips: Michigan Index Shows Decline in MarchQuick show2025-03-30 20:30:33Michigan 5-Year Inflation Expectations Rise to 4.1% in March 2025Quick show

- 2025-03-30 20:30:33Mexico's Fiscal Balance Worsens Significantly in FebruaryQuick show2025-03-30 20:30:33US Stocks Tumble on Inflation Concerns and Trade DisruptionsQuick show2025-03-30 20:30:33TSX Retreats Amid Trade Tensions and Economic HeadwindsQuick show2025-03-30 20:30:33Crude Oil Eases, But Posts 3rd Weekly GainQuick show2025-03-30 20:30:33Stagnation in CFTC Gold Speculative Net Positions: No Change Observed in Latest Data UpdateQuick show2025-03-30 20:30:33Semi-Stable Shores: New Zealand Dollar Speculative Net Positions Remain UnchangedQuick show2025-03-30 20:30:33Stability in CFTC JPY Speculative Net Positions Marks a Steady Signal Amid Economic VolatilityQuick show2025-03-30 20:30:33CFTC BRL Speculative Net Positions Hold Steady at 40.7K as of March 28, 2025Quick show2025-03-30 20:30:33Australian Dollar Positions Hold Steady Amid Market Speculation: CFTC Data RevealsQuick show2025-03-30 20:30:33Swiss CHF Speculative Net Positions Hold Steady at -34.4K, CFTC ReportsQuick show

-

Betting on AI: five high-potential stocks to watch

Betting on AI: five high-potential stocks to watch -

World’s top 5 CEOs according to Brand Finance

World’s top 5 CEOs according to Brand Finance -

Wall Street legends: top 10 investors of all time

Wall Street legends: top 10 investors of all time -

Top 7 US presidents who shaped history

Top 7 US presidents who shaped history -

Key developments in Artificial Intelligence (AI) expected in 2025

Key developments in Artificial Intelligence (AI) expected in 2025 -

Top 5 cities home to wealthiest people

Top 5 cities home to wealthiest people -

Top 10 risks for the next two years

Top 10 risks for the next two years

Stay

Stay