Kereskedési feltételek

Products

Eszkozok

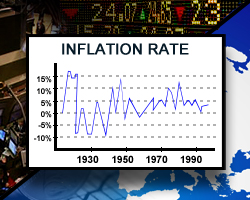

Singapore's consumer price inflation moderated further in July to the lowest level in more than one and-a-half years, primarily due to lower charges for private transport, data published by the Monetary Authority of Singapore and the Ministry of Trade and Industry showed on Wednesday.

The consumer price index, or CPI, climbed 4.1 percent year-over-year in July, slower than the 4.5 percent increase in the previous month. That was in line with economists' expectations.

Moreover, this was the weakest inflation rate since January 2022, when prices had grown 4.0 percent.

The MAS core inflation rate also eased to 3.8 percent in July from 4.2 percent in the prior month. The downward trend was mainly driven by a smaller increase in food prices and a fall in electricity and gas costs.

Month-on-month, core consumer prices rose 0.2 percent in July, largely due to an increase in the costs of services and food. Meanwhile, the total CPI dropped 0.2 percent.

Among the main categories, private transport inflation slowed to 4.8 percent from 5.8 percent as core prices rose more slowly.

Data showed that food inflation softened to 5.3 percent from 5.9 percent due to reduced costs for prepared meals and non-cooked food.

Costs for services grew at a stable rate of 3.6 percent annually at the start of the third quarter.

Singapore's import prices continued to decline compared to last year on the back of easing global supply chain frictions and, lower energy and food commodity prices.

Domestically, unit labor costs are likely to increase in the near term. Businesses will continue passing through accumulated labor costs to consumers, though more gradually amid the slowdown in domestic economic activity.

Looking ahead, core inflation is expected to moderate further in the second half of this year as imported costs fall from year-ago levels and the current tightness in the domestic labor market eases.

For 2023 as a whole, headline and core inflation are projected to average 4.5-5.5 percent and 3.5-4.5 percent, respectively.

There are upside risks to the inflation outlook, including fresh shocks to global commodity prices and more persistent-than-expected tightness in the domestic labor market, the MAS said.

We may place cookies for analysis of our visitor data, to improve our website and measure advertising performance. Overall this data is used to provide a better website experience. More information

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of Instant Trading EU Ltd including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaForex anyway.

We are sorry for any inconvenience caused by this message.

Maradok

Maradok