Kereskedési feltételek

Products

Eszkozok

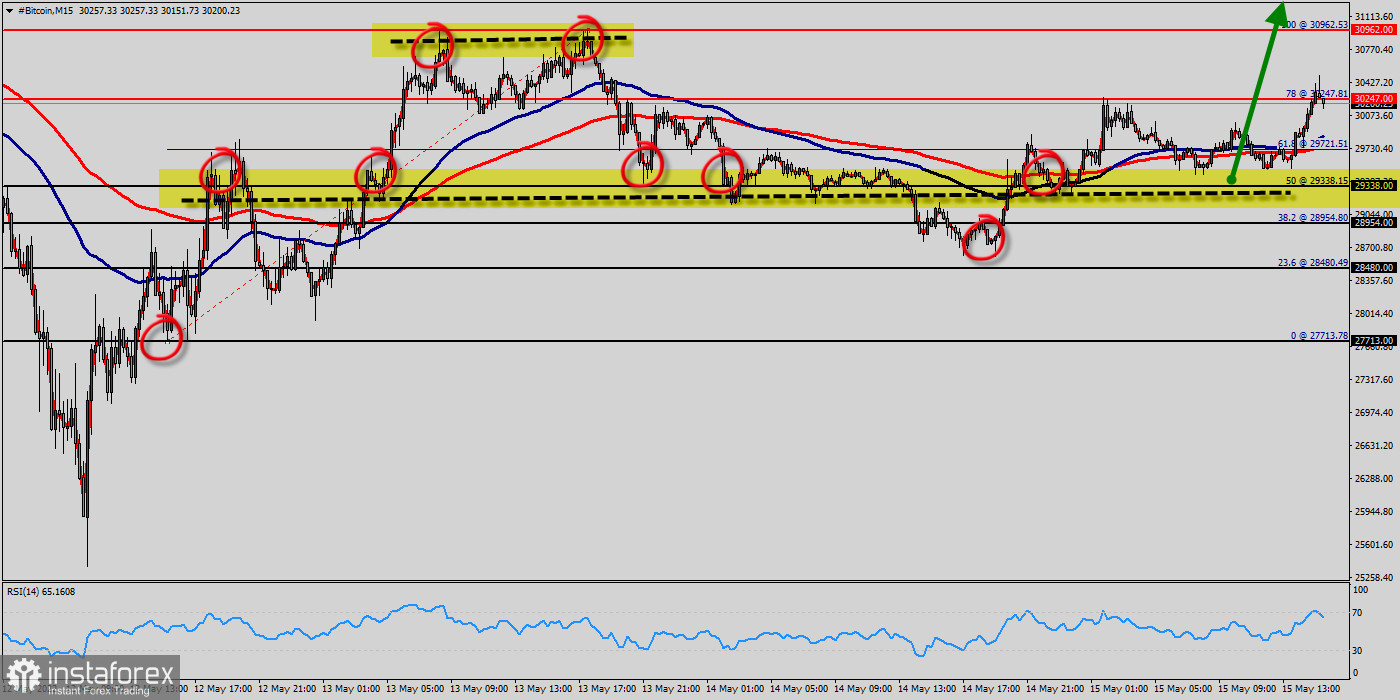

Technical market outlook (Bitcoin):

The BTC/USD was unable to increase and eventually broke to the downside. This resulted in a considerable liquidation cascade and a drop below the critical support level of $30,962.

Bitcoin dropped strongly from the price of $30,962 to reach the bottom price at $27,713, but the trend rebounded from the lowest price to close at $30,101 (currently price).

Bitcoin can stage a relief rally within the $30,962 to $27,713 range, but selling at resistance could still keep BTC in a strong bear trend.

The bulls must set above the price of $29,338 in order to resume the up trend. Closing above the pivot point ($29,338 ) could assure that BTC/USD will move higher towards cooling new highs.

BTC broke below the $30,247 support on May 12, 2022 and later slipped below the psychological level at $29,338. The bulls bought the dip to $27,713, which has started a relief rally.

Right now, BTC has been set above the strong support at the price of $29,338, which coincides with the 50% Fibonacci retracement level.

This support has been rejected three times confirming the veracity of an uptrend. The market is likely to show signs of a bullish trend around the spot of $29,338.

Trading BTC/USD : Bitcoin

The trend is still bullish as long as the price of $29,338 is not broken. Thereupon, it would be wise to buy above the price of at $29,338 with the primary target at $30,962.

The volatility is very high for that the BTC/USD is still moving between $29,338 and $30,962 in coming hours. Consequently, the market is likely to show signs of a bullish trend again. So, it will be good to re-buy above the level of 30,962 with the second target at $31,500 and further to $32k in order to test the daily resistance 2.

Then, the BTC/USD pair will continue towards the second target at $32,000 (a new target is around $32,000).

Alternative scenario :

The breakdown of $27,713 will allow the pair to go further down to the prices of $26,000 and $25,500.

InstaForex analytical reviews will make you fully aware of market trends! Being an InstaForex client, you are provided with a large number of free services for efficient trading.

We may place cookies for analysis of our visitor data, to improve our website and measure advertising performance. Overall this data is used to provide a better website experience. More information

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of Instant Trading EU Ltd including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaForex anyway.

We are sorry for any inconvenience caused by this message.

Maradok

Maradok