Condizioni di trading

Strumenti

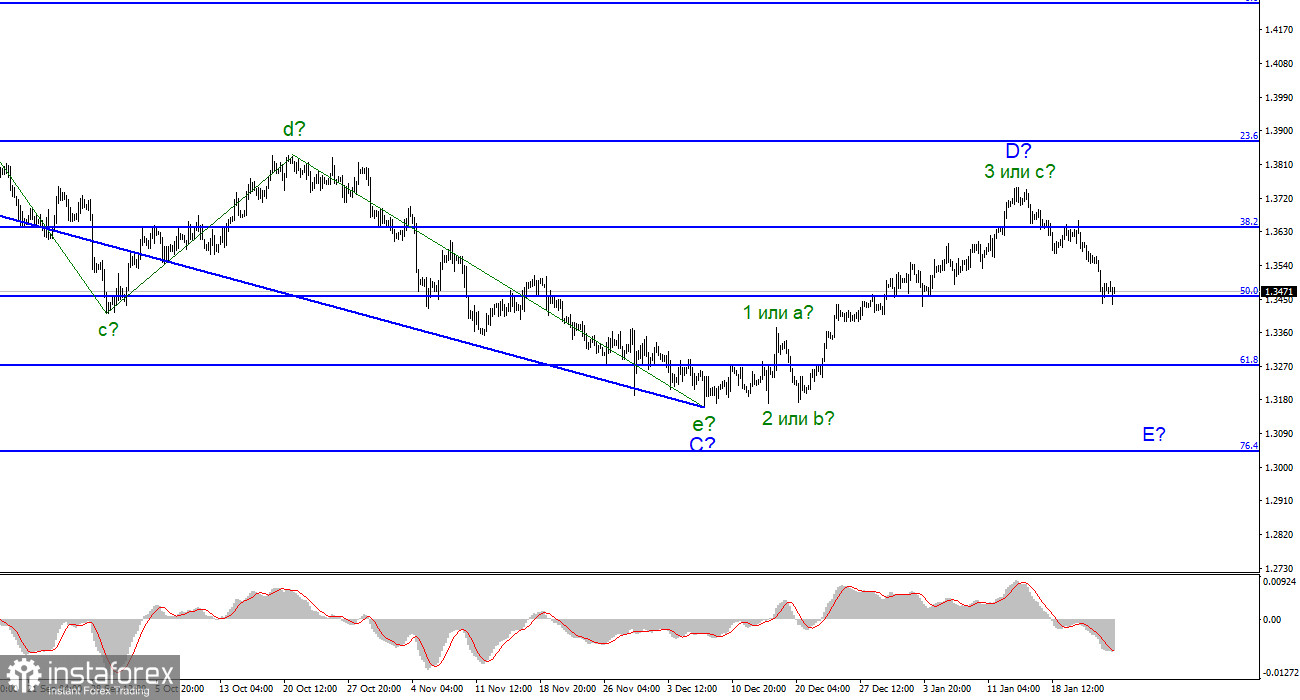

For the Pound/Dollar instrument, the wave markup continues to look quite convincing. In the last few weeks, the instrument has continued to build an upward wave, which is currently interpreted as wave D of the downward trend segment. If the current wave marking is correct, then this wave has completed its construction and the construction of wave E has begun. Thus, the entire downward section of the trend may take on an even more extended form. Wave D has taken a clear three-wave form and its internal wave marking does not cause any questions now. A successful attempt to break through the 1.3644 mark, which corresponds to 38.2% Fibonacci, indicates that the markets are ready to sell the British. A successful attempt to break through the 50.0% level may cause increased sales of the British. Correction waves are not visible at all inside the supposed wave E, which leads to the conclusion about its possible very extended appearance. Thus, both the euro and the pound may significantly sink in price in the coming months.

Moving away from the topic of Boris Johnson and focusing on the FOMC meeting.

The exchange rate of the Pound/Dollar instrument decreased by 50 basis points during January 25, but in the afternoon it managed to add about the same amount in price. Thus, the scenario of the previous day was completely repeated, when the demand for the US currency grew for most of it, but by the end of the day, the situation changed slightly towards the British. However, the Briton is still not in his best position right now. If the current wave marking is correct, then its decline will continue with targets located below the previous low mark of 1.3159. This means that the instrument may lose at least 300 more points in the coming weeks. Tomorrow's Fed meeting can help him in this. As I said in my review of the Euro/Dollar instrument, there is a high probability that the demand for the US currency will grow tomorrow against the background of the FOMC decisions. Most likely, Jerome Powell will also take a "hawkish" position, which will further assure the market of the inevitability of a rate hike in 2022. But the meeting of the Bank of England will take place a little later, so the Briton will have "nothing to cover" tomorrow. Although he already had the opportunity to have his say last week, when various reports were published only in the UK. Unfortunately, not all of them could support the demand for the pound and not all of them were interested in the market at all. In the same week, all the most interesting things will happen in the USA. Today, the news background was also only in America. The consumer confidence indicator in January was 113.8, which is slightly better than market expectations. However, this report did not cause any reaction from the market. Yesterday, the dollar fell slightly against the background of weak business activity indices, but today it should have continued to increase. But this report was rather weak, and there were no others today. As in the case of the Euro/Dollar instrument, I believe that the wave marking is in the first place now, and the news background is in second place.

General conclusions.

The wave pattern of the Pound/Dollar instrument assumes the construction of an assumed E wave. A successful attempt to break through the 1.3458 mark will allow you to continue selling the instrument with targets located near the estimated 1.3271 mark, which corresponds to 61.8% Fibonacci. I am not considering alternative options right now, as there is no reason for this. The E wave can get a clear five-wave structure.

Le recensioni analitiche di InstaForex ti renderanno pienamente consapevole delle tendenze del mercato! Essendo un cliente InstaForex, ti viene fornito un gran numero di servizi gratuiti per il trading efficiente.

Potremmo utilizzare i cookie per analizzare i dati dei visitatori, migliorare il nostro sito web e misurare le performance della pubblicità. In generale, questi dati vengono utilizzati per fornire una migliore esperienza sul sito web. Maggiori informazioni.

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of Instant Trading EU Ltd including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaForex anyway.

We are sorry for any inconvenience caused by this message.

Rimani

Rimani