Condizioni di trading

Strumenti

The GBP/USD currency pair tried to resume its upward movement on Wednesday and generally moved about the same as the EUR/USD pair - with a minimal upward bias. Thus, at this time, the upward trend for the pair remains, as the price continues to be located above the moving average. We have said more than once that the British currency has much more reason to grow than the euro. If you look at the charts of the movement of both pairs over the past 13-14 months, it is clear that it was the euro currency that became cheaper against the dollar much more willingly. The pound has adjusted against the dollar in total after the 2020 trend by only 38.2%. The euro has adjusted by 70%. Thus, we prefer the British currency, which could start a new long-term upward trend in mid-December. Moreover, the Bank of England, unlike the ECB, does not beat around the bush, understands the danger of rising inflation, and gets down to business without long swings. Now the market is confident that the Bank of England will raise the rate at least 2 more times this year. And this is serious support for the British currency, given that the Fed has not yet taken a single step to tighten monetary policy.

Unfortunately, there was practically nothing for traders to react to this week. In the UK, a couple of reports of medium significance will be published on Friday. In the States, the only report this week is today. There will also be a speech by the Chairman of the Bank of England, Andrew Bailey, tonight, but we don't even remember the last time Mr. Bailey told the market anything important. Therefore, we do not hope for a market reaction to this event.

And Brexit again.

Recently, the entire information space of Britain has been occupied by only one figure - Boris Johnson. If we omit all the scandals related to the Prime Minister, he managed only in the new year to cancel all quarantine measures, to comment in the style of Donald Trump on a possible conflict between NATO, Ukraine, and Russia (that is, every day), as well as to return to the topic of Brexit and negotiations with the European Union. British journalists believe that Johnson talks so much about extraneous topics and practically does not touch on the topic with his participation precisely to distract public attention from his possible resignation. Recall that five of Johnson's assistants left their posts last week. 40-45 letters from conservatives were sent to the "1922 committee" with approval of a vote of no confidence in Johnson. Boris himself was under investigation by Scotland Yard regarding his "coronavirus parties" at 10 Downing Street. However, these topics have not yet affected the mood of the market.

But the topic of Brexit and the resumption of negotiations with the European Union regarding the "Northern Ireland protocol" and the trade deal may affect the pound. However, Johnson started the new year off the bat and immediately started talking again about Article 16, which allows the UK to abandon part of the agreements provided for by the agreement with the EU on Brexit. This article states that any of the parties to the transaction may cease to comply with certain provisions if there is a threat to its internal security, economic and social stability. This is exactly what Boris Johnson is trampling on in negotiations with the European Union. However, David Frost, who left his post last year, is no longer conducting these negotiations. On Wednesday, the British Prime Minister reiterated that his country is ready to activate Article 16 of the European Union "does not show common sense" in the negotiations. Thus, a new part of the new season of the Mexican TV series called "EU-UK negotiations" begins. Potentially, this situation could result in a serious conflict between the Alliance and the Kingdom, since the deal was signed and if London does not comply with the agreement, the case may go to court. To the European Court of Justice. And the European Union itself can impose sanctions on the UK, more than 50% of whose exports are sent to EU countries.

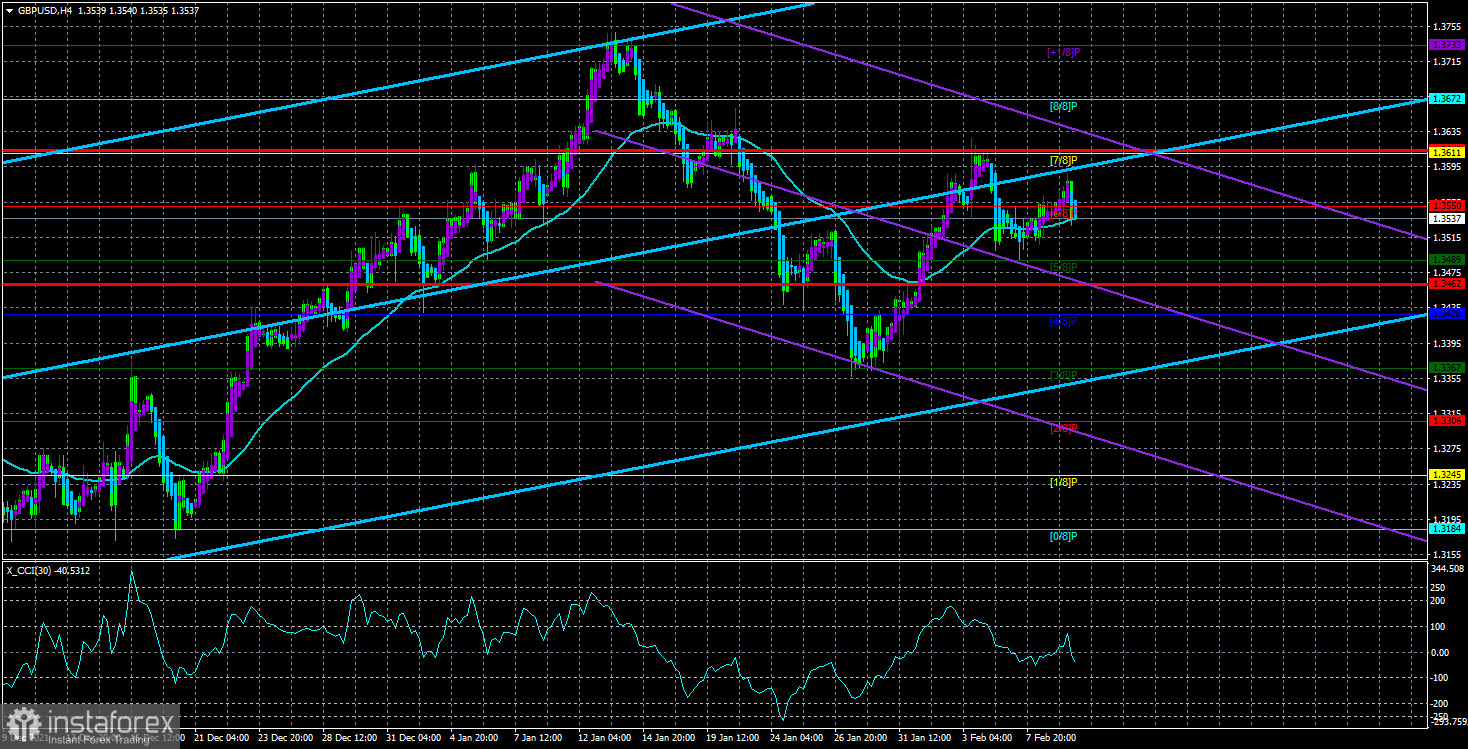

The average volatility of the GBP/USD pair is currently 76 points per day. For the pound/dollar pair, this value is "average". On Thursday, February 10, thus, we expect movement inside the channel, limited by the levels of 1.3462 and 1.3614. The reversal of the Heiken Ashi indicator downwards signals the continuation of the downward correction.

Nearest support levels:

S1 – 1.3489

S2 – 1.3428

S3 – 1.3367

Nearest resistance levels:

R1 – 1.3550

R2 – 1.3611

R3 – 1.3672

Trading recommendations:

The GBP/USD pair continues to adjust on the 4-hour timeframe. Thus, at this time, it is recommended to consider options for new long positions with a target of 1.3611, but now there is a high probability of flat and frequent reversals of the Heiken Ashi indicator. It is recommended to consider short positions if the pair is fixed below the moving average, with targets of 1.3489 and 1.3462.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.

Le recensioni analitiche di InstaForex ti renderanno pienamente consapevole delle tendenze del mercato! Essendo un cliente InstaForex, ti viene fornito un gran numero di servizi gratuiti per il trading efficiente.

Potremmo utilizzare i cookie per analizzare i dati dei visitatori, migliorare il nostro sito web e misurare le performance della pubblicità. In generale, questi dati vengono utilizzati per fornire una migliore esperienza sul sito web. Maggiori informazioni.

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of Instant Trading EU Ltd including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaForex anyway.

We are sorry for any inconvenience caused by this message.

Rimani

Rimani