Condizioni di trading

Strumenti

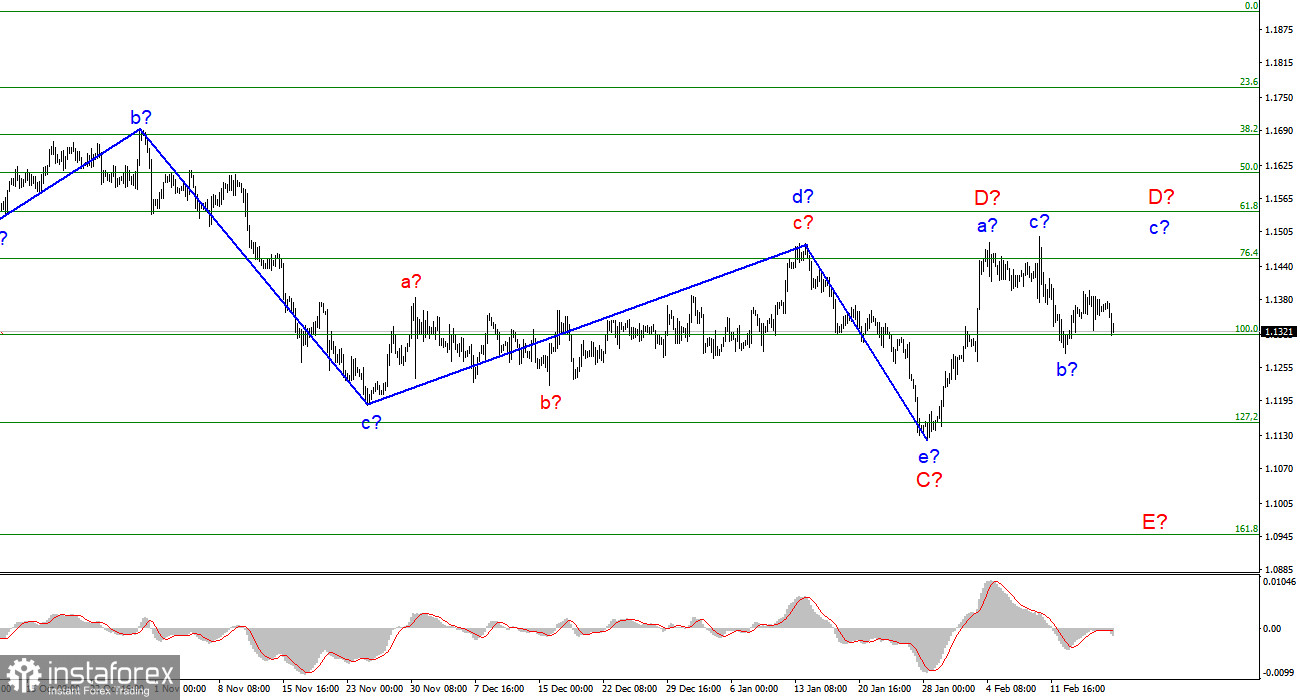

The wave marking of the 4-hour chart for the euro/dollar instrument has undergone certain changes and now it no longer looks as unambiguous as before. Last week, there was a decline in quotes, which may be a wave E, or it may be a wave b-D. I believe that wave D is over, as the news background openly supports the rise of the US currency. Moreover, there are no clear internal waves inside wave C. Thus, they may not be inside wave D either. Based on this, I think that the probability that the instrument has moved to the construction of wave E is 80 percent. I give 20% of the probability that wave D will take a more complex form, a three-wave one, but even in this case, it may already be completed. There is also a backup option with the completion of the construction of a downward trend section. In this case, on January 28, the construction of a new upward trend section began. But the same news background now does not give any reason to expect that an upward section of the trend will be built. A successful attempt to break through the 1.1314 mark, which corresponds to 100.0% Fibonacci, will indicate that the market is ready for new sales of the European.

The market is in complete confusion.

The euro/dollar instrument continued to trade with a small amplitude on Friday. It was only 30 basis points. Throughout the day, the market showed no desire to trade. The information background of the economic plan was absent on Friday. Therefore, geopolitics again came to the fore, but even it could not greatly affect the mood of the market. In the afternoon, the demand for the dollar rose slightly, which allowed it to rise by 60 points. Agree, such a movement could not be connected with anything at all. Although, on the other hand, it was on Friday that new reports began to arrive from Ukraine about the aggravation of the military conflict in the Donetsk and Luhansk regions. Let me remind you that now the LPR and the DPR, which are not recognized by anyone, have been created there. It is unclear for what reasons, the local authorities began evacuating civilians to Russia. Also yesterday. Thus, the markets could react to this news with an increase in demand for the dollar.

Like most analysts, I believe that the deterioration of the geopolitical situation in Ukraine can help the US currency. Demand for it may increase due to the flight of investors from risky currencies (hryvnia, ruble) to less risky ones (yen, dollar). However, now even the wave marking implies an increase in demand for the US currency. Therefore, we can assume that the puzzle has developed.

General conclusions.

Based on the analysis, I conclude that the construction of wave D is completed. If so, now is a good time to sell the European currency with targets located around the 1.1153 mark, which corresponds to 127.2% Fibonacci, for each MACD signal "down". Another upward wave may be built inside wave D, but for now, this option is a backup. A successful breakout attempt of 1.1314 will indicate that the market is ready for new sales of the instrument.

On a larger scale, it can be seen that the construction of the proposed D wave has now begun. This wave can be shortened or three-wave. Considering that all the previous waves were not too large and approximately the same in size, the same can be expected from the current wave. There is reason to assume that wave D has already been completed. Then the construction of wave E began.

Le recensioni analitiche di InstaForex ti renderanno pienamente consapevole delle tendenze del mercato! Essendo un cliente InstaForex, ti viene fornito un gran numero di servizi gratuiti per il trading efficiente.

Potremmo utilizzare i cookie per analizzare i dati dei visitatori, migliorare il nostro sito web e misurare le performance della pubblicità. In generale, questi dati vengono utilizzati per fornire una migliore esperienza sul sito web. Maggiori informazioni.

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of Instant Trading EU Ltd including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaForex anyway.

We are sorry for any inconvenience caused by this message.

Rimani

Rimani