Condizioni di trading

Strumenti

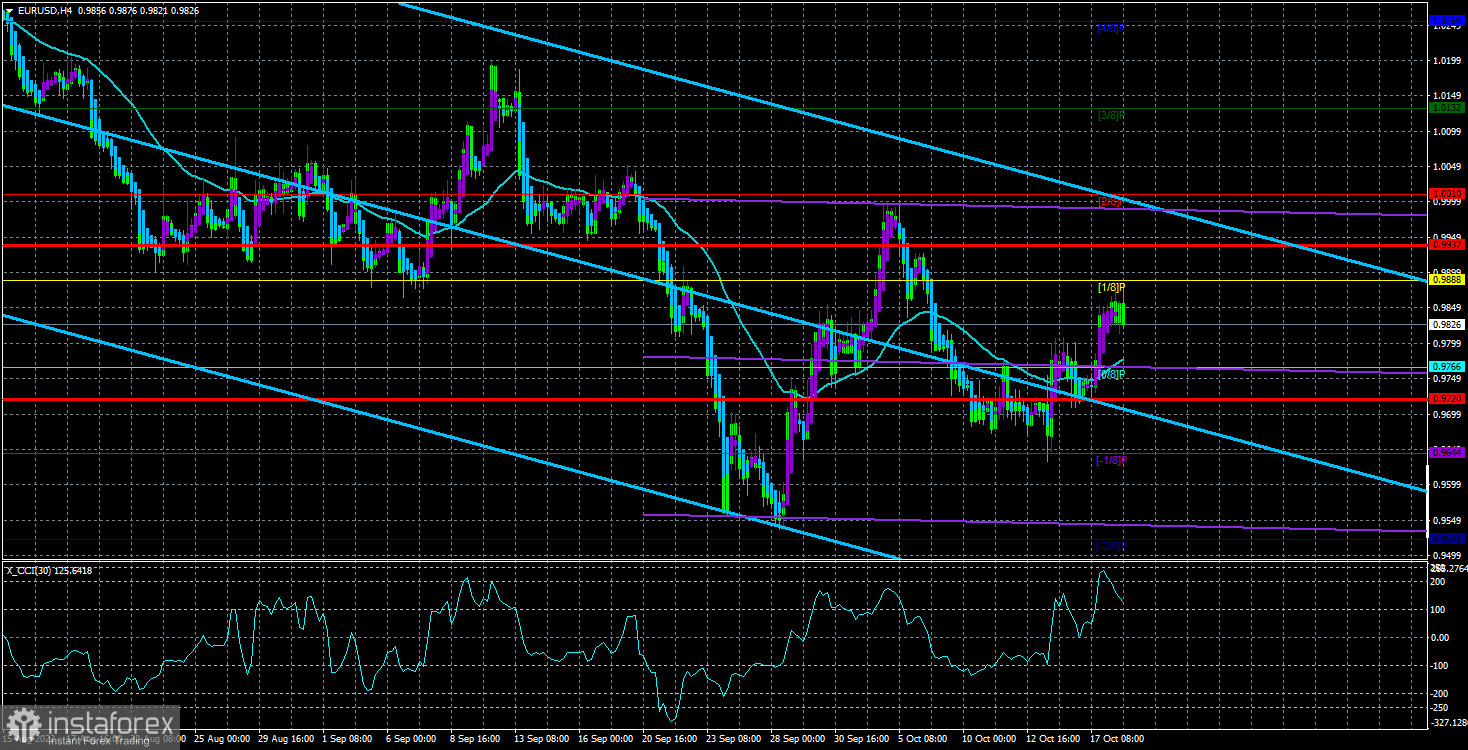

The EUR/USD currency pair showed a fairly strong upward movement on Monday, but it was trading a little more calmly on Tuesday. In general, it should be noted that most of the strong movements during the day often fall during the American trading session. We also recall that the pair's exchange rate now depends more on American foundations and macroeconomics than the European one. Thus, we get a clear market bias towards the US and the dollar. The European currency, we can say, has been growing for several weeks, but during this time, it has managed to move away from its 20-year lows by "as much as" 300 points. Even on the 4-hour TF, it is visible that each subsequent price peak is lower than the previous one, which clearly indicates the continuation of the downward global trend. Thus, we still do not see how the European currency can expect serious growth in the coming weeks or months. If the pound sterling, at least from a technical point of view, can continue to move north, then even technical factors do not speak in support of the euro currency.

No important macroeconomic statistics have been published in the last few trading days, and no serious fundamental events have occurred. The market began to debate again about how much rates will be raised at the next meetings of the Fed and the ECB when the recession in the American and European economies begins, whether the European Union will be able to avoid an energy crisis, and so on. From our point of view, the euro/dollar pair does not show any interest in this news right now. One has to remember that the US and EU economies are walking on the edge of the abyss, but the dollar is still growing. Thus, one of the key factors remains geopolitical. As long as the geopolitical situation in Europe remains difficult, it is, in principle, difficult for us to count on the strong growth of risky currencies.

The ECB Vice-Chairman believes in the euro currency. Isn't it for nothing?

The ECB's attention is once again focused on increasing. Only a few days ago, information was received that the ECB rate may grow much weaker than the Fed rate, which is another additional factor in favor of supporting the dollar. Experts expect that at the beginning of 2023, the European rate will increase to 3% or so. At the same time, the Fed's rate may already be 4.5% or even more. Therefore, if the US dollar was growing steadily at a time when the Fed was tightening monetary policy and the ECB was not, at a time when both rates were growing synchronously. In the coming months, the balance of power between it and the euro will not change because the ECB rate will still lag far behind the Fed rate. The problem with the European economy lies precisely in the fact that it is not one state's economy. These are 27 states with different economies, budgets, and public debts. For example, troubled Italy and Greece cannot cope with high rates, as this will increase the cost of servicing public debt, which is more than 100% of GDP. And more stable Austria, Germany, or the Netherlands will cope with high rates, but the ECB cannot raise the rate for some countries and not for others. Therefore, the ECB will most likely take a position "somewhere in the middle," which will not lead to a significant drop in the consumer price index. This alone will not be enough for the significant growth of the euro currency.

However, ECB Vice-Chairman Luis de Guindos believes that the euro-dollar exchange rate will stabilize in the near future. However, he said this on Monday without informing us on what basis such a forecast was made. De Guindos assured us that the ECB does not target the euro exchange rate and does not use currency interventions to stabilize it. Nevertheless, the words of de Guindos should be taken since he has more information than we do.

The average volatility of the euro/dollar currency pair over the last five trading days as of October 19 is 107 points and is characterized as "high." Thus, on Wednesday, we expect the pair to move between 0.9720 and 0.9937 levels. The reversal of the Heiken Ashi indicator downwards signals a round of downward movement.

Nearest support levels:

S1 – 0.9766

S2 – 0.9644

S3 – 0.9521

Nearest resistance levels:

R1 – 0.9888

R2 – 1.0010

R3 – 1.0132

Trading Recommendations:

The EUR/USD pair has made a new upward leap. Thus, now you should stay in long positions with targets of 0.9888 and 0.9937 (if you managed to open them) until the Heiken Ashi indicator turns down. Sales will become relevant again no earlier than fixing the price below the moving average with goals of 0.9720 and 0.9644.

Explanations of the illustrations:

Linear regression channels help determine the current trend. The trend is strong if both are directed in the same direction.

The moving average line (settings 20.0, smoothed) determines the short-term trend and the direction to trade now.

Murray levels are target levels for movements and corrections.

Based on current volatility indicators, volatility levels (red lines) are the likely price channel in which the pair will spend the next day.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.

Le recensioni analitiche di InstaForex ti renderanno pienamente consapevole delle tendenze del mercato! Essendo un cliente InstaForex, ti viene fornito un gran numero di servizi gratuiti per il trading efficiente.

Potremmo utilizzare i cookie per analizzare i dati dei visitatori, migliorare il nostro sito web e misurare le performance della pubblicità. In generale, questi dati vengono utilizzati per fornire una migliore esperienza sul sito web. Maggiori informazioni.

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of Instant Trading EU Ltd including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaForex anyway.

We are sorry for any inconvenience caused by this message.

Rimani

Rimani