Condizioni di trading

Strumenti

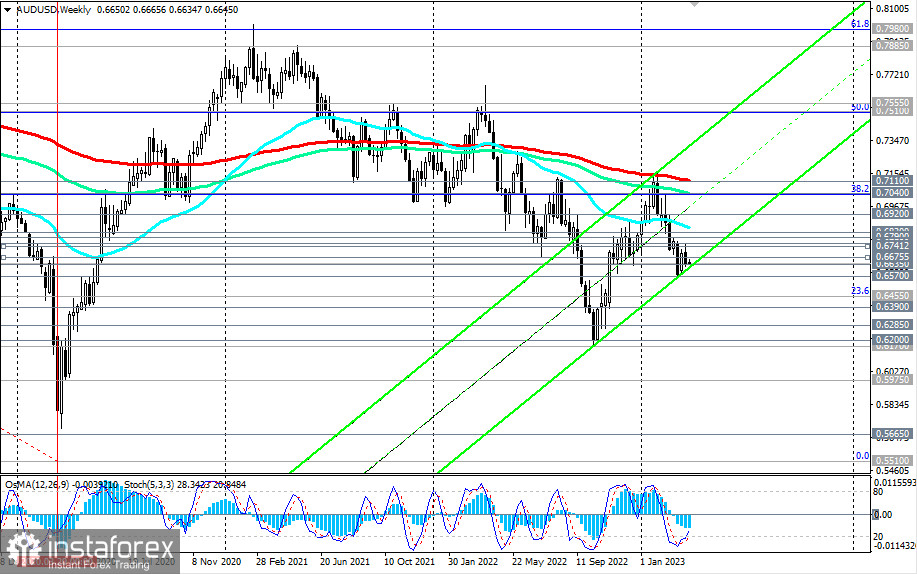

AUD/USD continues to trade in a bear market, short-term, medium-term, long-term. Last week's macro statistics from Australia were weak and could not support the Australian currency, and from the minutes of the Reserve Bank of Australia's March meeting, published last Tuesday, it follows that the members of the Central Bank's management decided to revise the arguments in favor of a pause at the next meeting, recognizing that would give additional time to reassess the prospects for the economy.

In addition, the prevailing market and investor uncertainty weigh on the quotes of commodity currencies, particularly the Australian dollar.

Last month, as we mentioned in our previous review, was very bad for the Australian dollar and the AUD/USD pair, which lost all the gains of the previous two months in February and fell to 0.6729. This month also began for AUD/USD with a significant decline. However, this decline stopped near the local support level of 0.6570. At the moment, the pair is trading slightly above the local support level of 0.6635. If the corrective growth continues, a breakdown of the important short-term resistance level 0.6675 (200 EMA on the 1-hour chart) might be the first signal to resume the long positions, and a breakdown of the resistance levels 0.6740 (20 EMA on the 4-hour chart), 0.6758 (50 EMA on the daily chart) might be a confirmation signal.

To enter the medium-term bull market, the pair needs to break into the zone above the key resistance level 0.6820 (200 EMA on the daily chart).

In the main scenario, the price will break through the local support at 0.6635, last week's low at 0.6625, and head towards last year's low and the marks of 0.6285, 0.6200.

Technical indicators OsMA and Stochastic on the daily and weekly charts are also on the sellers' side.

A breakdown of the local support level at 0.6570 will confirm our assumption. In any case, for now, preference should be given to short positions.

Support levels: 0.6635, 0.6625, 0.6600, 0.6570, 0.6500, 0.6455, 0.6390, 0.6285, 0.6200, 0.6170

Resistance levels: 0.6675, 0.6700, 0.6740, 0.6758, 0.6790, 0.6820, 0.6900, 0.6920, 0.7040, 0.7110

Le recensioni analitiche di InstaForex ti renderanno pienamente consapevole delle tendenze del mercato! Essendo un cliente InstaForex, ti viene fornito un gran numero di servizi gratuiti per il trading efficiente.

Potremmo utilizzare i cookie per analizzare i dati dei visitatori, migliorare il nostro sito web e misurare le performance della pubblicità. In generale, questi dati vengono utilizzati per fornire una migliore esperienza sul sito web. Maggiori informazioni.

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of Instant Trading EU Ltd including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaForex anyway.

We are sorry for any inconvenience caused by this message.

Rimani

Rimani