Condizioni di trading

Strumenti

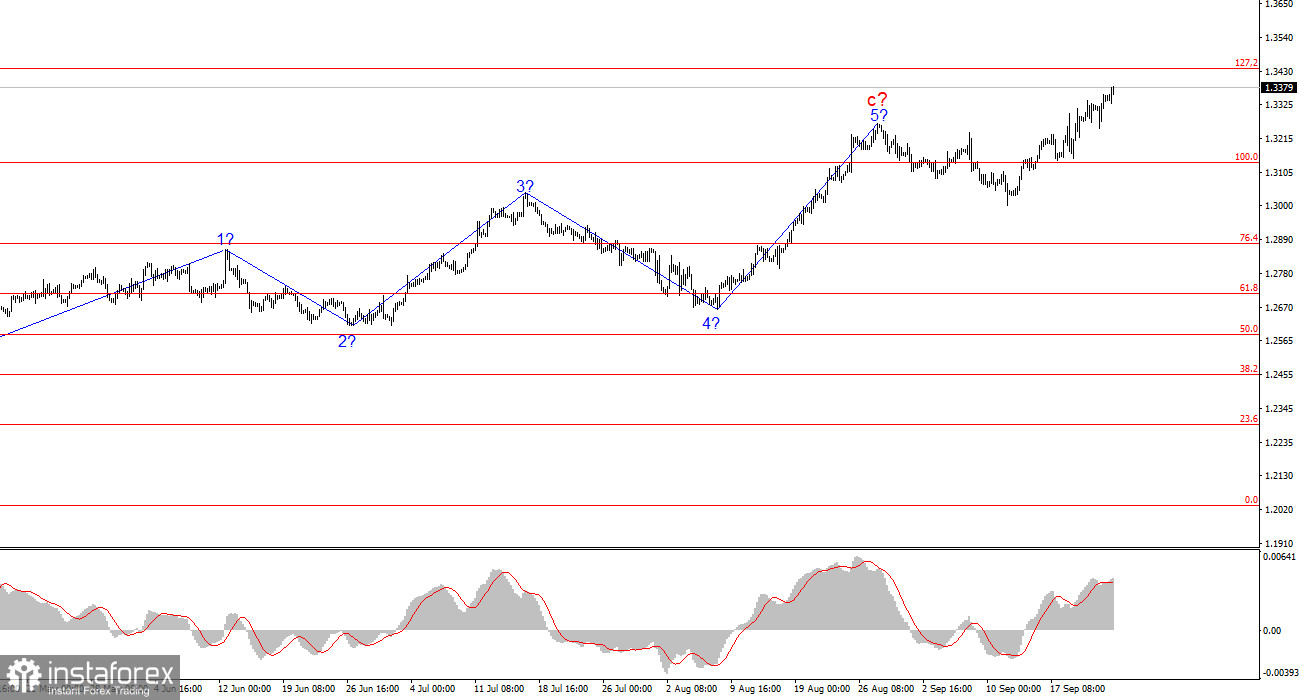

The wave pattern for GBP/USD remains complex and continues to evolve. For a while, the wave structure appeared convincing, suggesting a downward wave pattern with targets below the 1.2300 level. However, in practice, demand for the British pound continues to grow, disrupting any potential wave formations. The market tirelessly continues to build long positions.

At present, I can only assume that the upward trend, which began on April 22, has become significantly more complex. Some of the corrective waves might be transferred to a smaller scale (substructure), which would increase the number of higher ascending waves. If the current movement possesses an impulsive nature, it indicates that we are in the larger third wave, which began on August 8. If this assumption is correct, we have already observed waves 1 and 2 within it. Consequently, there is substantial space for the pound to rise further.

UK Business Activity Disappointed, but the Pound Remained Resilient

The GBP/USD pair rose by 30 points on Monday and added another 40 points today. As we can see, the rise of the British currency continues unabated, even though there was no clear fundamental reason for its strengthening yesterday or today. Yesterday, the UK's business activity indices were weaker than market expectations, reflecting some challenges within the British economy. Today, there were no significant data or news releases, yet market participants continue to increase demand for the pound.

The nearest growth target appears to be the 1.3440 level. Since the news background and common sense haven't been able to halt the pound's rise, we can only rely on significant resistance levels. The pair last traded at these price levels in March 2022. Although explaining such a surge from the 1.0450 level remains difficult, it is not the primary concern. What matters most is understanding the pair's potential next move. Currently, it is trending upwards.

The market may continue to factor in the anticipated easing of the Federal Reserve's monetary policy, but it's impossible to predict how much longer this will last. Therefore, the most prudent approach is to monitor the pair's movement from one level to the next. Presently, news events seem to have little impact on the pair's rate, but new negative data from the U.S. could further strengthen buyer interest. If traders are willing to buy the pair without solid reasons, what will occur when strong reasons materialize? The upcoming FOMC meeting may lead to another rate cut, while the Bank of England might opt to pause again. Based on this scenario, the pound could continue to appreciate, given the current market dynamics.

The wave structure for GBP/USD continues to evolve. If the upward trend began on April 22, it has already taken on a five-wave form but could become significantly more extended. I still find selling the pair more attractive, but clear signals are required. Currently, there is no doubt that a new upward wave is forming. The nearest target for this wave is the 1.3440 level, which corresponds to the 127.2% Fibonacci level.

On a larger wave scale, the wave structure has transformed. We can now assume the formation of a complex and extended upward corrective pattern. At present, it's a three-wave pattern, but it could evolve into a five-wave structure, which might take several more months to complete.

Key Principles of My Analysis:

Le recensioni analitiche di InstaForex ti renderanno pienamente consapevole delle tendenze del mercato! Essendo un cliente InstaForex, ti viene fornito un gran numero di servizi gratuiti per il trading efficiente.

Potremmo utilizzare i cookie per analizzare i dati dei visitatori, migliorare il nostro sito web e misurare le performance della pubblicità. In generale, questi dati vengono utilizzati per fornire una migliore esperienza sul sito web. Maggiori informazioni.

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of Instant Trading EU Ltd including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaForex anyway.

We are sorry for any inconvenience caused by this message.

Rimani

Rimani